Long-time readers should note some significant changes in how I communicate in the public domain. The primary purpose of this forum is now to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Accordingly, this document should not be construed as an endorsement or recommendation of the companies or securities discussed herein. I am not an investment advisor and this is not an investment thesis. It is merely one part of the story, which I present for debate in hopes of determining all risks and upside potential. The disclosure at the end of this piece is critical to understanding the content of this document. Further, I frequently trade my positions and may buy, sell, or short the securities mentioned herein at any time, regardless of the facts or perceived implications of this article.

The following article was authored by Spence Watson with contributions and editing by yours truly. This is what happens when a little blog fosters research collaboration and succeeds. Hope it inspires you to join the revolution. Enjoy!

After the SMSI Q1 conference call it became apparent there are five dominoes / catalysts that should be falling in quick succession:

1. New major release of Safe and Found

2. Nationwide PR campaign from Sprint

3. Final sunset of Family Locator

4. Initiation of Wall Street coverage

5. SMSI marketing their story to investors

Assuming these business-related dominoes fall, five investor-related dominoes should follow suit:

1. Television, text, email, social media, and aggressive in-store coverage, driven by Sprint and AAA promise to make SMSI’s Safe & Found service a household name among Sprint’s 60 million subscribers and AAA’s 58 million customers.

2. Of course, this will raise SMSI’s visibility among investors, just as Fortnite has propelled Turtle Beach (HEAR) and MoviePass made Helios (HMNY) a moonshot for early/nimble investors. Like $HEAR and $HMNY, I believe that the prospects for profitability will drive SMSI’s share price.

In that regard…

3. SMSI is following Turtle Beach’s path. Management has said that it will turn profitable within months. This, along with Sprint/AAA’s nationwide campaign, should spark a commensurate revaluation of SMSI shares.

4. A continuation of its recent Safe & Found momentum should give SMSI the bandwidth/cache to ramp its numerous other already-signed carrier wins. (a subject which was previously covered). With its high operating leverage, Management’s statements imply that SMSI can deliver at least $0.40 of SaaS-based EPS in 2019.

5. This would lend visibility to $0.80 of 2020 EPS, further multiplying its share price (the shares are currently just $2). This should put SMSI in the Russell 2000 discussion, taking its visibility on Wall Street to the next level.

As it stands, SMSI is already seeing increased institutional interest and ownership (a story to be covered later this week). Today, we will discuss our discovery that Sprint started rolling out its nationwide marketing campaign this week!

The first domino fell on May 15 with the release of version 1.3 of Safe & Found (which was discussed here a few days ago). Immediately after this release Sprint began two new marketing campaigns around Safe & Found:

Marketing Campaign #1

Sprint obviously places a high value on their relationship with AAA and on May 15 they began aggressively marketing their relationship with AAA. As an AAA member you are entitled to the following perks with Sprint:

1) Member only pricing on phones and plans.

2) Sprint will pay your yearly AAA membership!

3) FREE membership into Safe & Found.

And in case you haven’t read Mark’s research, SMSI gets paid a flat fee, which he estimates at $3.50 per month per subscriber, regardless of whether Sprint sells it for $20 or gives it away for free!

To facilitate this marketing campaign, Sprint created the following landing pages:

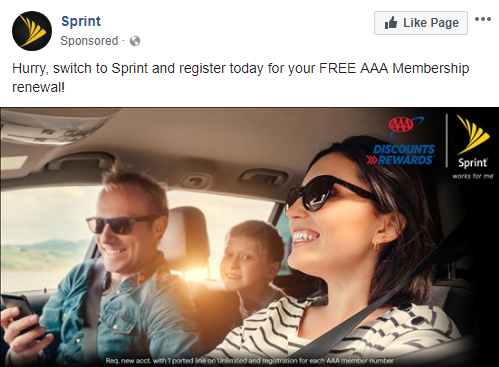

These landing pages are for the 58 million people who are current AAA members or those considering AAA. I don’t have Sprint or AAA but I have seen ads numerous times over the weekend on Facebook like this one:

When you click on these ads, you get taken directly to the landing page where after answering one question you are shown the three benefits of being with Sprint and AAA.

