Long-time readers should note some significant changes in how I communicate in the public domain. The primary purpose of this forum is now to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Accordingly, this document should not be construed as an endorsement or recommendation of the companies or securities discussed herein. I am not an investment advisor and this is not an investment thesis. It is merely one part of the story, which I present for debate in hopes of determining all risks and upside potential. The disclosure at the end of this piece is critical to understanding the content of this document. Further, I frequently trade my positions and may buy, sell, or short the securities mentioned herein at any time, regardless of the facts or perceived implications of this article.

Smith Micro’s Safe & Found App Is Gaining Momentum (Part II)

See my last post “SMSI’s Safe & Found App: 100,000 Downloads & Counting” for the first part of this report. This post will review my notes from SMSI’s earnings call and my subsequent conversation with the company.

Before we begin, it should be noted that the download and reviews for Sprint’s Safe & Found are really picking up now. On Android, Safe & Found is now over 100,000 downloads.

I’m trying to get specific data on what percent of Sprint users are on Android vs. Apple’s iOS. For now, I’ll assume it’s about 2:1 in favor of Android, which would mean that there are over 50,000 Safe & Found downloads on iOS.

Perhaps, that makes the total about 160,000 (over 100,000 + over 50,000). If we assume that each “customer” (family) consists of 4 phones (and therefore 4 downloads), then Safe & Found now has about 40,000 customers. If so, that represents about 12% penetration of Sprint’s estimated 350,000 Family Locator customer base.

That’s pretty good progress. It suggests that SMSI is already recognizing $400,000 in quarterly revenue… with 70% of that — or $280,000 — dropping straight to the bottom line, based on my recent profit-margin discussions with management.

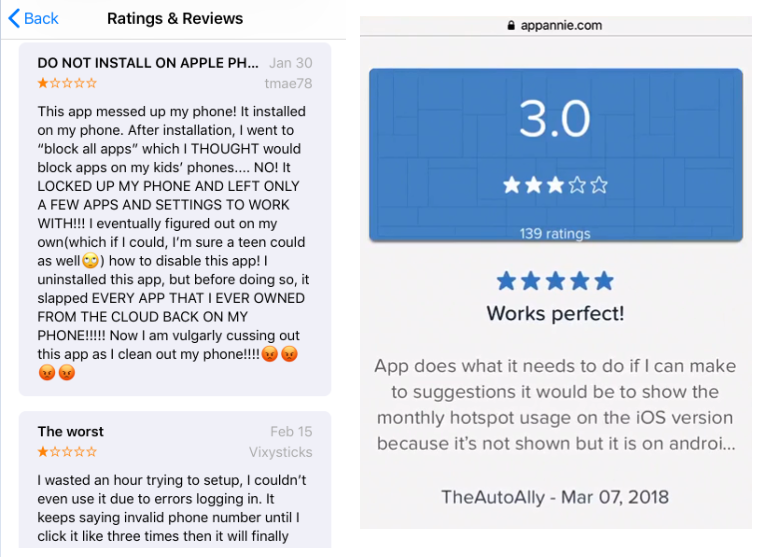

More importantly, the reviews are getting much better.

I’ve posted the last few reviews to YouTube. Take note of the difference between the star ratings and the actual commentary. Very similar (and more importantly, minor) complaints (especially compared to the horror stories posted a few months ago).

This validates my earlier commentary that software is generally fixable, especially for a company with decades of experience, such as Smith Micro.

The takeaway is that SMSI seems to be in the clear with its Sprint relationship. We should now expect continued momentum in the relationship, leading to profitability and growth, beginning in just a couple of months. You’ll see more evidence of this as you peruse the remainder of this report. As a disclosure, I purchased even more shares on March 28, extending its lead as my largest position.

Let’s jump right in…

Section I – Q4 Transcript Cliff Notes

For those who don’t have the time to read the SMSI earnings transcript start to finish, here are the highlights.

By the way, I’m searching for anyone who currently uses Sprint’s Family Locator product (the old product; not Smith’s new product). In exchange for occasional insight for a couple of months, I’m willing to provide special research perks (and even compensation, if necessary). Let me know if you know anyone. Cheers!

Bill Smith (Founder & CEO)

Thank you for joining us today for our 2017 fourth quarter and year end conference call. Fiscal 2017 proved to be a very important year for the company, as we achieved some very significant goals building upon the restructuring efforts we undertook in 2016.

