Long-time readers should note some significant changes in how I communicate in the public domain. The sole purpose of this forum is now to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses. Accordingly, this document should not be construed as an endorsement or recommendation of the companies or securities discussed herein. I am not an investment advisor and this is not an investment thesis. It is merely one part of the story, which I present for debate in hopes of determining all risks and upside potential. The disclosure at the end of this piece is critical to understanding the content of this document. Further, I frequently trade my positions and may buy, sell, or short the securities mentioned herein at any time, regardless of the facts or perceived implications of this article.

That being said, I don’t know anyone who is short HMNY (nor has been short since establishing this blog). Nor have I been short since establishing this blog. Further, I have no intention of shorting HMNY at any point in the near-future (though I will be tempted if/when another financing event becomes evidentially immanent).

My sole interests here are to 1) chronicle this story, 2) call it like I see it for investors who follow my work, since most learned about this company from me, and 3) attract more professional research partners by showcasing my capabilities. Aside from that, call me a nerd, but analyzing stocks is among my favorite retirement hobbies (right up there with volunteering as a track coach and reading comic books… maybe someday I’ll grow up).

OK, let’s get to work…

It’s been another great week of progress for our collaborative research efforts. People are interacting in the comments section of my articles and I’m getting a lot of great information via email and phone calls. In turn, I’m feeding that knowledge back to the group here.

SMSI’s Guidance

SMSI released Q4 results last night. They also provided cash flow and profitability guidance. For me, both represented bullish news for the stock.

That being said, not everyone knows enough about the story. So, I didn’t jump in with both feet. Here’s why…

When GAIA reported, it was a similar situation. Not enough people understand the story, so the shares actually fell initially. But once people figured it out (with the help of management), the stock jumped some 40% in about two weeks.

I bought the breakout as a trade (on top of my core position) and captured 20% of the ride. I sold that trading position yesterday, but continued to hold 100% of my core stake as of noon today.

Getting back to SMSI, I picked up 5,000 shares last night, but wanted to see if people would panic out this AM (like they did with GAIA). There was some action this AM (some of that was me, testing the water with two 5,000 share purchases). Eventually died down and the stock started to drift lower, as I suspected it might.

As was the case with GAIA, SMSI management now has more freedom to interact with institutions. I suspect they will do that. I also suspect that Chardon Securities (the banker on their recent financing) might initiate coverage of the stock in the coming weeks.

In other words, most (if not all) of the possible negative catalysts are out of the way, while the list of near-term catalysts expands… all while the stock sits at the most attractive risk/reward levels since last October.

All that, and the stock is down 4%. Meanwhile, AEHR is up 9% today. That’s a 13% swing, on a day that SMSI could easily be up 13% on its own. Consequently, I decided to swap some of my AEHR for SMSI. These are still my #1 and #2 positions. However, as I alluded yesterday, I have now made SMSI my largest position.

Diving into the Q4 results, the numbers were much better than I expected. Expense controls kicked in, which will provide an easier path to profitability. This was reflected in the guidance, which confidently predicted that cash flow and profitability will begin in the summer.

Investors are encouraged to read my full report on SMSI, which talks about the scalability of its operating model, what that has meant for its past performance (I counted at least 10 multi-bagger runs), and what it (and the Sprint deal) means for its potential upside in 2018.

Of course, further delays are always a risk. However, in private conversations with the company, it seems evident to me that the ramp-up delay was primarily caused by an internal pricing issue (at Sprint) which required 3 months to resolve. Management said that the product is selling well into existing accounts (and importantly, new accounts), which provides hope that they can capture most of Sprint’s 350,000customers and add 350,000 more in the coming year.

Most importantly, it relieves my fear that there was something wrong with the relationship. With Sprint selling the product and management saying that they have C-level support at Sprint, it definitely feels like SMSI’s “Gold Mine” phase has just begun. Indeed, if things ramp up as planned, we’ll look back at today as the inflection point.

For those who don’t have the time to read through my full report, here’s the key section, IMHO:

“…once this deal kicks in, management expects it to generate over $14M of annual recurring revenue, which it hopes will grow as more aggressive marketing and market awareness takes hold.

According to both, the CEO and CFO, about 70% of SafePath revenues should drop straight to SMSI’s operating profit line. As mentioned above, the company just restructured and has minimal incremental expense requirements (they left some of the infrastructure in place to support its anticipated SafePath needs and commissions on new sales are expected to be “minimal”, per Mr. Smith).

