Long-time readers should note some significant changes in how I communicate in the public domain. The primary purpose of this forum is now to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Accordingly, this document should not be construed as an endorsement or recommendation of the companies or securities discussed herein. I am not an investment advisor and this is not an investment thesis. It is merely one part of the story, which I present for debate in hopes of determining all risks and upside potential. The disclosure at the end of this piece is critical to understanding the content of this document. Further, I frequently trade my positions and may buy, sell, or short the securities mentioned herein at any time, regardless of the facts or perceived implications of this article.

This post will provide a lesson in just how hard it is to decipher a stock’s trading action (in hopes that you will learn that learning about fundamentals is the smartest path to making your millions… as if Warren Buffett isn’t proof enough.

Early last week, I provided evidence that the preponderance Smith Micro (SMSI) short-sellers was ready to abate.

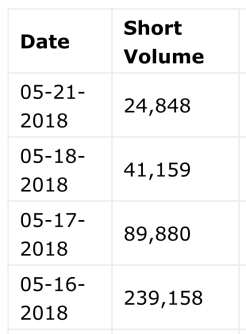

It’s evident to me that short selling has/had been ongoing to hedge positions taken during SMSI’s May 3 round of funding. However, in the days following my report, this happened (as reported by FINRA):

As you can see, the “shorting” fell off a cliff after May 16.

As a result, the stock has made five straight closing highs for the first time this year Today may snap that streak, but a 15% move in five days is not too shabby. That being said, there’s plenty of reason to believe that there’s much more to come (the rest of this week’s posts will explain why… stay tuned).

FYI, I put shorting in quotes because, based on my experience, most of these short transactions were not a traditional bets against the company for fundamental reasons. Indeed, I see little reason why anyone of substance (a big enough fish to move the stock) would short a $2 stock with clear evidence that profitability is around the corner.

Investors of substance tend to do enough due diligence to know what’s going on before initiating a naked fundamental short. Further, many can’t even short $2 stocks (many institutions have clear charters that restrict certain kinds of trades).

That being said, investors of substance will short stocks as part of arbitrage bets. For sure, some proportion of the investors bought into the SMSI round simply because they believe they could sell shares on the open market and make a quick profit from the difference.

Rounds of funding like the one SMSI did on May 3 do not come with much warning (unlike the March round). Having participated in rounds like that before, I can tell you this — if you don’t already know the company, you don’t have enough time to do proper due diligence.

The for the short notice is simple. If the company telegraphs that a round is coming, the stock is likely to experience significant selling pressure, almost regardless of the fundamentals (though there are some exceptions). Think about it this way — if I told you that a round of funding was coming for ABC and you owned it, would you not be tempted to sell (at least as a quick trade)?

Personally, I’m more than tempted. If I feel that a round is coming, I get out of the way. Investors need not look any further than HMNY to understand why.

Now, beyond the “shorting” that takes place in relation to a financing event, “shorters” or sellers are never truly gone.

For starters, for every buy, there is a sell. In many cases, the seller is simply a market maker (who helps to inject liquidity into the system).

There are many other types of situations, though.

For example, if I sell calls to cover a share purchase, I am effectively putting out a negative position (which makes me a “shorter” for that particular transaction). Now, if the person on the other side of my option transaction wants the hedge their bet, they can do so by shorting the stock (without actually becoming net short).

So, if someone trades the options, it could (and likely does) impact the stock.

Another example — if there are any natural sellers on the institutional side, they might sell a certain number of shares in relation to the day’s volume (so they don’t force the stock down too much while filling their position). Look up “VWAP” if you want to understand this better.

This morning’s action started with a ~50,000 share market order that round-tripped the stock from $2.06 to $2.29 and back in one minute (by the way, please do yourself a favor and learn about limit orders / Level II quotes before placing large orders on small stocks!). This is the exact kind of action that could spark small bits of VWAP-type selling to persist throughout the day.

Meanwhile, investors heads are surely wondering, “what’s going on”?