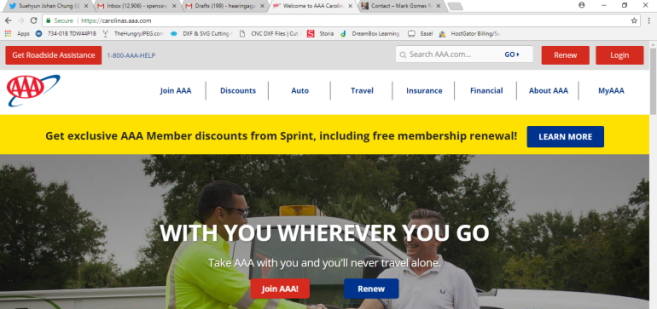

To make it even better, some AAA sites are sending their members directly to this landing page. Take a look at the AAA website for all of the North and South Carolina (https://www.carolinas.aaa.com/).

That yellow bar across the top takes you directly to the mentioned landing page.

These are just two of the ads I have seen this weekend of Sprint aggressively promoting their relationship with AAA.

The most exciting thing is that Sprint will give you Safe & Found indefinitely as long as you know the magic word — AAA. You can go to the Sprint AAA promo site and read this:

“Sprint will pay Classic or Basic AAA membership renewal for as long as you remain a Sprint subscriber”

OK, so I pay for my first year of AAA and get Safe & Found for free. After that, Sprint will pay my AAA membership and give me Safe & Found as a perk.

In Summary: If you are one of the 58 million AAA members and one of the 57 million Sprint customers, Sprint will give you Safe & Found FREE OF CHARGE and pay SMSI a monthly license fee.

This is a benefit that Sprint and AAA are telling as many people as they can about! That in itself is exciting news. However, I promised two promotions, so here’s the second.

Marketing Campaign #2

Sprint upper-managers have officially started touring Sprint stores around the country to train associates on the benefits of Safe & Found. As part of this, they are decorating the stores with Safe and Found promotional material.

Judging from the efforts put out, one would assume they are training members to up-sell the service. However, it goes further than this. Due diligence has revealed that application attach-rate are going to become a focused metric in the near future.

In other words, reps will have incentives (carrot and/or stick; we don’t know yet) for pushing applications like Safe & Found to customers.

FYI, one Regional President at Sprint has been documenting his ramp-up activities. He started his tour on May 15th and has detailed many of his stops on his twitter. Some of his tweets from the past few days include:

- “Sprint offers great services such as Lookout (security on mobile device)/Safe and Found(family location service). Come and visit Sprint stores near you.”

- “Sprint offers great services such as Lookout (security on mobile device)/Safe and Found(family location service). Come and visit Sprint stores near you.”

- “Store in Campbell has great partners so that customers have great customer services. We have new services: Lookout and Safe & Found. Please visit Sprint stores near you.”

His twitter images are filled with Safe & Found promotional material. Here’s a nice shot of the Safe & Found poster in store:

Proof Is In The Pudding

These campaigns are less than a week old and just getting started. What are the results thus far? Let’s look at the app rankings:

Safe & Found spiked at the beginning of the month on Google Play, but eventually drifted a bit lower after that initial spike. However, starting on May 14, it has been back on the rise (ranked in category):

- #64 on Monday –> #66 –> #65 –> #62 –> #60 –> #57 on Saturday. A very nice steady climb back up to the 50’s.

Safe & Found has always been ranked low on iOS, but the new marketing initiative is paying off. The app was recently trending around #300 in category. But again, starting on Monday, May 14:

- #361 on Monday –> #299 –> #308 –> #243 –> #245 –> #221 on Saturday! On iPhone, Safe & Found has spiked from below #300 to low 200’s. This is an incredible jump. The data speaks for itself.

If I’m right, Family Locator will soon be done away with, forcing subscribers to switch to Safe & Found. For now, they are gradually pushing for voluntary switch-overs and training employees before pulling the plug.

As we can see, they are being trained right now!

By the way, Sprint’s methodical approach to rolling out Safe & Found has many benefits. For one, they can retain as many subscribers as possible by making it their choice to switch.

Also, their support staff can handle the inevitable influx of calls that occur when a new app gets installed (even I have done my fair share of calling into their customer service call center!). Anyone who experienced the customer service issues during HMNY’s ramp-up can understand why a methodical approach is optimal.