Smith Micro’s most significant milestone was the launch of our SafePath platform with Sprint our key partner and customer. While the conversion of Sprint’s existing customer base is still underway, it will equal approximately $3.5 million in additional quarterly revenue for the company once it’s completed. We’re excited about the upside we see from this.

I believe this capital raise will be the last one before the company returns to profitability. Looking ahead, I am pleased with where we stand as we are positioned for a very solid fiscal 2018. By the second half of the year, we expect to be cash flow positive and profitable as a business.

Tim Huffmyer (CFO)

The funding was completed on March 6, and provided several key benefits to the company. First, $4.5 million of net cash was generated to support the business as the Sprint SafePath platform continues to grow subscribers.

Second, the balance sheet was improved by extending the maturity date of $1.2 million of short-term debt to Q1 of 2020. And last it will reduce our annual dividend outflow from the newly issued Series B Preferred Stock by approximately $400,000 as certain shares will be converted to common stock in the coming months.

We are excited with this new round of funding as we continue our journey back to revenue and profit growth.

The decrease in revenue year-over-year for both the quarter and the year-to-date was primarily due to lower customer adoption rates with our CommSuite product. During Q4 we rolled out CommSuite product enhancements, which we’ve now seen positive results from, and we do expect will contribute to 2018 revenue growth.

Revenue from the Sprint SafePath launch is expected to accelerate based on recent Sprint actions. These actions though, are completely dependent on Sprint execution. We continue to support those efforts.

In the near term, we expect our quarterly operating expense to be approximately $5.9 million, which excludes any unannounced restructuring plans.

NOTE: To achieve profitability, this will need to be offset by gross profits (which are about 80% of revenue). Thus, 5.9 / .8 = $7.375M in quarterly revenue will be needed. Management is guiding for this to occur in the second half of this year, with cash flow positive operations occurring around the start of summer.

The decreased operating loss is a direct result of cost saving achieved by the previously announced restructuring plan to align operating expense with the anticipated revenue.

In other words, some of the loss comes from expenses related to the upcoming ramp in Sprint revenue. Otherwise, the company would already be even closer to profitability.

Due to our cumulative net loss over the past few years, our GAAP tax expense is primarily due to foreign income taxes. For non-GAAP purposes, we utilize a 38% tax rate. During the fourth quarter, we recorded a deferred tax asset related to certain tax credits, which became available through the 2017 Tax Act recently signed. The resulting tax impact, when combined with the operational 38% tax rate, in the fourth quarter for non-GAAP purposes, was tax expense of $140,000 and a fiscal 2017 tax benefit of $1.6 million.

Due to the cumulative net loss over the past few years, I believe that SMSI will not be paying any meaningful taxes on its Sprint profits for many years to come.

Bill Smith

Thanks, Tim. As I stated at the beginning of the call, launching our SafePath Family platform with Sprint, slight labeled as Safe & Found was a very solid win for the company. Let me start by updating you on where we currently stand with the rollout of Safe & Found. While we anticipated a full deployment to Sprint’s large already installed Family Safety subscriber base in Q4, the conversion to our platform has of been slower than we anticipated. The good news is, that the rate of deployment is increasing, and we believe we’ll continue to accelerate as Sprint’s messaging program continues to expand.

We continue to work very closely with key senior executives of Sprint, including strong C-level support to accelerate the conversion process in order to reach the revenue goals both companies have set with the Safe & Found service.

With several new conversions and new-subscriber initiatives starting in 2018 (such as in-app messaging, digital marketing campaigns, e-newsletter content and trial offers), both Sprint and Smith Micro anticipate the acceleration of the conversion of legacy users as well as the addition of new subscribers to the Safe & Found platform.

(For Tier 1 carriers), providing value-added services to subscribers continues to grow in strategic importance. Not only do these strategic services enable carriers to further monetize their network investments and increase subscriber ARPU, value-added services also help to reduce subscriber churn and increase customer satisfaction and perceived service value. In an increasingly commoditized mobile service market in which carriers often compete on price alone, value-added services provide a critical competitive differentiator.

It is a proven fact that customers who pay for value-added services, not only add new revenue streams but also churn less than those that don’t. Not only are family plans worth more, they are also more sticky in terms of subscriber retention, making family-plan customers all the more vital for carriers. In terms of these benefits, our SafePath Family solution checks all the boxes for Tier 1 carriers.

