Long-time readers should note some significant changes in how I communicate in the public domain. The primary purpose of this forum is now to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Accordingly, this document should not be construed as an endorsement or recommendation of the companies or securities discussed herein. I am not an investment advisor and this is not an investment thesis. It is merely one part of the story, which I present for debate in hopes of determining all risks and upside potential. The disclosure at the end of this piece is critical to understanding the content of this document. Further, I frequently trade my positions and may buy, sell, or short the securities mentioned herein at any time, regardless of the facts or perceived implications of this article.

OMG — HMNY Announces TWO Dilutive Offerings — Here’s What To Do

Almost every week seems crazy in Helios World, but this week took the cake (an old way of saying, “it was O.D.”). I can’t possibly do it all justice, so I’ll just recap a few things of particular importance (in no particular order).

First, the 10-K was filed (finally) on Tuesday. Of course, it contained a lot of large negative numbers, but the important takeaway is that those large negative numbers went a long way toward validating my MoviePass Model.

Specifically, the 10-K stated that HMNY provided $55.5 million between Dec 19 and Feb 20. The model estimated a cash burn of $54 million during the Dec to Feb time frame. The 10-K also stated that HMNY provided $35 million between Mar 1 and Apr 12. The model estimates Mar/Apr cash burn of $38 million.

This comes as no surprise. Management has been very vocal about its various prices, promotions, subscribers, ticket purchases, and costs. It’s been easy to assemble the data into a spreadsheet and do the math.

Nonetheless, it was good to see the additional validation. It increased my confidence that a new round of dilutive funding was near (and that the summer blockbuster season is going to be absolutely brutal). Because of this, I continued to caution investors to avoid the stock.

Speaking of summer blockbuster season, I’ve been predicting that the next three months will result in $232 million of cash burn, requiring a commensurate level of dilutive funding (barring a major change in the business).

Well, based on today’s news, that prediction appears to be right on target.

After the bell on Wednesday, Helios and Matheson (HMNY) submitted filings with the SEC for TWO separate rounds of funding.

Yes…. TWO.

The first offering may be completed before you read this. The amount of money to be raised was not disclosed, but it should be assumed that they’re hoping to attract $100 million (approximately the same amount as they raised in each of the last two rounds).

If so, I expect that stock to act the same way it did after the last two rounds — it tanked (and kept tanking).

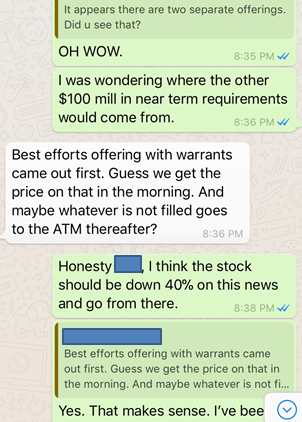

UPDATE: They were only able to raise $30 million. This is extremely bearish. The following is part of conversation from last night, where I provided my take on the filings.

Sure enough, the stock has been floating around -40% today. However, that doesn’t account for the “and go from there”. According to my MoviePass model (which enabled me to predict this), MoviePass will need seven times more than $30 million over the next three month.

If the stock is down 40% on a $30 million offering, where can we expect it to go as the other offering unfolds? Read on…

The company also filed for a best-efforts at-the-market (ATM) offering. With ATM offerings, the company effectively prints and sells newly-issued shares into the open market whenever it makes sense (or whenever it becomes necessary).

In this case, Canaccord Genuity will be selling HMNY’s shares and delivering the proceeds to the company. In my opinion, this role is basically Canaccord’s reward for being bullish on the stock (in other words, for misleading investors into thinking that the shares might be worth $15 anytime soon).

So, how many shares of HMNY will Canaccord be dumping onto the open market?

$150 million worth.

Based on HMNY’s after-hours price and my current estimates, this one offering will entail the sale of at least 45 million shares between now and the end of July.

On a combined basis, I expect the two offerings will result in 75 million shares worth of selling over the next 90 days or so.

UPDATE: The $30 million raised today “only” required 11 million shares. However, I expect that the other $150 million will now require HMNY to sell about 70 million more shares (if not more)…

…and that still only gets them to $180 million in total funding.

The model tells me that $180 million will barely get them through the end of June (July 4th to be exact – how ironic). At that point, yet another round of funding will be needed (barring a major change in the business model — stay tuned).

This completely dwarfs HMNY’s 11 million share short interest and threatens to represent about 10% of the company’s total trading volume through the end of July.

I’ve been warning of this for months. Yet, now that the reality is here, I still cannot understate how terrible this news is for common shareholders.