As a result, until we see concerted nationwide coverage on Safe & Found, I will be quite happy to see the download numbers float in a range around the recent levels. It’s likely an appropriately manageable level for their support organization.

Adding customer service staff that you won’t need in a few months is unwise (especially for a new and highly strategic application like this one). Besides, as it stands, I estimate that the Safe & Found subscriber base will grow by roughly 100% per quarter through year end. That’s more than enough to keep the momentum rolling.

One Final Note on Reviews

My hunch is many negative reviews are being manipulated by someone or group with an interest in keeping Family Locator in place instead of Safe & Found. Over the course of development there have been some known issues with the app, but Mark’s product trials weren’t able to confirm many of them.

For example, the app tends to drain the battery, according to some people. However, Mark’s phone showed that Safe & Found only represented a small percentage of his battery use (even though he was testing it heavily).

Further, the 1-star reviews almost always cite no issues and only say, “I want Family Locator back”. It’s becoming clear that most of these 1-star reviews have never used Safe & Found. They take the time to leave a review but can’t give a single reason why they hate it so much? Sorry, I’m not buying it.

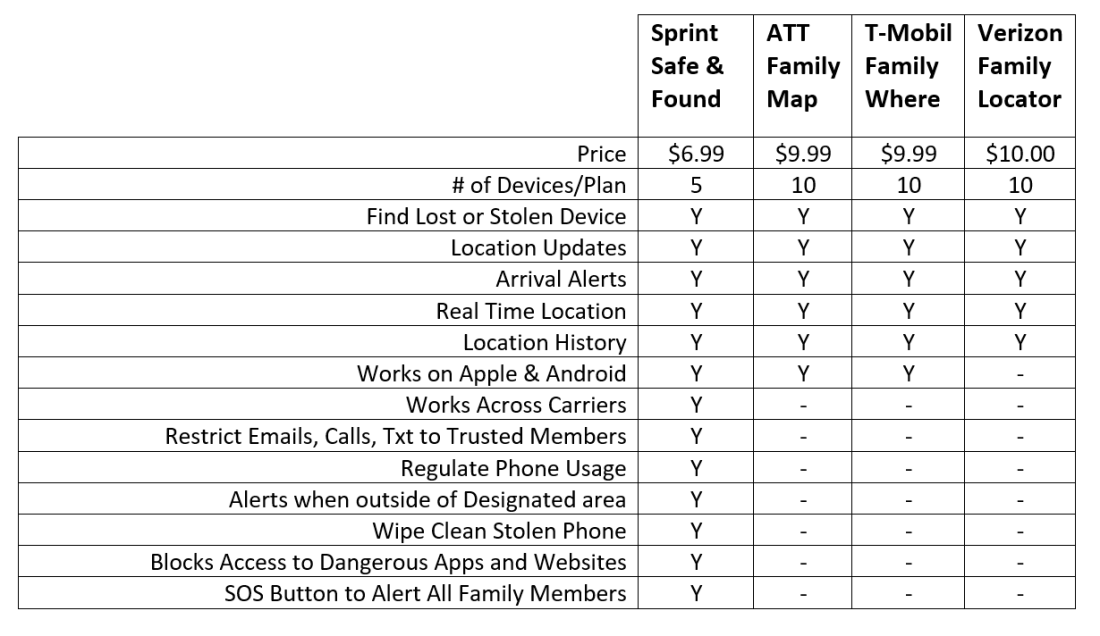

A Note Regarding The Competition:

1) Life360 (which was valued at about $250 million in 2014) has a locator app that has some automobile features that S&F doesn’t offer. However, S&F + AAA offers all of this and more. Adding AAA (paid for by Sprint) beats all of the competition (including all of the other U.S. tier-1 carriers).

Now I understand the significance of Sprint paying for AAA memberships. I wouldn’t be surprised to see insurance companies follow suit.

2) The Family Locator app is getting major manipulation right now: 40+ reviews per day, most of them 5-stars and no explanation. Someone is obviously manipulating the date against S&F and for Family Locator (though it’s shouldn’t be a surprise to see SMSI or Sprint counteracting).

I estimate that I’ve done about 500 hours of research on this one company. However, at least this time, it appears that Spence Watson has outshined Sherlock Gomes (sorry, couldn’t resist).

Great job, Spence… and great job SMSI. Stay tuned!