SMSI also has an $80 million deferred tax asset, stemming from federal and state net operating loss carryforwards of $134.6 million and $147.5 million, respectively, as of December 31, 2016, so those operating profits should substantially drop to the net income / EPS line.

If they execute against their rhetoric (always a challenge) incremental gross margins should be in the 90% range, enabling incremental operating margins in the 80% range.

This is the power of operating leverage, which is among the most attractive characteristics of software companies. The key is scaling one’s installed base, which SMSI has traditionally done by signing carriers with tens of millions of customers.

It all goes to explain why SMSI’s booms and busts have been so pronounced.

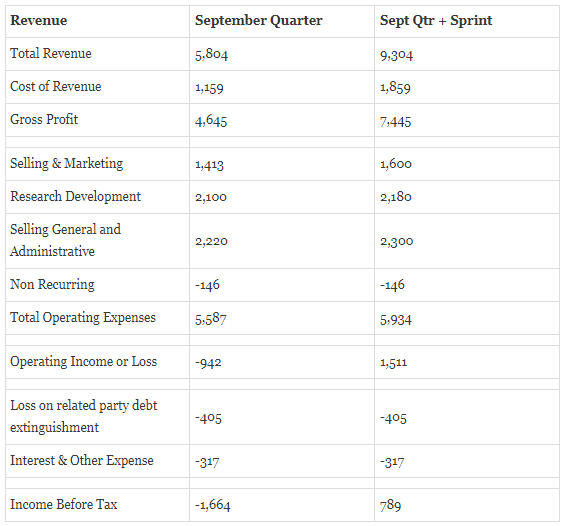

When management’s figures are added to SMSI’s current revenue/expense base, we derive the following income statement:

Of course the restructuring benefit is non-recurring, so that gain should be backed out. Similarly, the loss on related-party debt extinguishment should also be treated as non-recurring. Lastly, SMSI has a massive tax asset, so it wouldn’t be paying any significant tax in reality.

Netting it all out, if our assumptions are correct, SMSI should (no prediction; no guarantee) generate profits of ~$1.1 million per quarter (all else being equal) in the back half of this year. In other words, Sprint could be adding about $2.5 million in quarterly revenue / cash flow to SMSI’s bottom line (and growing, as/if Sprint expands its marketing efforts).

Multiply that by four quarters and we get $4.4 million of annual profitability.”

Beyond that, I have heard that Sprint wishes to double its installed base in the first year (as I alluded above with my “350,000 plus 350,000” comment) and grow to millions of customers over time. If they start to show good traction at Sprint, the other major carriers could quickly follow. Indeed, this is already happening internationally in a number of green-field accounts.

In short, based on discussions with management, I calculate that every 100,000 new subscribers will deliver an additional $0.10 in annual EPS. If they hit that 350,000 plus 350,000 at Sprint, that will generate 70-cents of incremental EPS.

Needless to say, that’s quite significant for a $1.50 stock – the most I’ve seen in years, in fact.

They just need to execute. We’ll see…

SMSI vs. MoviePass

Many readers are familiar with Smith Micro (SMSI) and/or MoviePass (HMNY). This section is for those who are familiar with HMNY, but not SMSI.

Before I start, let me be clear in saying that I am not comparing what SMSI offers to what MoviePass offers. However, I am most certainly comparing their business models. Both are subscription businesses. However, they have very different scalability profiles.

As most of you know, I’ve been critical of the lack of scalability in MoviePass’ model. The MoviePass app does not carry a large expense base. However, for them, subscriber growth has required a growing amount of capital (due to negative gross margins), in hopes that the company can eventually start build the critical mass needed to generating enough revenue from theaters, studios, etc. to attain profitability.

The SMSI’s Safe & Found app doesn’t carry a large expense base either. The company is less than $2 million away from quarterly profitability. However, for them, subscriber growth generates significant and instant profits (due to 80% gross margins and only 10% operating expenses), giving them near-term visibility into attaining profitability.

If you look at the profile of most any successful subscription business, the business is characterized by a certain amount of upfront investment to build an infrastructure that enables high variable margins (high incremental profit per subscriber).

Almost every subscription software company (including SMSI) fits this description. Whether they succeed depends on whether they can attract enough high-margin subscribers to cover their relatively fixed expense base.

The problem I’ve had with MoviePass is that it will always have a low (negative, in fact) incremental profit per customer, requiring ancillary revenues to offset the expense base and negative gross margins. This is inherently riskier and provides less scalability in the long run.

