Opening Disclosure — Long-time readers should note some significant changes in how I communicate in the public domain. The primary purpose of this forum is now to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Accordingly, this document should not be construed as an endorsement or recommendation of the companies or securities discussed herein. I am not an investment advisor and this is not an investment thesis. It is merely one part of the story, which I present for debate in hopes of determining all risks and upside potential. The disclosure at the end of this piece is critical to understanding the content and context of this document. Further, I frequently trade my positions and may buy, sell, or short the securities mentioned herein at any time, regardless of the facts or perceived implications of this article.

Safe & Found Roll-Out Update: I visited some Sprint stores this weekend and spoke to employees. The stores around here don’t have the Safe & Found promotional materials yet (unlike the stores in Central California), but they’re aware and anticipating them coming in.

More importantly, at least some employees at every store I’ve visited are confirming that they’re aware of metrics (a.k.a. incentives / quotas) that they’ll be measured against for pushing Safe & Found to customers.

Those haven’t been officially enacted yet, but Safe & Found is in their systems and ready for up-sell by thousands of Sprint associates. Once the metrics are enacted, it will be exciting to see how it impacts the download numbers!

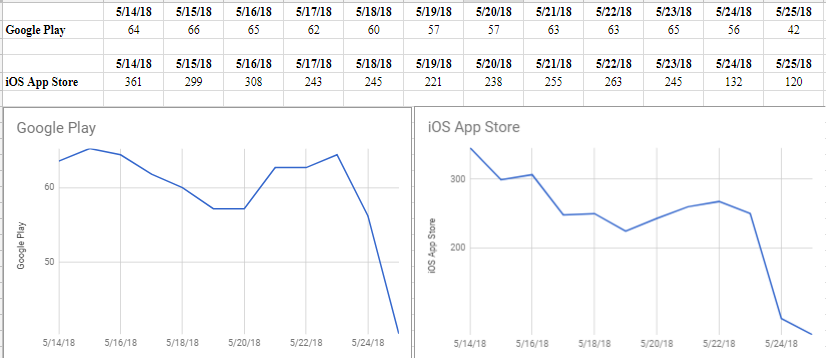

In other news, Safe & Found has taken another leap forward in the app rankings. See for yourself:

I suspect this move is being spurred by 1) final Location Labs pre-sunsetting activity and 2) Sprint’s confidence that the customer support burden is easing.

The latter point is important. As the last of the challenging customers are handled, the customer support burden per download will decrease, enabling Sprint to open the floodgates a bit wider. I believe that’s exactly what’s happening now.

I expect that the floodgates will remain regulated. Also, the ranking will perhaps moderate back to some “normal” level. Either way, I believe we’re seeing clear signs that the Sprint Location Labs installed base is finally being transitioned to Safe & Found in earnest.

That puts my EPS model (which was been built based on management’s guidance) into play.

I’ll leave you with some photos of the roll-out in progress…

Tomorrow I’ll release my institutional ownership analysis. Stay tuned!

More Research:

- The Quick Investor’s Guide To SMSI

- Smith Micro (SMSI): Knocking Down The Dominoes!

- SMSI: Show Me The Money

- Videocast: AEHR 10-Q, MoviePass Update

- SMSI 10-Q Released — Strategies For Trading The Stock

- AEHR Grows 175% — Beats On The Top & Bottom Line (Buying More)

- New Version Of SMSI’s Safe & Found Released; Additional Catalysts On Tap

- Lose 33% In 9 Months To Make 1,000% In 15?

- GAIA vs. MoviePass: CAC Shows Which One Is A True Mini-NFLX

- Buying SMSI — Today Is The Day I’ve Been Waiting For!

- MoviePass Projected To Burn $600M In 2018

- SMSI: Riding A New Trend & Making Its Latest Comeback

- Mark Gomes Research

To get my posts in real-time, just follow/subscribe to this free blog.

If you only want to receive my most critical reports, simply sign up for my MailChimp mailing list instead. If you’re on that list, you will only get key articles and occasional recaps of all the work I’ve recently done.

Disclosures / Disclaimers: I am long SMSI. However, this is not a solicitation to buy, sell, or otherwise transact any stock or its derivatives. Nor should it be construed as an endorsement of any particular investment or opinion of the stock’s current or future price. To be clear, I do not encourage or recommend for anyone to follow my lead on this or any other stocks, since I may enter, exit, or reverse a position at any time without notice, regardless of the facts or perceived implications of this article.

I am not a financial advisor. Nor am I providing any recommendations, price targets, or opinions about valuation regarding the companies discussed herein. Any disclosures regarding my holdings are true as of the time this article is written, but subject change without notice. I frequently trade my positions, often on an intraday basis. Thus, it is possible that I might be buying and/or selling the securities mentioned herein and/or its derivative at any time, regardless of (and possibly contrary to) the content of this article.