More Research:

- SMSI Q1 Results: Sprint Ramp Confirmed & T-Mobile Discussed!

- “Top Ten Stocks” Update (and note to HMNY watchers): AMC & GAIA Report Stellar Earnings!

- Are SMSI’s Unlocked / Hidden Assets Worth Over $20 Per Share?

- HMNY’s ATM Offering: Where’s The Stock Going Next?

- Smith Micro Raises $7 Million (At A Premium) To Accelerate Its Momentum

- Videocast: AEHR 10-Q, MoviePass Update

- AEHR Grows 175% — Beats On The Top & Bottom Line (Buying More)

- GAIA vs. MoviePass: CAC Shows Which One Is A True Mini-NFLX

- Major Update on SMSI

- SMSI’s Safe & Found App: 100,000 Downloads & Counting

- MoviePass Projected To Burn $600M In 2018

- SMSI: Riding A New Trend & Making Its Latest Comeback

- Mark Gomes Research

To get my posts in real-time, just follow/subscribe to this free blog.

If you only want to receive my most critical reports, simply sign up for my MailChimp mailing list instead. If you’re on that list, you will only get key articles and occasional recaps of all the work I’ve recently done.

Disclosures / Disclaimers: I am long SMSI. However, this is not a solicitation to buy, sell, or otherwise transact any stock or its derivatives. Nor should it be construed as an endorsement of any particular investment or opinion of the stock’s current or future price. To be clear, I do not encourage or recommend for anyone to follow my lead on this or any other stocks, since I may enter, exit, or reverse a position at any time without notice, regardless of the facts or perceived implications of this article.

I am not a financial advisor. Nor am I providing any recommendations, price targets, or opinions about valuation regarding the companies discussed herein. Any disclosures regarding my holdings are true as of the time this article is written, but subject change without notice. I frequently trade my positions, often on an intraday basis. Thus, it is possible that I might be buying and/or selling the securities mentioned herein and/or its derivative at any time, regardless of (and possibly contrary to) the content of this article.

I undertake no responsibility to update my disclosures and they may therefore be inaccurate thereafter. Likewise, any opinions are as of the date of publication, and are subject to change without notice and may not be updated. I believe that the sources of information I use are accurate but there can be no assurance that they are. All investments carry the risk of loss and the securities mentioned herein may entail a high level of risk. Investors considering an investment should perform their own research and consult with a qualified investment professional.

I wrote this article myself, and it expresses my own opinions. I am receiving no compensation for it, nor do I have a business relationship with any company whose stock is mentioned in this article. The information in this article is for informational purposes only and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

The primary purpose of this blog/forum is to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Great job Spence! (and Mark)

LikeLiked by 1 person

Great article through great collaboration. Thank you Spence for taking the time to research and share this information with us. And, or course, thanks Mark for facilitating this exchange of ideas.

LikeLike

The thing I didn’t realize until after I wrote this was how big Life360 is. I’ve thought of S&F being in competition with the other carriers location apps. In reality, Family Map. Family Where and Family Locator are all dead. Life 360 is the #2 app in category(#1 in Tinder) and it has 50 million users. Nobody is going to sign up for ATT Family Where when they can get pretty much the same thing on the free version of Life 360. However S&F + AAA offers most of the features of the paid version of Life360 and some other features Life360 doesn’t offer.

And I can’t stress enough Sprint is offering S&F+AAA FREE TO EVERYONE that understands the promotion. That fact still blows my mind.

I have no idea what ATT, Verizon and T-Mobile will do with their locator apps but I’m sure plans are on the table to get rid of or replace what they have. Its just embarrassing for Verizon to be charging for an app that doesn’t work as well as the free Life360.

LikeLiked by 1 person

FANTASTIC job guys, love it!

Safe and Found on the surface “looks” a lot better in the Google Play store now, much higher ranking and positive highlighted reviews compared to just last week.

I do think it is a stretch to think there is manipulation going on with the app reviews, Family Locator is pushed as an editors choice and has ads in the Google Play store when you search for those terms. It is just a high volume app at 10m downloads, flagged as free and not attached to a carrier.

LikeLike

The manipulation is not with the Family Locator product — it’s manipulation with the Safe and Found rankings.