Both companies are still within their risky stage of development, but with ciritcal differences.

MoviePass is growing quickly, but hasn’t proven that profitability is possible, given the frequent movie-going nature of its current customer base. It must attract a high ratio of infrequent moviegoers before their installed base collapses its capital structure.

In contrast, Smith Micro just announced that Safe & Found is now growing quickly at Sprint, but hasn’t proven that its customer base can get into the 6- or 7-figures. However, even a low 6-figure customer count will make SMSI cash flow positive. They expect this to occur next quarter, leaving the capital structure well-protected.

Here are some additional points of comparison:

- MoviePass offers an exciting subscription product which should appeal to millions of Americans (an all-you-can eat movie service, delivered via a cellphone app).SMSI offers an exciting subscription product which addresses an important & growing trend that should appeal to millions of Americans (a family safety service, delivered via a cellphone app).

- MoviePass has over 2 million customers, as it targets over 250 million moviegoing Americans.Sprint has begun marketing SMSI’s Safe & Found, with a stated goal of over 2 million customers (into its base of 55 million subscribers). If successful, it will open the door for SMSI to sign the other U.S. carriers to target over 250 million Americans.

- MoviePass is currently priced at $8.78 per subscriber per month. However, according to management’s public statements, I calculate that those customers are spending $24.77 per month on tickets. So, MoviePass is currently generating gross losses of $15.99 per subscriber per month.SMSI’s Safe & Found is currently priced at $6.99 per subscriber per month. According to management’s public statements, I estimate that SMSI is currently generating gross profits in excess of $3.00 per subscriber per month.

- MoviePass is planning to add additional features and ancillary revenue (restaurant discount offers, merchandise sales, etc.); to offset subscriber losses and achieve profitability.SMSI is planning to add additional features (driver tracking, IoT wearables, etc.) and ancillary revenue to augment subscriber profits and expand upon the profitability it is expected to achieve, starting this summer.

- MoviePass is currently valued around $300 million, based on its last round of funding and closer to $400 million based on HMNY’s current share price.SMSI is currently valued around $30 million, based its current share price.

Again, I’m not trying to compare what SMSI and HMNY do. That would be stupid. However, the structural / business model of any two subscription products can always be compared (and is always a useful exercise to see the difference and determine which has the less risky / more scalable profile).

HMNY News

We finally got some good news from these guys. It wasn’t all good, but it was a decent mix. I’m running out of time today, so I’ll save my analysis for another post. In the meantime, here are my thoughts on their decision to only offer annual-only subscriptions…

MoviePass recently stopped offering a monthly plan. New customers can only sign up for its annual plan. I don’t know if that will attract a higher ratio of casual users or a higher ratio of unprofitable frequent moviegoers. I’ll let you decide for yourself.

Either way, the impact on new customer sign-ups has been dramatic:

If you ask me, this is bullish.

If MoviePass is destined to succeed, it’s going to need more funding. To get that funding without diluting existing shareholders into oblivion, investors (like me) will need some proof that its utilization rate really can get down to 1.5 or less (which I believe is required for it to properly reward long-term shareholders).

The slowdown in sign-ups is good because it give us a chance to see what happens to utilization. It also enables MoviePass to get past the May-July movie gauntlet with fewer customers (and therefore less expense).

In the meantime, anyone who does sign up is providing them with much-needed upfront cash. Of course, they’ll have to service those customers for the next 12 months. However, they can cross that bridge more easily if they can prove that utilization isn’t a fatal flaw in their original plan.

Too many people have been focused on subscriber growth at any cost. “At any cost” is never a smart strategy. I agree that they need to build critical mass, but they need to do it intelligently. Otherwise, they’ll be forced to do more raises like the last two… and I’ve already written about where that could lead them.

If utilization improves at a better-than-expected rate (without worse-than-expected churn), the stock might justify a higher valuation, enabling them to attack the next leg of their journey without leaving its common shareholders behind.

p.s. To get my posts in real-time, just subscribe to this free blog. If you don’t to get all of my posts via email, just get on my MailChimp mailing list instead. To that list, I only send key articles and occasional recaps of all the work I’ve recently done.