SafePath provides a great platform upon which to build a fully integrated family services offering that will extend value past smartphones to in-home devices such as smart TVs and voice-controlled virtual assistants. This leads us into the wearable device world, where we are seeing significant growing demand in the market. Having just returned from Mobile World Congress in Barcelona, I can tell you that a major theme throughout this show was wearables…from GPS-enabled devices for children and the elderly to real-time pet tracking devices.

I believe that we are just on the forefront of a significant growth curve with this product.

During 2017, we completed several new initiatives that reversed the trend of flat revenue growth associated with our CommSuite implementation at Sprint. As a result, CommSuite revenues grew in Q4 of 2017, as we reached new customers by adding new functionality to our Visual Voicemail solution and improving back end workflows.

Now for the first time, both corporate and prepaid users are using CommSuite contributing to the profitability of the product. We see upside from this as the prepaid market is growing extremely well, and frankly, corporate users tend to use voicemail more than individual consumers.

We see great potential in 2018 to build on a very profitable installed base…We have many new innovative features to expand the market appeal of CommSuite in 2018.

Now on to QuickLink IoT and how we plan to address the extremely dynamic evolving and rapidly growing opportunity that is the Internet of Things. With carriers continuing to accelerate the rollout of purpose built IoT networks, our QuickLink IoT platform will become more relevant and more in demand… In addition, we will continue to develop and build upon the synergies between QuickLink IoT and our SafePath platform, specifically, in that growing wearables market. This strategy will continue to mature and evolve throughout 2018…

Lastly, on to our graphics group. Fiscal 2017 was all about rebuilding, rebranding and reengaging with a significant and diverse customer base our graphics products attract. I am pleased with this significant progress that was made in 2017 as we maintained a very profitable business unit while rebuilding it from the ground up. There has been a lot of work done behind the scenes that is building momentum and I expect good things coming in 2018.

During the coming quarters, you will see the launch of several new products as well as new strategic partnerships and expanded global distribution channels.

In closing, although, the top line didn’t meet my expectations for 2017, we’ve built a very strong foundation for growth and profitability in 2018.

Mark Gomes

Hey, congratulations, gentlemen, looking forward to seeing you return to cash flow positive. So I’m jumping right in. You made – mention of the legacy solution at Sprint being unique in that you have that installed base there. Assuming that the Sprint deployment goes well, it’s my understanding that the legacy solution is also in place at all of the other Tier 1 in the U.S. Is that correct? And would it be safe to assume that if you do have a successful launch at Sprint that that would multiply your opportunity by having opportunity to go after those accounts as well?

Bill Smith

Thanks, Mark, this is Bill. Yes, you’re right. All the other Tier 1s use the same legacy platform. Our goal is to ensure that the Sprint launch is incredibly successful. There is no better way to bring other carriers to our platform than to demonstrate what a great decision Sprint made. And so we are totally focused to that goal. And we are executing on that. And once again, I’m just really pleased with the support and the activity that’s going on the part of Sprint to grow this platform. And I know it’s critical to their plans going forward.

Mark Gomes

Okay. Well, I could tell you, I’ve tested product, the latest version it works great, and I’m impressed with the improvements relative to the early reviews. What do you see as kind of coming up for the next version of this product? And how is that – how’ll that help you with your deployment in Sprint?

Bill Smith

Well, first off, we have a full roadmap that we are executing against with SafePath. We have a next major release coming out in 2018. Really don’t want to talk too much about that right now. We’ve listened to the marketplace as to what thing seemed to be matter the most and we’re reacting to that in a very positive way. Our goal is to be the absolute leader in this space in the industry. And being number one, we will set ourselves on the path of extreme growth and very strong profitability.

Mark Gomes

Can you just give us a sense of what advantage do you feel Smith Micro has and not just in product but in terms of selling and servicing carriers specifically? Thanks.

Bill Smith

Sure. We are a very unique software house. We have been servicing large Tier 1 carriers for years. They know us well. We have performed extremely well. We do what we say.

We understand what it means to be carrier grade. This is a major differentiation between us and other players, not only in the Family Safety business, but in other parts of our product line up, where we really do know how to get the job done. And this is the difference that we bring. And as a result, we have access virtually to every carrier that’s out there to have a conversation is not a difficult thing for us. And I think that’s really one of our strengths.

