Long-time readers should note some significant changes in how I communicate in the public domain. The primary purpose of this forum is now to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Accordingly, this document should not be construed as an endorsement or recommendation of the companies or securities discussed herein. I am not an investment advisor and this is not an investment thesis. It is merely one part of the story, which I present for debate in hopes of determining all risks and upside potential. The disclosure at the end of this piece is critical to understanding the content of this document. Further, I frequently trade my positions and may buy, sell, or short the securities mentioned herein at any time, regardless of the facts or perceived implications of this article.

As I’ve reported over the past couple of weeks, Smith Micro’s (SMSI) relationship with Sprint is finally ramping up. Sprint’s Safe & Found offering (based on SMSI’s SafePath product) is officially the only Family Location/Protection product Sprint is offering. We’ve also heard from multiple sources that Sprint will be mandating that its installed base migrate to SMSI’s product in the coming weeks.

On the heels of this good news, SMSI surprised investors with a $7 million round of funding. The most notable aspects of this deal were:

1) The money was not needed, but rather wanted. In the video below, I explore the possible reasons. UPDATE: Looking back through my notes, I was reminded that one of my contacts (closely tied to SMSI’s corporate development activities) intimated that they were working on an “interesting project” a few weeks ago. They gave NO CLUE as to what it might be. I assumed it might be their divestitures. However, I now believe that it is related to finding and acquiring more companies like iMobileMagic to leverage into SMSI’s carrier accounts.

2) The deal was done at $2.21 per share. not only is this a premium to yesterday’s close, it’s a 50% premium to where the stock settled after their last offering (which was needed, not wanted). The fact that investors were willing to pay a premium for $7 million of SMSI stock implies that they were privvy to some exciting new information (which is not uncommon — I was provided with NDA information prior to their last round).

I suspect that management will provide insight into this information on their earnings call on Wednesday.

The deal also included warrant coverage, but participants won’t profit from that unless the shares remain persistently above $2.16 (halfway between the $2.21 deal price and the $2.11 price to convert the warrants into common stock).

So, for what did SMSI raise the money? Is it bullish or bearish? I answer these questions and many more in the video below. UPDATE: Spoiler Alert — I believe the money is earmarked for an immanent cash-acquisition. One thing I didn’t discuss in the video is that an acquisitive SMSI will accelerate their path toward the ballpark of a $175 million market cap. This would qualify them for inclusion in the Russell 2000, which would spur the forced buying of approximately 7% of its shares outstanding by institutions. For a company with a relatively low float like SMSI, this could be a great catalyst for the shares, albeit one for which we’ll have to wait until next year.

Appendix: Key Points

Appendix 2: Current Chart Pattern

More Research:

- Sprint & T-Mobile Agree to Merge! Implications for Smith Micro (SMSI)

- SMSI’s Latest Family App Launches Sprint Relationship To A New Level (4.5 Stars)

- Sprint FINALLY Ramping Up SMSI’s Product!

- Videocast: AEHR 10-Q, MoviePass Update

- AEHR Grows 175% — Beats On The Top & Bottom Line (Buying More)

- GAIA vs. MoviePass: CAC Shows Which One Is A True Mini-NFLX

- Major Update on SMSI

- SMSI’s Safe & Found App: 100,000 Downloads & Counting

- MoviePass Projected To Burn $600M In 2018

- SMSI: Riding A New Trend & Making Its Latest Comeback

- Mark Gomes Research

To get my posts in real-time, just follow/subscribe to this free blog. Better yet, download the WordPress app for real-time alerts and Q&A access to yours truly!

If you only want to receive my most critical reports, simply sign up for my MailChimp mailing list instead. If you’re on that list, you will only get key articles and occasional recaps of all the work I’ve recently done.

Finally, you can find me on Twitter (@PipelineDataLLC) and StockTwits (@MasterCap). FYI, don’t fall for imposters. Those are my only official stock-related handles!

Disclosures / Disclaimers: I am long SMSI. However, this is not a solicitation to buy, sell, or otherwise transact any stock or its derivatives. Nor should it be construed as an endorsement of any particular investment or opinion of the stock’s current or future price. To be clear, I do not encourage or recommend for anyone to follow my lead on this or any other stocks, since I may enter, exit, or reverse a position at any time without notice, regardless of the facts or perceived implications of this article.