LikeLiked by 1 person

Hey guys,

Great work summarizing the upcoming catalysts. I’d like to offer up some thoughts for debate and would love to hear what others think:

1. The article mentions the following:

“Besides, as it stands, I estimate that the Safe & Found subscriber base will grow by roughly 100% per quarter through year end.” (I interpreted this as doubling of subs per quarter)

I believe this is extremely optimistic. My data shows they’re gaining around 50-80k downloads (not subs)/month. This works out to be around 150 – 250k downloads/quarter. You can validate this rate based on the growth in the number of new reviews – it would roughly match.

2. The article implies to the new marketing campaign on AAA and Sprint’s 60M (x2) subscribers as having a large momentum in growing the S&F subscriber base. Admittedly, this was my initial thoughts as well (after Q1 CC), in fact I left a comment in one of Mark’s earlier articles estimating the number of subs they could gain from this campaign.

However, so far 10 days into the campaign, the growth rate of S&F’s downloads has been linear (not accelerating). This leads me to believe the following:

a) If this campaign weren’t running, S&F’s growth rate would likely actually be decreasing, I attribute this due to the fact that everyone who wanted to volunteer to switch over to S&F from the legacy platform has already done so. So the lower hanging fruits has been picked.

b) The current AAA marketing campaign will likely not produce significant acceleration in S&F’s growth, but rather keep it growing roughly at the same rate.

Overall, since the launch of the new campaign, I’ve had to revise my estimates down. That said; I still believe the stock is very undervalued and we have a significant margin of safety. I can share my revenue estimates if anyone’s interested, but right now I don’t see them getting 3.5M in quarterly revenue by Q3/Q4 without a significant boost in sub growth.

There’s two ‘dark horses’ that I have not accounted for (known unknowns):

1. The current AAA campaign is still in the process of ramping up, the next 2-6 weeks will be important to observe and could accelerate growth rate.

2. The SMS campaign that’s coming up (I think you guys missed this in the article).

I also want to point everyone to the fact that AppAnnie’s data is not very accurate, please don’t put too much emphasis on it. I recommend using it to show relative growth/decline but not absolute numbers. What this means is if S&F ranked at 45 back in March and it ranked 60day, then you could guesstimate that S&F’s download rate is actually lower than it was in March. it does NOT mean it’s 20% lower, because the rankings App stores (iOS and Android) is NOT linear, but rather exponential. A ranking increase from 60 -> 50 is much easier than a increase from 20 -> 10.

Hopefully this is helpful. I’m hoping someone can poke some holes in my thoughts. And thanks again to Spence and Mark in putting together this article.

LikeLiked by 2 people

I’m fairly tuned into Sprint’s advertising. They started an aggressive marketing campaign on 5/15 advertising the AAA relationship, using search ads, content ads and social media ads. It definitely had a noticeable effect on downloads. This campaign abruptly stopped on 5/20.

Then on 5/20 they starting ads for a 3rd landing page. This one is for people over 55 years old(I’m not). This landing page is all about their 2 phone special for 55+ with AAA. S&F is mentioned as an afterthought at the bottom of the page.

Its possible that Sprint ramps up the AAA ads near holidays. There are 58 million AAA members and 18% of them have Sprint so that makes the potential of free to consumer installs is massive, about 2 million families.

And we haven’t even mentioned the advertising from AAA. They have even more incentive than Sprint to tout the relationship.

All to say when Sprint spends ad money, downloads jump.

As far as the downloads. I estimate there were 32,000 Play downloads last month and 8,000 iOS downloads. I use AppAnnie for ranking but have just found another site to estimate downloads. I believe the reviews are being manipulated in both directions so I don’t go by review numbers. I’ll post where I got my downloads from later. Its written down but need to find the website I used.

LikeLiked by 1 person

FYI, I have very good sources (several inside of Sprint and several from a SMSI). Triangulating their data points gave me an estimate of $250,000 of revenue for Q1. The number surely came in above 300,000 (giving me confidence that my sources are leading me in the right direction, but still coming up conservative).

Of course, this lends confidence to my forward numbers also being conservative. 😉

LikeLiked by 3 people

This is excellent. I wasn’t aware their campaign stopped on 5/20. I’m based in Canada so I’m not part of their targeted advertising audience, so it really helps to have someone in tune with this in the US. Thanks for this critical info Spence.