Aria Cole

Thank you very much and best of luck to you here in 2018. Question number one, regarding the Safe & Found application being rolled out at Sprint. Based on your press releases, it would seem as if the legacy number of subscribers as may be about 300,000 or so, which would be (less than 1%) of the 38 million Sprint subscribers out there. (Why has) the attach rate with the legacy Sprint product had been so low?

Bill Smith

Actually that’s a question I would probably prefer you ask Sprint about then to ask us. I will say this that the – there is a great room for growth. Actually, the total subscriber base at Sprint is larger than what you stated. So there is a lot of upside. I think it is the goal of not only Smith Micro, but also of Sprint, to see millions of subs using the SafePath product…

Brian Swift

I wanted to know if you commented on the process and the pace at which you expect Sprint to be migrating their customer base over to the SafePath? And if you have any color that you can give on what’s been happening with that recently?

Bill Smith

The Safe & Found deployment at Sprint and the migration of their legacy users over to our platform is accelerating. We still have our ways to go, but we are very pleased with the level of acceleration, and we think that if there’s still more growth that can happen beyond this.

…our customer has put together some really strong messaging and is now deploying that messaging, not only to their legacy installed base but to the broader market of literally tens of millions of subs… and while its critical to bring over the users that were on the legacy platform, the real upside… comes from the new subscribers that have never used Family Safety before.

Brian Swift

(Can) you speak to the wearables markets? And when some of those types of offerings might be added to the Safe & Found product?

Bill Smith

I don’t think we’re allowed about to talk about (that) because my customer wants to tell people when they’re going to do that.

Brian Swift

(It’s) pretty obvious that they didn’t make this switch just to add more features to the existing customer base.

Bill Smith

…we provide them a platform (in Safe & Found) which is more than just an app and a server. It’s actually (a platform to deliver many) very appealing service offering(s) for the carrier. Our goal is to make that wildly successful at Sprint and then use that to demonstrate what we can do for all the rest.

Section II – Post-Call Discussion (Tuesday, March 20)

On my post-call discussion, the company wasn’t willing to delve any deeper into the specifics of the Sprint rollout (largely because they shared so much information on the last few earnings calls). However, I can tell you that they were noticeably excited about some new marketing efforts that are being pushed forward by Sprint. In April, campaigns will be rolling into their stores and the sales force will be trained.

They are also pleased that downloads are picking up and have publicly said that they are on target relative to their latest expectations. They emphasized that they have an extremely close relationship with Sprint and are spending the entire week with them this week. This is clearly important to Sprint and SMSI, right up to the C-level of both companies.

Here are some additional key takeaways in the form of paraphrased quotes. These are not actual quotes, but rather my best attempt to recreate what was said based on my recollection and notes:

From a beta tester who I brought onto the call – “I was very impressed with the user interface. It feels very Uber-like. I think the tracking mechanism, with alerts and the geo-fencing is really good. Then, from a control point of view, that’s where I thought it can evolve to being a little more obvious to use.”

SMSI on Android vs. iOS: “There are some hurdles that we have to get over, due to the differences / flexibility between Android and iOS. There are some limitations that come with using iOS, which every provider has to deal with, because it’s a closed system. However, we’re right on target with our goals for each, but they’re very different in how they operate. Android gives you a bit more control.” This explains some of the remaining criticisms of the product (as discussed at the beginning of this report).

SMSI on its win over Location Labs: “There are some key things where we were better. Most importantly, we’ve taken a platform approach, upon which more and more services can be built and launched (i.e. wearables, driver monitoring, pet monitoring, etc.). There are several new things that are coming in the pipeline. Product roadmap is very important to carriers, which we know from our decades of experience with them.

From a feature perspective, we have geo-fencing, URL filtering, parental controls, phone security, our web portal, etc. FYI, to compete, Location Labs made a very expensive upgrade, but they still had a lot of problems with it. On iOS, it was to the point where you could say that it really didn’t work at all. That’s where we are now and that’s what is currently in play for the major U.S. carriers.”

SMSI regarding the Sprint rollout strategy: There will be several new things that come into play for this.