The answer to that question is essentially “nothing”. Just an ill-advised buy order and some normal market ripple effects.

To wrap things up, many have asked me what will happen to the warrants out there. Well, first of all, if you don’t know how warrants work, please Google it. In the stock market, the less you know, the less $$ you make.

Once you’ve done that, you’ll understand this — in order to sell the shares associated with the outstanding warrants, the investors have to exercise the warrants. It’s their choice whether or not to exercise, but it’s required to get the associated shares.

Most of the outstanding warrants are priced in the low-2s. If I have warrants with a $2.30 strike price, I have the right to buy the stock from the company for $2.30 a pop. Of course, I won’t do that unless the shares are above $2.30… and it’s much more likely that I’ll wait until it’s much higher.

The reason is simple.

If I like the stock, I can remain “invested” by just holding the warrant, perhaps until they expire, a few years from now, with no cash outlay.

However, if I want to exercise the warrants to sell the stock, the stock has to be high enough for me to make an attractive profit. If my warrants are at $2.30, I probably want to hold until the stock is at least $3.

That sounds like a $0.70 profit, but once I exercise the warrants (by paying the company $2.30 per share), I still have to sell the shares! If that selling drives the stock down to $2.60, I’ve only profited $0.30 per share for my trouble. Of course, they can sell (short) first and exercise later, but again, shorting at $2.30 and then exercising at $2.30 makes no sense.

So, I don’t expect a lot of exercising in the low 2s. An experienced portfolio manager told me that $3 is the probably the level to watch for potential warrant-selling action.

Suffice it to say, there are many things at work. Just one more reason that it’s smarter (and more profitable) to focus on the fundamentals and not the trading action.

In the meantime, I stand by the data, which shows that the big wave of “shorting” is gone. Selling pressure is a natural part of a stock’s journey, but it appears that the this stock is finally back in the hands of the bulls.

More Research:

- SMSI Q1 Results: Sprint Ramp Confirmed & T-Mobile Discussed!

- “Top Ten Stocks” Update (and note to HMNY watchers): AMC & GAIA Report Stellar Earnings!

- Are SMSI’s Unlocked / Hidden Assets Worth Over $20 Per Share?

- HMNY’s ATM Offering: Where’s The Stock Going Next?

- Smith Micro Raises $7 Million (At A Premium) To Accelerate Its Momentum

- Videocast: AEHR 10-Q, MoviePass Update

- AEHR Grows 175% — Beats On The Top & Bottom Line (Buying More)

- GAIA vs. MoviePass: CAC Shows Which One Is A True Mini-NFLX

- Major Update on SMSI

- SMSI’s Safe & Found App: 100,000 Downloads & Counting

- MoviePass Projected To Burn $600M In 2018

- SMSI: Riding A New Trend & Making Its Latest Comeback

- Mark Gomes Research

To get my posts in real-time, just follow/subscribe to this free blog.

If you only want to receive my most critical reports, simply sign up for my MailChimp mailing list instead. If you’re on that list, you will only get key articles and occasional recaps of all the work I’ve recently done.

Disclosures / Disclaimers: I am long SMSI. However, this is not a solicitation to buy, sell, or otherwise transact any stock or its derivatives. Nor should it be construed as an endorsement of any particular investment or opinion of the stock’s current or future price. To be clear, I do not encourage or recommend for anyone to follow my lead on this or any other stocks, since I may enter, exit, or reverse a position at any time without notice, regardless of the facts or perceived implications of this article.

I am not a financial advisor. Nor am I providing any recommendations, price targets, or opinions about valuation regarding the companies discussed herein. Any disclosures regarding my holdings are true as of the time this article is written, but subject change without notice. I frequently trade my positions, often on an intraday basis. Thus, it is possible that I might be buying and/or selling the securities mentioned herein and/or its derivative at any time, regardless of (and possibly contrary to) the content of this article.