I am not a financial advisor. Nor am I providing any recommendations, price targets, or opinions about valuation regarding the companies discussed herein. Any disclosures regarding my holdings are true as of the time this article is written, but subject change without notice. I frequently trade my positions, often on an intraday basis. Thus, it is possible that I might be buying and/or selling the securities mentioned herein and/or its derivative at any time, regardless of (and possibly contrary to) the content of this article.

I undertake no responsibility to update my disclosures and they may therefore be inaccurate thereafter. Likewise, any opinions are as of the date of publication, and are subject to change without notice and may not be updated. I believe that the sources of information I use are accurate but there can be no assurance that they are. All investments carry the risk of loss and the securities mentioned herein may entail a high level of risk. Investors considering an investment should perform their own research and consult with a qualified investment professional.

I wrote this article myself, and it expresses my own opinions. I am receiving no compensation for it, nor do I have a business relationship with any company whose stock is mentioned in this article. The information in this article is for informational purposes only and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

The primary purpose of this blog/forum is to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Thanks for the update Mark!

LikeLiked by 1 person

looking forward to finding the time (and peace & quiet) to watch/listen to you video. Just scored some shares of SMSI @ 1.97 today (had a GTC) and didn’t think it would fill. Previously you taught me about leverage on high risk. Thus I’m keeping it under 1% of the market value of each account.

LikeLiked by 1 person

That’s smart.

I’m starting to push the envelope with my position size, but I have focused almost 100% of my resources on this one in recent weeks and feel very good about the findings.

Cheers

LikeLike

Are you referring to 1% position size in SMSI at the end of your comment? The risk/reward for this investment warrants a bigger than 1% position unless I read your comment wrong. This is probably the best opportunity that Mark has shed light on since I started following him. I made 780% on HMNY but only had 3% in it because I sold my other 10% I had in there after a nice gain well before we got close to 780%. Everything seems to be going in the right direction for SMSI. I am looking to add more tomorrow depending on how the stock acts.

I now look at investments not on how much I can make but how much is being risked vs the reward. This is a great investment, but it still could go south but there is a lot pointing the other way.

LikeLike

Yep. I think you got it all right.

LikeLike

Yep only 1%. I’ve done a little due-diligence. Enough to feel comfortable. Now I do have 2 1/2% in tech precision which Mark first turned me on to many years ago. It nearly went bankrupt – and should have. I didn’t buy until it was below $.50 a share. I’m convinced the reason it didn’t go bankrupt is because it’s a key supplier to the military industrial complex for some key part in nuclear power plants. They can’t even discuss who some of their clients are. I don’t know of anybody making nuclear power plants in the USA except for military ships. I think it was general dynamics and Connecticut just cut a deal so they expand to three submarines per year. I’ve carefully read every report they filed with the SEC. You’re not going make quick money with tech precision. but I think this is a real turnaround candidate.

LikeLike

I think it is great you are making choices based on your comfort level after your research. Position size has lots of variables that honestly only the person investing can determine.

LikeLiked by 1 person

I’ve got money to risk. Losing a mil won’t change my life, but adding 10 could be fun. 🤷🏻♂️

LikeLiked by 1 person

Yeah. That didn’t work out, but you’re not the only one who stayed in. My mentor and I still have a little. You’re assessment on that one is correct.

LikeLiked by 1 person

Oh I didn’t get in till years later. Just for some reason I kept following it. I keep reading their fillings and the transcripts of their quarterly calls. Then the change in many. I couldn’t figure out why they hadn’t gone bankrupt – when they were obviously insolvent. Eventually I figured out something was going on with the military; that’s when I bought. GoodNight all.

LikeLiked by 1 person

Nicely done. If everyone did like you, things would be a lot easier for everyone 🙌🏼

LikeLike

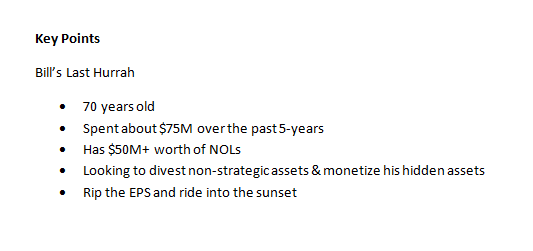

Thanks Mark. Your coverage on this stock is outstanding. Really appreciate you sharing. I am still trying to find something wrong with your analysis so we can argue about it, but haven’t found anything just yet other than I still can’t prove that Bill owns 29%. I’ll let you know when I do. 🙂 Next week’s call will be interesting. I’ll bet you’ve rewritten all of your questions today!