Based on this information, it makes sense as to why the download numbers weren’t as high as what we had expected. I feel much better now lol. It seems they’re taking a fairly conservative approach, and potentially testing ROI based on the two campaigns.

LikeLike

Boom 🔥

LikeLiked by 1 person

1. That’s a decent methodology, but I’m using Android rankings data and management’s guidance commentary… and yes, AppAnnie data isn’t 100% either, but when coupled with mgt guidance to triangulate, I believe it’s more accurate methodology (with all due respect to yours).

BTW, I believe that the number of reviews has been declining as a percentage of downloads as a result of the declining number of one-star ratings. Less squeaky wheels, so you have to adjust up by about 50%. Finally, of course, the PR is just beginning, so ALL past/recent download data points (yours and mine) go out the window anyway.

2. Another great observation, but they are not pushing the marketing effort to aggressively to avoid overloading the customer service organization, as I noted in the post.

Also, I didn’t miss the MMS campaign. I simply used the word “text” instead.

THANK YOU For playing devils advocate. Challenges to the thesis like this are one of the big reasons why I do this. If I’m wrong about a name, I’d rather find out the easy way, not the hard 😉

That’s why yours is easily the POST OF THE DAY. Cheers brother (and great work on the due dilly)! 🙌🏼

LikeLiked by 1 person

Thanks for the feedback Mark.

1. Your point on the accuracy of the review count vs download is something I had missed. I agree we may need to revise the numbers up given recent negative reviews has dropped, which would have skewed my estimates down. Thanks for pointing this out. I won’t go into too much depth in revising my model just yet because I feel like I’m going too much into guess work at this point. Will have to wait and see if new data becomes available.

2. I hear ya on this point, it’s a bit too early to tell. I look forward to see what they’ve got cooking in June 😉

LikeLiked by 2 people

👍🏼

LikeLike

Great article, but one thing to note since were referencing sprints 60 million customers.

Who is eligible:

Per the sprint page, Sprint Postpaid customers on Android, iOS and even Wi-Fi only phones or tablets.

From my understanding (and I could be wrong) when sprint says it has 60 million customers this includes a large percentage of people that have PREpaid plans. For instance, I have my parents on TELLO (many others like this) that use sprint towers. In this situation, even though I have AAA, and technically “sprint coverage via tello”, I would not be eligible for this offer. Just thought I’d point this out.

LikeLiked by 1 person

Yes sir ! Great observation. The reason I didn’t get into this is that we have no way of calculating an anticipated attach-rate to estimate how many customers will sign up.

So, listing the absolute number of customers for Sprint and AAA is merely to provide a magnitude-based point of reference.

That being said, no matter how you slice it the combined services have roughly the same number of customers as Costco which significantly contributed to driving MoviePass to 2 million customers.

The only difference is that MoviePass loses about $3 for every dollar of revenue, while SMSI drops $.70 of each revenue dollar to the bottom line. 😎

GREAT post 🙌🏼

LikeLike

EXCELLENT information and research, thank you so much. However, I am a bit concerned about Sprints aggressive marketing campaign (playing devils advocate) what is the seemingly huge benefit to Sprint, a AAA membership can be over $75 a year, if they give it away and pay SMSI $42 / year per sub ($3.50×12) their outlay in year 1 could be ~$125 per sub, if 50% of Sprints 60m subs install that’s as much as $425m with no revenue from that, forgetting years 2-3-4, we all know there is nothing “free” with phone carriers, what piece of this puzzle isn’t visible yet? This is also not a marketing campaign for Sprint alone, half a billion isn’t spent on that.

LikeLike

Greg,

It must be Excellent Observation Day.

Your observation is 100% accurate. However, what you were missing is that Sprint isn’t trying to “make money“. They are trying to lock the customer base in. If you saw the churn numbers you would realize that it’s well worth $125 per year to ensure that customers doesn’t move to another carrier.

Once they are hooked on the service BUNDLE, they are less likely to move to another carrier (who doesn’t / can’t offer that same bundle), giving them higher customer LTV, which = higher profits, even after accounting for the outlay!

Not to mention, locking customers in will make it easier for them to hold (or even raise) prices, instead of constantly lowering them.