Prior to the ATM announcement, investors could at least hope for trading opportunities. Bounces like the one we saw on Monday have kept traders in the game, hoping for a quick pop. But with a $150 million ATM offering queued up, investors should expect that Canaccord will be selling shares into any strength.

In other words, the upside has been significantly capped, while the downside risk is now limited only by the amount of damage that a million shares worth of daily selling can inflict.

Some of that damage will surely come in the form of shareholders who choose to sell instead of sticking around to see what 90 days of selling does to their position.

I understand that bulls may want to cling to the various bits of positive news flow that have cropped up over the past couple of weeks. However, in my opinion, none of it comes close to putting a dent in the bearishness of this news.

I’ve been negative on this stock since it was $12 per share and I see no reason to change that stance.

As I’ve said before, the COMPANY may ultimately succeed, but THE STOCK will continue to get pummeled until the preponderance of positive evidence is sufficient to justify the steady flow of dilution.

In my experience, it’s been best to wait until the preponderance of positive evidence emerges. Sure, you’ll often miss the bottom, but that’s usually not a bad thing. Thus far, nearly every bullish investor has gotten burned by trying to time HMNY’s bottom.

It’s like the saying goes — never try to catch a falling knife…

…and this one is bigger than Crocodile Dundee’s.

Those who are in the stock but wish they weren’t should read my piece on “Trading Up”. It will help you understand why it was easy for me to sell my shares of HMNY, making room to buy SMSI, a beat up stock with much better near-term prospects.

Indeed, one of HMNY’s biggest bulls made the same move earlier this week (selling HMNY and buying SMSI). In doing so, he missed today’s big drop in HMNY. With the threat of further HMNY declines ahead, trading into SMSI may become the latest catalyst for the shares, which experienced a technical breakout earlier this week.

Speaking of which…

SMSI Product Lines To Be Acquired?

During my most recent conversation with SMSI CEO Bill Smith, he shared his vision for what the company will look like going forward. He described it as a three-legged stool, consisting of the Safe & Found business, the Visual Voice product (CommSuite), and the Graphics business.

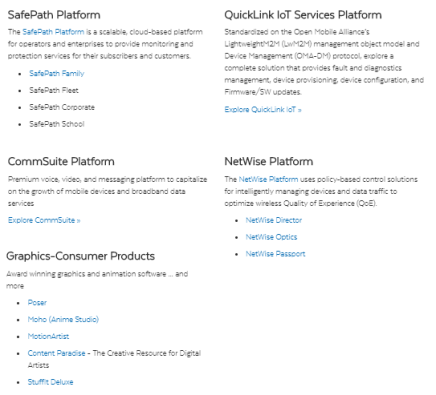

In addition to this, management has previously made clear to investors that it has an interest in shedding a couple of its product lines to increase focus (and/or improve the bottom line). Looking at SMSI’s Product Catalog, it becomes easy to see that those “couple of product lines” are QuickLink and NetWise.

I’d be interested in anyone’s insights into these product lines and what their sale might mean for SMSI and its financials.

Coming Up: Investigating Why SMSI Might Become A Ten Bagger

More Research:

- Sprint FINALLY Ramping Up SMSI’s Product!

- Videocast: AEHR 10-Q, MoviePass Update

- AEHR Grows 175% — Beats On The Top & Bottom Line (Buying More)

- GAIA vs. MoviePass: CAC Shows Which One Is A True Mini-NFLX

- Major Update on SMSI

- SMSI’s Safe & Found App: 100,000 Downloads & Counting

- MoviePass Projected To Burn $600M In 2018

- SMSI: Riding A New Trend & Making Its Latest Comeback

- Mark Gomes Research

To get my posts in real-time, just follow/subscribe to this free blog.

If you only want to receive my most critical reports, simply sign up for my MailChimp mailing list instead. If you’re on that list, you will only get key articles and occasional recaps of all the work I’ve recently done.

Disclosures / Disclaimers: I am long SMSI. However, this is not a solicitation to buy, sell, or otherwise transact any stock or its derivatives. Nor should it be construed as an endorsement of any particular investment or opinion of the stock’s current or future price. To be clear, I do not encourage or recommend for anyone to follow my lead on this or any other stocks, since I may enter, exit, or reverse a position at any time without notice, regardless of the facts or perceived implications of this article.

I am not a financial advisor. Nor am I providing any recommendations, price targets, or opinions about valuation regarding the companies discussed herein. Any disclosures regarding my holdings are true as of the time this article is written, but subject change without notice. I frequently trade my positions, often on an intraday basis. Thus, it is possible that I might be buying and/or selling the securities mentioned herein and/or its derivative at any time, regardless of (and possibly contrary to) the content of this article.