LikeLiked by 1 person

Right?? 😂 Bill’s stake effectively went to 29% via the implications of the convert. That effective number has changed, but it doesn’t change the amount of his personal $$$ invested.

LikeLike

He owns 1.8 mil in common, and will own an extra 3.6 mil from preferred conversion. See page 16 of the 10k

LikeLiked by 2 people

Thanks

LikeLike

Won’t the conversion increase to total number of shares outstanding, the denominator? And, isn’t the 29% based on the current denominator?

LikeLike

That’s correct. You’ll have to factor in the new shares added with the latest offering, so the overall percentage will go down. He can’t convert until after the annual meeting/vote to remove the 19.99% limitation on ownership I believe. I think Mark’s point is not the exact percentage, just that he’s put his own skin in the game and it’s a fairly sizable investment of his own money.

LikeLike

Absolutely agree with your last sentence.

LikeLike

Bingo on all counts

LikeLike

Yes. 29% is the old number… from when he first bought the stake. I need to start citing a new number, but he did take his stake from 12% to 29% and has since diluted himself (and others) via both “need” and “want” rounds.

I’m just happy to see the “need” now giving way to “want”. Bearish vs. bullish.

LikeLike

I saw that Unterberg unloaded their 1.9 million stake, probably accounted for much of the volume in the past week or 2.

LikeLike

Looks like they picked up 170,000 GAIA.

LikeLike

GAIA is an execution monster right now. From the data I’ve analyzed, their marketing ROI is off the charts.

They know this, which is why they did a “want” round of funding (to increase their marketing spend).

LikeLike

Agree, but why dump all of your SMSI?

LikeLike

I’ll be trying to answer that question. In the meantime, “there are always buyers and sellers”.

Bill Smith’s stake went up and Unterburg’s went down. Gotta match up (and more importantly, PROPERLY WEIGHT) each data point.

LikeLike

Unterburg was the largest shareholder after Bill Smith, so selling 100% of their SMSI holdings is definitely a significant event. I am not weighing it at all yet since I do not know why they did it.

LikeLike

I understand. As one of the top shareholders, I’m curious too.

However, my increased stake and Bill’s increased stake dwarfs Unterberg’s. Until I can get an explanation (assuming I can) those two data points are much more significant to me. I know the research I’ve done and nobody know the company better than Bill.

Institution sell for many reasons.

Bottom line, it will be nice if we can find out why they sold, but we cannot interpret it as bearish without getting the answer. Hypothesizing is the playground of the amateur/lazy investor — a waste of time that could be spent doing research.

That’s not directed at you Brad! Just saying, for the sake of the broader reader base.

LikeLike

Yeah, I am not sure why Unterberg purged all of their SMSI, would be good to see if we can get some feedback from Mark on that. Could be that they sold their current position, kept warrants, and participated in the new offering?

LikeLike

That would make sense, except they sold out before March 31st.

LikeLike

Irrelevant. The last offering (before this one) was well-telegraphed as of Jan 31 and could have been predicted earlier.

Again, hypothesizing takes focus away from gathering valuable data. I have more coming in now 😉

LikeLike

Not sure why you said that date is irrelevant. The reporting I am looking at shows no purchases during the month of March, so it is relevant. I am not hypothesizing. I am sharing a fact.

LikeLike

Ah…. I understand

LikeLike

I understand now… but it doesn’t (and won’t) bring us one iota closer to understanding why they did what they did (whatever it is they did).

I’ll ASK around! 😉

LikeLike

Heading out to play golf with some contacts from a company I have covered. Maybe somebody can go through the SMSI registration statement and see if Unterberg is mentioned in there. 😉

Better than hypothesizing back and forth…

LikeLike

I went through the registration statement. They are not mentioned in there. So they did not buy in that offering, but did sell what they previously held sometime during Q1.

LikeLike

Cool. Added it to my list of questions for my next 1-on-1.

LikeLike

Great find Brad!! I’ve been concerned about this dark pool supply of shares just above $2 for weeks now. The seller never shows his ask and when the market takes it out he slams down on the bids at any price. It’s unusual behavior and has me a bit concerned.

LikeLike

To add to the drama, I believe this may be a larger red flag. Mr Arno ( board of directors) is highly connected to Unterberg.

LikeLike

Nice catch. From the Smith Micro Website:

From 2009 to 2012, Andrew served as Vice Chairman and Chief Marketing Officer of Unterberg Capital, LLC, an investment advisory firm that he co-founded.