Disclosures / Disclaimers: I am long SMSI and GAIA. I have no position in HMNY, nor have I traded the stock since launching this blog. Further, I am not aware of anyone who has been short HMNY or its derivatives since launching this blog. This is not a solicitation to buy, sell, or otherwise transact any stock or its derivatives. Nor should it be construed as an endorsement of any particular investment or opinion of the stock’s current or future price. To be clear, I do not encourage or recommend for anyone to follow my lead on this or any other stocks, since I may enter, exit, or reverse a position at any time without notice, regardless of the facts or perceived implications of this article.

I am not a financial advisor. Nor am I providing any recommendations, price targets, or opinions about valuation regarding the companies discussed herein. Any disclosures regarding my holdings are true as of the time this article is written, but subject change without notice. I frequently trade my positions, often on an intraday basis. Thus, it is possible that I might be buying and/or selling the securities mentioned herein and/or its derivative at any time, regardless of (and possibly contrary to) the content of this article.

I undertake no responsibility to update my disclosures and they may therefore be inaccurate thereafter. Likewise, any opinions are as of the date of publication, and are subject to change without notice and may not be updated. I believe that the sources of information I use are accurate but there can be no assurance that they are. All investments carry the risk of loss and the securities mentioned herein may entail a high level of risk. Investors considering an investment should perform their own research and consult with a qualified investment professional.

I wrote this article myself, and it expresses my own opinions. I am receiving no compensation for it, nor do I have a business relationship with any company whose stock is mentioned in this article. The information in this article is for informational purposes only and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

The sole purpose of this blog/forum is to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Excellent timing and brief on smsi. Bought more today and will watch for a few weeks. I think there were weak holders from financing flipping stock for the warrants that caused the supply.

But company is funded to profitability so all good.

Well played on Gaia. Take a look at smlr when you have time. Review Q2 – Q4 earnings reports. Tells an impressive story.

Sent from my iPhone

>

LikeLike

Hi Mark, great information again and good questions during the conference call yesterday. I wish someone has asked (unless I missed it) about the Tier 1 Latin America contract. I have not heard much about it lately. Do you have any additional information on this?

Also, I know you have addressed this in past posts, but it really worries me the amount of bad reviews they are getting for their Safe and Found app. Many are uninstalling it and I worry that Sprint might think they made the wrong decision by switching from Family Locator to S&F. Besides, it could affect trying to get other Tier 1 contracts in the US. What is your take on this?

https://play.google.com/store/apps/details?id=com.sprint.safefound&hl=en

LikeLike

Great questions. A Wall Street colleague was invited to beta test the latest version (and I was invited by him). It’s come a long way and by all accounts, Sprint is moving forward with the rollout.

As for the LA tier1, I wouldn’t expect much from that, but the European tier1 looks to more than make up for that. Cheers!

LikeLike

Wow…You’re not kidding about those reviews. Those reviews would definitely make me question my investment. I probably should have read the reviews before jumping in tho this. These people just don’t like the new app, they are absolutely angry and pissed off and want Family Locator back.

LikeLike

You’re reading about the angry few. I’ve actually tested the product. Sell if you want though. I still have some dry powder left in case of a market correction. 😂

LikeLike

I (and a Wall Street hedge fund veteran) both tested and gave the software a thumbs up. The reviews you’ve read are not indicative of the masses (nor the latest version).

Plus… it’s SOFTWARE. I’ve been a software analyst since 1994. Long enough to know the software is just code, which is easily improved. It’s not rocket science.

I’ve gone through this a hundred times in my career. I remember Oracle 10.7 (over 15 years ago) being TRULY terrible. It was so bad that we had warn customers (and investors). Larry Ellison himself wanted to kill us. It took awhile to fix, but they did (and became dominant).

More recently, I went through the same issue with HMNY and WDAY.

WDAY’s Financials application set is complex (but still not rocket science). Based on the severity of the issues (which I determined via research, not just reading reviews) I knew it would take several quarters to fix.

Fast forward to December and a handful of folks were still giving me VERY negative reviews of their financial software. But guess what? Upon further research, they turned out to be the exceptions and the stock is now at all-time highs. I’ve made a killing on it by knowing what to do with the negative data points (test it against a broader set of customers and industry contacts). Viola!

With HMNY, I tested the software back in September and it failed on day 1. But I saw it as an easy enough fix relative to what was required to sell the service. Since then, the negative reviews continue to roll in, but those are the vocal minority. Most have been having no problems and they’ve made big improvements. I saw that coming and played the stock perfectly. Viola!

The software has been good enough to attract (and for the most part, keep) 2 million customers. Unfortunately, their business model is a bigger / worrisome issue, which is why I got out. NOT the software.