This way, they turn an undifferentiated commodity service into a differentiated one. It’s brilliant and exactly the way that Softbank thinks. Very strategic. Very Asian.

LikeLiked by 2 people

Makes sense, much appreciated

LikeLike

Such games being played with this stock. Just before the last trade of the day the Bid/Ask was 2.03 X 2.05 and the last trade of the day was for 100 shares and it went off at 2.07. I’ve seen this multiple times today in both directions.

LikeLiked by 2 people

It feels like it’s a cannon about to explode. Then all the day traders are going to pile in not realizing the true float and it could pop big time, then fall back to range. I’m going to be ready to try and increase my share count.

LikeLiked by 1 person

After listening to the last conference call, I don’t think management is into the idea of “marketing their story to investors.” However, I could be wrong.. or that presumption could be wrong.. but that’s fine either way. I think your dominos metaphor is a goo one, and looking forward to management at least continuing to be transparent and executing on their plans for the next few quarters.

LikeLike

They’re not? Hmmm…

Smith Micro to Present at 8th Annual LD Micro Invitational on June 4, 2018

https://finance.yahoo.com/news/smith-micro-present-8th-annual-103000237.html

LikeLiked by 1 person

That’s interesting. A tiny OTC company that I have on my watch list (IGEN) is going to the same conference and is speaking just before SMSI. This other company got a contract to supply auto trackers for Sprint’s IoT Factory, which is a program from Sprint that you’d think SMSI would be involved with. Probably just a coincidence?

LikeLike

I will add that company to my agenda and find out!

LikeLike

By the way, I’m starting to believe that safe and found is being viewed as a Trojan horse for becoming a “big brother” app… not only for tracking people, but for everything they own.

The value for a carrier to have all of that information is so incredible that it’s no wonder they’re giving the service away to many customers.

If I was Sprint, I would actually PAY to have customers use the app, just to gain access to all of that data.

LikeLike

Carvski,

Another good observation. However, Management has simply been cautious about becoming boastful before knowing that everything is running at 100% at Sprint. Now that we see that momentum, you can expect to see a change in their tone.

By the way, even though they weren’t boisterous on the call, their words and guidance was very bullish.

LikeLike

A completely OT comment: LFIN is going to the Grey Sheets today. Why people buy into scam co’s like LFIN is beyond me. A lot of people got hurt. As I always say, Live & Learn!

LikeLike

I was short 🙌🏼

LikeLike

Thanks to all for the analysis and updates. Am a AAA member, but to date haven’t seen or heard anything about the S&F promo here in North FL. A measured ramp up of a new program like this makes great sense. Proper training for sales associates in marketing the product will be key ( as it always is ) for making the customers “sticky” – make sure the customer understands the product and ALL its benefits. Big hurdle for telecoms since they aren’t known for great customer service.

LikeLiked by 1 person

BINGO 👍🏼🙌🏼

LikeLike

IMPORTANT UPDATE:

Something started yesterday. I don’t think its internet advertising.

The iOS rankings updated:

361 on Monday –> #299 –> #308 –> #243 –> #245 –> #221(5/20) –> #238 –> #255 –> #263 –> #245(Wednesday) –> #132 (Yesterday)

Play:

#64 on Monday –> #66 –> #65 –> #62 –> #60 –> #57(5/20) –> #57 –> #63 –> #63 –> #65 –> #56 (Yesterday)

You can see the effect of the advertising that was started on 5/15 and abruptly ended on 5/20. Yesterday with no advertising we jumped above that 5/20 number. No steady climb as before.

Sprint has told me the Family Locator would “stop working at any time”. Is the 3rd domino starting to fall?

LikeLiked by 2 people

Oh wow

LikeLike

My guess is they are kicking groups of people off FL, testing the reaction, updating software where needed and then kicking more people off.

based on: Insane jump in category, new slew of negative reviews, a new release is imminent according to responds on app store.

LikeLiked by 1 person

Can someone check the iOS rank? It continues to climb on Play and today is at #54.

LikeLiked by 1 person

I see #120 iOS, and #52 Play right now

LikeLike

#42 Play right now!

Rock and Roll!

LikeLiked by 1 person

…and #2 on trending for Lifestyle (behind only Life360 Family Locator)

LikeLiked by 2 people

We just might have an ole fashion short squeeze!

LikeLiked by 1 person