LikeLike

Nice detective work. Still doesn’t tell us much though. I’ve seen lots of politics at these firms, first hand. Definitely great fodder for more pointed questions and investigations though.

LikeLike

No, but it does explain the heavy selling in March above and beyond any that Hudson Bay may have been selling.

LikeLike

ABSOLUTELY. Agree 💯

We may have completely churned the investor base last quarter.

BTW, I’m thinking that Unterberg caught wind of the funding round in late Jan (many of us did) and chose not to go under NDA (many of us didn’t) and sold the stock instead.

That’s actually what I wish I had done.

LikeLike

Right but you would have bought it back. They didn’t.

LikeLike

Not yet at least… but you’re right. If they wanted to sell and buy back they’d have been likely to buy right after the round, around Mar 3-15, as I did.

LikeLike

Perhaps they are just not believers in the story now and they liked the GAIA story better. They had some other new adds in Q1 too. I don’t remember the names.

LikeLike

Possibly. It would be hard to blame them. I assume they sold just ahead of the March offering, which was only necessary because of the Sprint delay. The delay coincided with bad reviews (the new version wasn’t released until March). I used some sneaky journalism tactics to get better insight into the reviews. If I hadn’t, would I have believed that they’d fix the issues? IDK…

LikeLike

so Arno is a bigwig at Unterberg who divested in March, but looks like he was given more for his personal from the company in March as well. He holds a good amount. https://www.streetinsider.com/SEC+Filings/Form+4+SMITH+MICRO+SOFTWARE+For%3A+Mar+12+Filed+by%3A+Arno+Andrew/13945711.html

I’m new to reading/understanding this stuff as well, if I’m interpreting it wrong.

LikeLiked by 1 person

I really like your analysis of how Safe and Found is a platform and it is so much more than Family Locator. I read through all the negative S&F reviews and what stood out to me is that the how many of them seemed to be from parents just complaining that “all I want to do is track my kid” and S&F is more complicated. As you have analyzed this is the vocal minority.

I work in healthcare software, and all the feedback is very similar to what I hear from the less skilled users as more robust features are added. Yes SMSI needs to cater to these users who just want to use the core tracking function and once that is easy to use, they will get acclimated to the more complex features as time goes on. It was just a shock to them as long as the functionality works and it gets less complex to use I see no concerns.

LikeLike

That’s EXACTLY what top-level customer support people at Sprint and one of the 3 top-ranking heads involved with the SMSI project at Sprint told me.

Some people just don’t like the change.

LikeLiked by 2 people

Interesting language in the SPA just filed:

From the date hereof until twenty-four (24) months after the Effective Date of the initial Registration Statement, neither the Company nor any Subsidiary shall issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of Common Stock or Common Stock Equivalents at an effective per share purchase price of less than $2.17 (as adjusted for forward and reverse stock splits) without first obtaining written approval to do so from Purchasers holding a majority of the Shares acquired pursuant to the transaction contemplated by this Agreement. In addition to the foregoing, neither the Company nor any Subsidiary shall issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of Common Stock or Common Stock Equivalents at an effective per share purchase price of less than $5.00 until 120 Trading Days following the Effective Date of the initial Registration Statement without first obtaining written approval to do so from Purchasers holding a majority of the Shares acquired pursuant to the transaction contemplated by this Agreement.

Interested to see who the purchasers are

LikeLiked by 3 people

I like it.

Great data gathering everyone. I think we can see a picture unfolding here.

In addition to no more rounds coming anytime soon, Arno’s untouched holdings coupled with Unterberg selling shows a disconnect. One could and wanted to sell and one couldn’t.

That furthers the hypothesis is that Unterberg saw the March round coming and sold out. Will have to snoop around for something more than a hypothesis…

Will also be interesting to see if Unterberg comes back (or perhaps came back with this week’s round). Selling ahead of the last round likely disqualified them (technically, if not actually) from the March round.

LikeLiked by 2 people

Mark, given the way the warrants are structured I bet Unterberg figures he can still get in with a large amount of shares in the low to mid $2.20 range assuming some of those warrants will be sold.

LikeLike

Looks like a good floor on the stock price moving forward

LikeLike

The plot thickens! Good info!