There’s a big and small lesson here. On the small level, always remember that early or imperfect versions will tend to get negative reviews, as 1) the vocal minority speaks out, 2) happy customers don’t bother writing a review… even I haven’t!, and 3) the company itself uses a small initial base as a crowd-sourced beta test to perfect the software.

I may have to copy/paste this for my weekend write-up. It’s been awhile since I’ve done a lesson on confirmation bias. Looking at reviews is good research, as long as its weighted properly and fosters the appropriate reaction.

That’s why I started reading the reviews months ago and asking people who have used it. A Wall Street analyst saw the reviews too, so he sought to test the latest version. I tested it with him (and his entire family). We were all impressed with the progress relative to the reviews, as I stated on the conference call.

For example, months ago, the reviews said that the location wasn’t accurate. A few months later (the version we tested), it consistently showed EXACTLY where we all were, down to a few meters of accuracy — more than they’ll ever need. That improvement was reportedly driven by Bill Smith himself, who’d go everywhere (including out on his boat) with the app open to see if it was working or not.

The same thing is happening with each imperfection… and that will continue. With each new feature, they’ll work through early negative feedback and fix it quickly.

Remember, this is SMSI’s first major carrier account for this particular software, but they’ve developed much more complex software for the past 30 years.

They know the process and that’s why I’m involved. No other company has successfully ramped a next-generation platform at a carrier yet. Smith’s reputation for making code ready for carrier-grade deployment is why they were chosen. The original code was just a good foundation. Otherwise it would have cost more than a few million bucks.

In short, it’s all about researching the research… and now I have the title for my next piece. 😊

LikeLike

p.s. Make sure you’re reading reviews for the right version. I tested version 5.x

Many have reviewed older versions.

6.0 coming in June.

LikeLike

👍🏼

LikeLike

I agree about the warrant-related flipping causing the weakness. Seen it many times 👊🏼 Thanks for the note and heads up!

LikeLike

Nice action on SMSI today.

LikeLike

Just needed to work through the arb selling and earnings call. Coast is clear. I even bought some more, just before lunch. Supply/demand shift appears underway.

LikeLike

I bought more this morning as well 🙂

LikeLike

After your scary comment? 😉

LikeLike

Mark, Thanks for the insight on SMSI. Would you explain exactly what is warrant flipping, and how that depresses stock price below the price of shares that were issued please.

LikeLike

For the record, there’s no OFFICIAL term called “warrant flipping”. However, I use it to describe when a company does a round of funding and includes warrants as part of the funding.

Some investors will participate in the funding (getting stock + warrants) and then immediately sell the stock. If they get a good enough price for the stock, the warrant ends up being extremely cheap (or even free).

In this case, investors in the funding got a share of stock plus a warrant for $1.75. Many of them immediately flipped the stock between $1.60 and $1.80, that left them with the warrant for somewhere between -5 cents and positive $.15

LikeLike

I stick by my scary comment but the stock was acting well so I bought more at 1.55 🙂 What is really scary is the price action in HMNY. So glad I’m out of that crap.

LikeLike

Ha. I think a lot of people have moved out of HMNY and into SMSI.

LikeLike

I have steered quite a few people from StockTwits over to your blog and SMSI. I post over there under Shockexchange 101. I have also been defending the heck out of you when people post the SEC documents against you from the past. I tell them to judge you based on your content and not your past history. I go on to tell them that there are two sides to every story.

LikeLike

I appreciate you. If people read between the lines on the SEC settlement, the first thing to note is that it was an out of court settlement. The second thing to note is that their concerns revolved around my disclosures (telling people about my trading practices) during that four month period (which was the responsibility of my website management partners, who I’ve been trying to pursue with legal action). My disclosures were always good when done myself, via MY compliance attorney. Finally, of all my “poised to triple“ articles, none of them came out during that four month period. That being said, I take full responsibility for what happened and paid the price. Cheers.

LikeLike

LOL!

LikeLike

Mark do you view the GAIA’s Launch of Public Offering of Class A Common Stock as a positive?

LikeLike

There’s a simple rule of thumb (which I wrote about after RDCM’s financing at $11) when it comes to judging these things…

“There are two types of financings. The kind that is needed for survival, and the kind that is desired for expansion.”

The first is almost always bearish and the second is almost always bullish.

RDCM was the latter. Most biotechs are the former. SMSI was 50/50. This one for GAIA is clearly the latter. 👍🏼

LikeLike