SMSI on getting the story out: “We are going to be in New York for The Microcap Conference on April 9th and 10th. Then, we will do an extra day of meetings there. It will be our CFO’s first time going out and really telling the story.”

SMSI on their high level of confidence to finally go tell the story to Wall Street: “We’re in a much different place than we were. We have a signed contract and we’re ramping up. It’s a great product and the feedback is now reflecting that. There is a lot of upside for the company and this product. I’ve seen it happen before. We’re addressing a valuable opportunity with a different approach and it’s our goal to be ahead of the game. I think this is just the beginning of many good things.”

SMSI on carriers: “Our platform approach is the way to do it. Carriers need to have sticky services to offer customers. If you have value-added services, customers tend to stay on… and families tend to never leave. I think we’ve built the right product/platform at the right time and I’m very confident. Carriers take a long time to get rolling, but when it goes, it goes quickly. That’s where we are now.”

Final Thoughts & Takeaways

In the direct competition for Sprint’s future business, the Location Labs product simply didn’t stack up (or even work on iOS). This sort of app isn’t easy to build, but once the foundation is set, it should be relatively easy to refine it. That’s where SMSI seems to be now, with the reviews quickly improving.

As for the other key competitors, the feedback we’ve received is that Life360 and Qustodio have been incapable, unsuccessful, and/or disinterested in competing for carrier business. It takes a certain level of experience with how carriers operate, what they want, how to integrate into their billing systems, etc.

SafePath address this by not just being a product, but a platform for delivering a growing array of services. This will enable the carriers to lock customers in and protect their businesses from the oncoming onslaught from Google, Microsoft, and others.

From a product perspective, SMSI says that there will be three legs to the stool going forward:

- SafePath

- CommSuite, which CEO Bill Smith believes will continue to grow as a predictable revenue stream.

- Graphics

This suggests that the NetWise and Captivate product lines will be sold off (or discontinued). This would leave the company with what I believe to be the company’s most profitable and/or promising product lines… and a more profitable overall income statement as a result.

As for QuickLink Internet of Things (IoT), it’s hard to say if it’s up for sale or poised to be merged into the SafePath unit. I simply don’t know enough to even hypothesize at this point.

Personally, I can’t wait to see how the business looks once they shed these units. By that time, Safe & Found should be ramped up and providing great year-over-year comps to go along with much better looking pro-forma comps (from the removal of the other businesses from the income statement).

Despite some minor delays, things appear to be right on track relative to where they were when I wrote my initiation piece. Anyone interested in this story should absolutely review that report and the operating model figures.

Sprint is already targeting 1) a switchover of its ~350,000 customer installed base and 2) a targeting of its tens of millions of other customers. Sprint stores will start pushing the product in just a few weeks and I anticipate that the old product will be fully (ad forcibly) switched over a few weeks after that, likely corresponding with a major new release of SafePath (they are currently on version 1.0.23 with Sprint’s Safe & Found).

With that, the majority of that 350,000 customer base will begin delivering about $10 per customer per quarter to SMSI, driving profitability, per management’s guidance. Beyond that, I calculate that each additional 100,000 customers will drive over 10-cents of annual EPS to the bottom line… and for every 10 points of P/E you choose to give it, that’s an incremental $1 of value to the stock.

According to SMSI contacts, Sprint’s goal is to double its customer base in year one and to sign “millions” over time. From there, we can all do the math and make our own assumptions on where the stock could go if they are successful.