LikeLiked by 1 person

8k is out https://fintel.io/doc/www.sec.gov/Archives/edgar/data/948708/000156459018010989/smsi-8k_20180503.htm

LikeLiked by 1 person

No one has discussed / commented on the change in language in the press release regarding profitability. Unless I’m late to the ballgame, 4Q’17 commentary indicated expectations to reach profitability in 2H’18. Now the press release indicates “break-even”. It’s one thing if they company is investing in growth and will reap GAAP profits later on, but the other possible read through is that the Sprint adoption continues to ramp slower than expected. Thoughts?

LikeLike

Has it changed? “We are diligently pursuing several strategic initiatives currently underway, and expect the Company to be cash-flow positive from an operations standpoint and break-even in the second half of fiscal 2018.”

LikeLike

Same quote that’s in the notes of this article.

LikeLike

4Q’17 Earnings Call: “I believe this capital raise will be the last one before the company returns to profitability. Looking ahead, I am pleased with where we stand as we are positioned for a very solid fiscal 2018. By the second half of the year, we expect to be cash flow positive and profitable as a business.”

3Q’17 Earnings Call: “I fully believe that we are well on our way to returning Smith Micro to growth and profitability in 2018.”

There have been other references as well along the way. I’ve been involved in the drafting of corporate press releases before and know that language surrounding future expectations tends to get extra internal scrutiny from the likes of management, counsel, and in some cases, the board. So my ears perk up a bit when I see a change like this.

This isn’t to say the thesis is off track….obviously a lot of money can be made if they reach profitability in 1H’19 vs. 2H’18, but its probably worth understanding the driver of the change.

Mark — thoughts?

LikeLike

To me, it’s very clear that Smith has found an opportunity that he believes will take the business to another level.

After more than doubling his stake, it’s one of only a few reasons he would dilute himself (which explains his statement, “…to facilitate the acceleration of our product roadmaps and planned M&A activity in the coming year,”).

I want to hear more, but my feeling is that it’s bullish. His recent moves have all been aligned with near-term (12-24 month) share price appreciation.

LikeLike

Mark SLATE discussions (Money) with F Salmon suggests that like previous S/Tmus attempt,fusion likely to fail. Debt overload at Sprint?

LikeLike

Thanks, but my report already told investors that the odds of this deal happening is pegged at around 35%.

Sprint won’t go out of business anytime soon (many many years). At worst they’ll go through bankruptcy reorganization, but the operations should continue under restructured debt or with the debt holders taking over. I’d have to look at the cap structure to understand better.

LikeLike

Big drop to $1.90 today. Not sure where all the shares are coming from? There does seem to be a dark pool as I don’t see these sizable ask prices. Trying to nibble at these levels.

LikeLike

Mark, What do you think about competition from the GPS wearable devices with 2 way communication that do not require a phone. As a parent, I’ve noticed these devices are more popular in our school since kids don’t have to carry a phone. Have you heard of any efforts by Sprint to develop one of these devices or Smith to configure their software to integrate with wearables? You may have already addressed this question. If so, sorry I missed it. Thank you.

https://www.safewise.com/resources/wearable-gps-tracking-devices-for-kids-guide

LikeLike

I’ve addressed this many times (and along multiple dimensions) in my reports. Check ‘em out! 😉

LikeLike

Just posted Safe & Found download rank data chart to StockTwits. It suddenly spiked last week.

It was the #79 lifestyle app on April 19, the #75 on April 29, and then suddenly shot up from there and is now up to #45.

LikeLiked by 2 people

Mark

Between the last offering including warrants and this offering including warrants there has been a lot of dilution. Unless they eventually come up with another deal or another software product that makes a lot of money the original hypothesis of there eps has gone down and a potential 20 bagger is reduced. Hopefully they raised this last offering for good reason as you hypothesized in your last blog.

LikeLike

See my last report (and stay tuned for the upcoming one) 😉

LikeLike

I read and know whT your last report said and agree. It I am just saying percentage wise a lot of dilution. I also own six figures worth of stock at this point so obviously I agree with your hypothesis.

LikeLike

Of course. I differentiate though. For me, the March round was true dilution (“need” money). This new round is different and shouldn’t count as true dilution until we see what they use it for IMHO.

LikeLike

This post seems disingenuous as this offering was most certainly not at a “premium”. While you can argue the offering was above the previous closing price, it’s far less bullish when you factor in the value of the warrants.

LikeLike

That would have been a valid point to discuss when it happened, two months ago. Stock has outperformed the market nicely since 😊

LikeLike