I undertake no responsibility to update my disclosures and they may therefore be inaccurate thereafter. Likewise, any opinions are as of the date of publication, and are subject to change without notice and may not be updated. I believe that the sources of information I use are accurate but there can be no assurance that they are. All investments carry the risk of loss and the securities mentioned herein may entail a high level of risk. Investors considering an investment should perform their own research and consult with a qualified investment professional.

I wrote this article myself, and it expresses my own opinions. I am receiving no compensation for it, nor do I have a business relationship with any company whose stock is mentioned in this article. The information in this article is for informational purposes only and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

The primary purpose of this blog/forum is to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

I have been putting Limit Sell orders in for half my position between 2.20 & 2.30 This morning I got busy. There went an opportunity. Never fails. I would have re-purchased at current levels.

LikeLike

The conference is coming up hot in less than 2 weeks now. I’m assuming they will be announcing their new “acquisition” — from the last offering at the conference. I’m still trying to speculate what this could be — any ideas? But either way I believe we should see a run up, whether it holds after the conference or not is another question.

LikeLike

No idea as to the timing or company type.

I trust Management to make a good (accretive) decision and that’s all that matters until they make an announcement.

Anything else is a waste of time and thought which can be better used elsewhere. 🤑

LikeLike

Mgt never said they were acquiring anything.

LikeLike

When?

LikeLike

Did they not say it within the SEC filing? — maybe i’ll have to read it again.

LikeLike

” The Company intends to use the net cash proceeds from the Offering for working capital purposes, and to fund required dividend payments, payment of principal and interest payments under short-term borrowing obligations, and payment of interest (but not principal) under long-term borrowing obligations.”

LikeLike

They have to say that.

LikeLike

Read the press release and earnings call transcript for the real story.

LikeLike

This is what i found on the press release:

“I am pleased with the new financing announced today, which will significantly strengthen our balance sheet, and facilitate the acceleration of our product roadmaps and planned M&A activity in the coming year,” said William W. Smith, Jr., President and CEO of Smith Micro Software.

This is where I got that they were planning some acquisitions…

LikeLike

BOOM

LikeLike

“I am pleased with the new financing announced today, which will significantly strengthen our balance sheet, and facilitate the acceleration of our product roadmaps and planned M&A activity in the coming year,” said William W. Smith, Jr., President and CEO of Smith Micro Software.

Most notably:

facilitate the acceleration of… planned M&A activity in the coming year

LikeLiked by 1 person

BOOM

LikeLike

If we are talking about a SMSI, the CEO said the opposite. The money they just raised is primarily for an acquisition they have in mind. That’s why it’s not truly dilutive. They didn’t raise it to burn it, but rather to use it to buy something accretive!

LikeLike

When?? Not following you. I basically was saying that mgt never confirmed any acquisition was imminent.

LikeLike

Ha ha. I must have missed read you. No, they haven’t publicly said that an acquisition is eminent. However, they have to have something in mind or else they would not have done another round of funding with the stock where it was.

As I teach people all the time, try to think like the CEO (especially when he is the largest shareholder).

LikeLike

Haven’t seen anything about AEHR lately. I am split same number of shares between AEHR & SMSI. Think it’s a good time to switch some of those AEHR’s over to SMSI or does anyone know of upcoming PR for it?

LikeLike

“Just an ill-advised buy order” after I retired and was advising a few friends I found a VERY THINLY TRADED Lehman pfd.it trades like 500 shares a week, one guy wanted to buy 2000, I was placing limit orders whenever I saw 100 available at my price, which kept moving by 1/4 pt. and no fill, all the while I was trying unsuccessfully to explain market/limit etc. orders. The shares were trading ~$12.50 x $13.50 size 1×1. So one am I wake up, log on, and see the stock trades 2000 shares with several small executions (that’s why they’re called “executions”) from $13.50 to $27.00, I just knew what happened. He’s calling me frantic about how he was screwed, well he called Schwab and said he wanted to “buy 2000 at $13.50, the best price possible” broker said, “the best price possible?” “yes” boom, market order sent and filled, I heard the tape. I told him he’s on his own, I’m done.

LikeLiked by 1 person