I undertake no responsibility to update my disclosures and they may therefore be inaccurate thereafter. Likewise, any opinions are as of the date of publication, and are subject to change without notice and may not be updated. I believe that the sources of information I use are accurate but there can be no assurance that they are. All investments carry the risk of loss and the securities mentioned herein may entail a high level of risk. Investors considering an investment should perform their own research and consult with a qualified investment professional.

I wrote this article myself, and it expresses my own opinions. I am receiving no compensation for it, nor do I have a business relationship with any company whose stock is mentioned in this article. The information in this article is for informational purposes only and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

The primary purpose of this blog/forum is to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Monitoring Twitter for new rollout Tweets. Follow me there for the retweets.

LikeLike

Hi Mark, finally a little life in AEHR.

LikeLiked by 1 person

Hey Mark,

I know that this was an earlier request at some point, but I don’t think it was ever addressed.

A reader had previously requested this, but I think it would be extremely valuable to detail some of the previous products and services that SMSI was offering in relation to its highly volatile stock price history.

Like you mentioned, there were many different years where SMSI broke the $50 mark and even hit the +$80s mark for short periods of time. What sorts of services and products were SMSI selling at the time to warrant such valuations then? I think having an article to highlight some of these products would provide some more understanding of this. That would be incredibly valuable as being able to relate that to the current situation with the Safe & Found app will shine some more light on where this thing is really going to go.

Right now, everyone knows SMSI is on the cusp of breaking out – I truly believe the only reason it hasn’t thus far is due to extremely limited coverage of the stock (minus your blog) and not enough institutional strength onboard with this. Once news passes that SMSI has had a profitable quarter and is on track to add hundreds of thousands of subscribers and them adding 70-80% of that revenue straight to the bottom line will warrant a change in perspective no doubt.

Just by taking a look at the trading volume of the past 2 weeks (May 17 – today), you can see that since May 16 the volume has never passed 250K with the average being closer to 100-150K, whereas the daily volume for the few weeks before (Apr 26 – May 16) hung around the 400k average range. This, with the movement of the stock from 2.17 down to 1.77 falls in line with Mark’s previous estimate that this movement was due to short selling and would have abated by May 16 per one of his previous posts.

Anyways, didn’t mean to go into the analysis of the technical movements of the stock – but I think this combined with the current catalysts for the stock right now present us with a very favourable situation in where I potentially see the stock gaining a lot of momentum in the next few months.

Mark – your turn, please give some thirsty readers such as myself more exclusive information into SMSI’s history – which should in turn highlight the $$$ to be made in the future ;).

LikeLike

Yushen,

My forte is analysis of current situations. I think would be great if you (or one of the other readers) take on this task. After all I’ve already written 25 reports. Time for some other of our members to pick up the slack. Sounds like a PERFECT job for you!

Remember, this is not a paid service… it’s a collaboration. 😉

LikeLike

I did a bit of research on it and found some good info. Their first acquisition was Cross Communications which provided modem sharing over enterprise LAN. They basically provided software for fax modems. They IPO’d at around 50/ share and bottomed under 3 in 1999. The internet rendered fax modems obsolete. The next cycle began around 2000 when the stock popped again on the heels of software compression programs. Quicklink Mobile basically turned your cell phone into a wireless modem. From Smsi’s website, sales of the software skyrocketed with Verizon and the launch of 3g. The third cycle looks to have been from their Music Essentials software which allowed people to download music to their PC and then zip the music to a cell phone for listening. The advent of the iPhone helped crush that business line and the stock went in decline after that. Hope this was helpful.

LikeLiked by 4 people

Maybe we can chart up these events and how they corresponded in terms of EPS at the time. I might take a stab at it later and write up a whole blog on the events. Thanks for the info!

LikeLike

Actually nevermind no need, found the EPS during those dates from Mark’s previous blog:

“SMSI’s 2006 high of $76.04 was accompanied by a near-doubling of net income to $9 million (split-adjusted EPS of $1.51 per share). Based on its enterprise value (EV), the resultant P/E was 41 (reasonable for that level of EPS and earnings growth, though pricey for a hit-driven stock).

Similarly, SMSI’s 2009 high of $51.48 preceded 2010 revenue of $130.5 million and 160% growth in net income to $12.3 million (split adjusted EPS of $1.44 per share) yielding a P/E ratio of 29, based on its $350 million enterprise value at the time.”

Assuming we can get Mark’s EPS goals of .50-.55 cents in 2019 and .85 in 2020 — we should be able to replicate similar results from previous years.

LikeLike