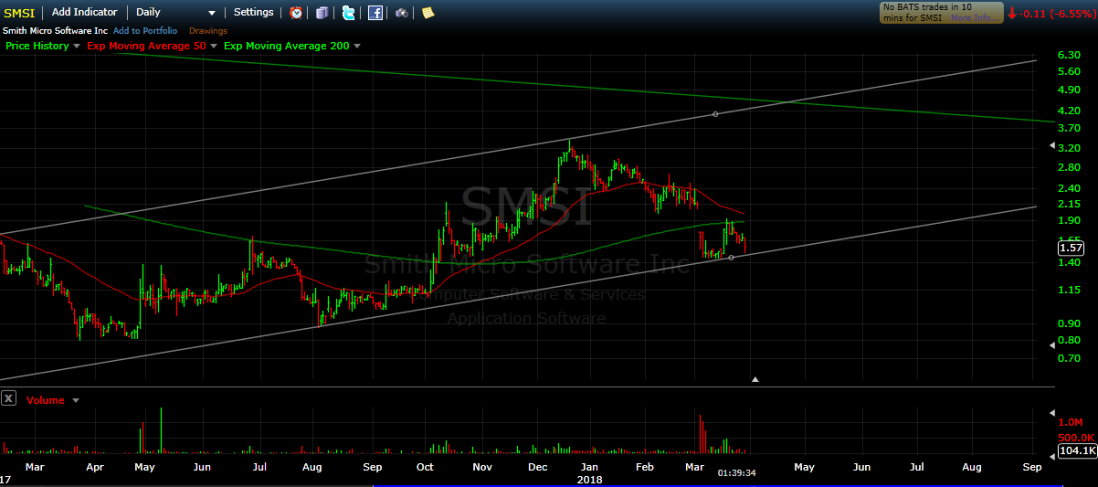

The Bottom Line: It appears that SMSI is finally accelerating down the runway. To me, the story has never been closer to fruition. Yet, the stock is 50% off its highs, due to the delays and tough funding round. Both of those issues appear behind them and the chart looks bottomed out.

From a risk/reward perspective, it’s hard to beat the combination of execution and low valuation (especially when we know why the stock has been under pressure). This is why I’ve been increasing my position this week… and why this is currently my favorite idea.

Cheers.

To get my posts in real-time, just subscribe to this free blog. If you don’t want to get all of my posts via email, just sign up for my MailChimp mailing list instead. For that list, I only send key articles and occasional recaps of all the work I’ve recently done.

Disclosures / Disclaimers: I am long SMSI. However, this is not a solicitation to buy, sell, or otherwise transact any stock or its derivatives. Nor should it be construed as an endorsement of any particular investment or opinion of the stock’s current or future price. To be clear, I do not encourage or recommend for anyone to follow my lead on this or any other stocks, since I may enter, exit, or reverse a position at any time without notice, regardless of the facts or perceived implications of this article.

I am not a financial advisor. Nor am I providing any recommendations, price targets, or opinions about valuation regarding the companies discussed herein. Any disclosures regarding my holdings are true as of the time this article is written, but subject change without notice. I frequently trade my positions, often on an intraday basis. Thus, it is possible that I might be buying and/or selling the securities mentioned herein and/or its derivative at any time, regardless of (and possibly contrary to) the content of this article.

I undertake no responsibility to update my disclosures and they may therefore be inaccurate thereafter. Likewise, any opinions are as of the date of publication, and are subject to change without notice and may not be updated. I believe that the sources of information I use are accurate but there can be no assurance that they are. All investments carry the risk of loss and the securities mentioned herein may entail a high level of risk. Investors considering an investment should perform their own research and consult with a qualified investment professional.

I wrote this article myself, and it expresses my own opinions. I am receiving no compensation for it, nor do I have a business relationship with any company whose stock is mentioned in this article. The information in this article is for informational purposes only and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

The primary purpose of this blog/forum is to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

from stocktwits user: I’m a Sprint franchisee. Our training is robust, and once it’s a focused metric, this will be bundled in every upgrade and new act

LikeLiked by 1 person

Nice! I’ll have to follow that person. Always valuable to have contacts involved with the business. Thanks!

LikeLike

Based on your comments I assume you own quite a bit (30%-75%??) compared to the daily trade volume? Does that worry you from a liquidity perspective? I ask because with my position in MBRX I can sometimes own 10-30% of the daily trade volume.

Kind of like the early days of HMNY where my buys could easily move the needle a few points 🙂

Still on the sidelines of SMSI, don’t have a lot of spare powder that isn’t in Cobalt/HMNY/MBRX/TCHEY and my “fun” money is in and out of DBX right now 🙂

LikeLike

“Kind of like the early days of HMNY”

You almost answered your own question! When I get into a small stock, the volume makes it hard to get in. It can take a month. However, if I’m right, the stock takes off… and the higher it goes, the easier it is to get in or out.

So, I don’t worry about the liquidity. I just focus on being right. It doesn’t always work out, but most the time it does, which more than makes up for when it doesn’t.

Cheers

LikeLike

Thanks it always makes me a bit nervous when I know I have to scale out (or in). Might join you soon in SMSI if DBX ever cools off 😉

From a day trade/swing Cobalt perspective ECSIF continues to pay off. It has bounced off of the 200dsma about 4 times in the past 2 months now going from 1 to 1.2~1.3. Since it is OTC Fidelity won’t let me set limit buys/sells to I have to watch it more closely.

LikeLike

Cool. First Cobalt might get rolling once its acquisition closes. Right now, the arbs might be long the acquiree and short the acquirer.

LikeLike

Yeah that is why I’m holding onto my USCFF, I’m confident First Cobalt will get rolling.

LikeLike

Thanks for the research Mark! I haven’t fully bought into the SMSI story yet and here’s what’s holding me back. 1) You’ve addressed it multiple times, and they are turning around, but the reviews I read on Google Play were awful. 2) That along with just personally, I have never used a carrier provided app much less a subscription based one. There just always seems to be something better or free on the marketplace.

That being said I did try to get a small order filled at 1.50 that never hit. You seem really confident in this one so I will probably be kicking myself in the second half of the year.

I’m currently heavily tied up in FUSZ, the one I asked if you’d heard of a couple of weeks ago. Check the chart for the last two months. It’s a been extremely fun.

Lastly, I just wanted to say thanks for opening this blog up, sharing so much and freely responding and answering questions. It’s greatly appreciated. I started trading less than two years ago and have become addicted and am learning as much as I can. I’m still small time, but since I’ve started I’m up over 500% and your initial coverage of HMNY was a large reason for that.

LikeLike

Cool post, Jason. Thanks.

By that way, if I could go back in time and offer advice to myself when I had 2 years experience, it would be this:

1) NEVER think you know what you’re doing. My biggest returns came when I finally accepted that I didn’t know that much. I still approach stocks with that attitude… and it helps immensely (by helping to combat overconfidence and confirmation bias).

2) Ignore your personal biasses in favor of trying to understand if there are people (and how many) who will want the product / service. I would NEVER subscriber to GAIA, but I’ve made great $$ by listening to those who have (and running the math on the business model — more on this Monday). 😉

3) Pay attention to trends and trajectories, not absolutes. If you wait for perfection, you’ll pay full price. The real $$ is made by those who do the research required to build confidence in something that seems like a more of a gamble to others. That’s when you get the big discounts to fair value.

Good luck !

LikeLiked by 2 people

Great advice. I definitely don’t think I know what I’m doing. I definitely know a lot more than last year though. I have gotten overconfident at times with my current system but then realized that if run at a bigger scale I would probably have a heart attack. I think that’s what I love about it though, having to research completely new things ALL the time.

LikeLike

I know the feeling. With any luck, you’ll feel like that every year of your life. Enjoy the ride. Cheers.

LikeLike

Mark are you going to the Microcap Conference?

LikeLike

I’m registered to go, but debating the value of heading up there.

LikeLike

Mark…if the conference runs today thru Wed, would you know which day SMSI is presenting on? Thanks

LikeLike

They presented today, but I wouldn’t expect an immediate reaction. Professional investors take their time calculating, following up, and deciding. There are non-pros there too, so that could provide a bump, but that could be offset by traders who played it for a bump. Many moving parts. To top it off, they are doing 1 on 1 meetings all day tomorrow and Wednesday.

This is why I don’t trade much. Watch the risk/reward and buy low / sell high.

LikeLike

Thanks

LikeLike

FYI, I’ll have a few updates on SMSI’s investor tour starting within the next 24 hours and continuing through Friday. Cheers!

LikeLike

Hey Mark, thanks for all the valuable and insightful updates on SMSI, AEHR, and others. [Disclosure: I’ve also been accumulating shares with you on these companies].

My only (major) concern with SMSI is I wonder if Apple and/or Google could come out with parental controls for their phones. Is there any kind of moat, in your eyes, that SMSI has here to prevent that? Couldn’t Apple come out with a “family watch” type feature?

LikeLike

There’s only so much functionality they can incorporate (basic stuff). Everything that SMSI is doing is geared to offering a robust application platform which will continually add new advanced features and services (driver monitoring, panic button, IoT devices, etc).

In theory, Apple and Google could incorporate tons of features that are provided by thousands of application providers, but they don’t because they are focused on the largest opportunities and the lowest hanging fruit, leaving more functionally-rich pictures to be created by the development community.

For proof, just look at how many apps created by how many developers you have on your phone. 🤔😉

LikeLike