I undertake no responsibility to update my disclosures and they may therefore be inaccurate thereafter. Likewise, any opinions are as of the date of publication, and are subject to change without notice and may not be updated. I believe that the sources of information I use are accurate but there can be no assurance that they are. All investments carry the risk of loss and the securities mentioned herein may entail a high level of risk. Investors considering an investment should perform their own research and consult with a qualified investment professional.

I wrote this article myself, and it expresses my own opinions. I am receiving no compensation for it, nor do I have a business relationship with any company whose stock is mentioned in this article. The information in this article is for informational purposes only and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

The primary purpose of this blog/forum is to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Thank you for the update! The HMNY saga continues…

If I ever get into HMNY again will be after the almost certain reverse split and only if MP turned the corner and had the backing of the big chains. I would rather be part of the “New Shareholder” era which if created would have been at the expense of the current shareholders.

LikeLiked by 1 person

I’ll obviously have to update this to reflect the terms. Only $30 million with that much discount doesn’t bode well.

LikeLike

Mark,

Just quick question for you. What are your plans on the shares of XXII you will be getting tomorrow when your put options that you wrote are exercised? Currently we are .15 below the break even and wanted to get an idea of what your thoughts were.

LikeLike

Selling the options and/or the stock. Will have no position. My strategy worked. Pulled a profit on both sides of the trade (including 100% on the call side).

I see no intuitive play here at this time. Cheers.

LikeLike

I deleted a post that TOTALLY missed the mark on how things work.

The post implied that the round may be enough to “buy out the remaining balance of MP”. They can’t do that, because there are other shareholders. MP can dilute those shareholders, but HMNY can’t force them to sell.

The post also implied that “a name change and/or spin-off of RedZone” might help matters prior to the next ATM drawdown. TECHNICALLY, that’s true, but a horrible assumption due to the insignificant impact that either would have.

The post demonstrated no willingness to examine HMNY/MP cash burn situation via the model I built for everyone’s benefit.

The poster is a good person and means well, but the content of the post was filled with misinformation, which isn’t in the spirit of this blog. We’re here to 1) do professional level research and/or 2) gather facts, and/or 3) understand stocks and the research process.

You can expect me to delete most posts that don’t fall into one of those categories. Q&A is fine, of course! 😎

LikeLike

I don’t talk the dilution side because that’s your main focus day in & day out!! As for HMNY buying the rest of MP I was only referencing the remaining balance available to them & was never talking Mitch Lowe/Kelly/etc shares. Just highlighting Mitch will buy the rest of whatever he can as it’s clear there will be no spin-off but a HMNY name change. As for whether this or the RedZone spin-off helps (having more options in general is usually a good thing) but I never said it’s in the bag / a winner and now the stock will rocket to $100 😎. Although would be nice LOL. I will articulate more in depth on future posts to help avoid ambiguity, while avoiding posts if they stray too far from your mission!!

LikeLike

Great post. I understand your points, but we all need to keep in mind that many readers don’t know how to interpret comments. We have to spell things out. Your clarifications in this post did that. Cheers buddy and thanks for understanding. 😎👍🏼

LikeLike

I have not been able to confirm this, but don’t you think it is highly likely that the remaining MP shareholders will be swapping for HMNY shares at this point? It seems they’ve completely blown any opportunity to consider IPO now and status quo is not good either. I have to think there will be a deal struck (perhaps one with some dilution protection like Ted’s) with Mitch and Chris to get them to do the swap and let HMNY assume 100%. I know you don’t like speculating, but I am thinking of the options available to them now and this one seems the most likely.

LikeLike

Makes sense, but that’s up to them. If HMNY gets to the point where they can’t fund them at a competitive valuation, MP will be free to find other investors after the anti-dilute expires.

Of course, HMNY will still have the commanding amount of shares, but only for so long. If they have to take outside $$, the ownership scales can shift.

LikeLiked by 1 person

Hey Mark,

Today SMSI filed a form 424B3 for 7.1M shares. My hunch is this is mostly a non-news as I thought this form is used to update information from past prospectuses as opposed to announcing new ones. Can you confirm if this understanding is correct? I’m assuming no material news was announced today that would significantly impact SP.

On a slightly different note, I’m looking into the cost savings from SMSI’s potential sale of QuickLink and NetWise and will share my research with everyone once it’s more polished. Cheers.

LikeLiked by 2 people

Latest MP iOS rollout today adds video support and makes movie ratings official (looks like they are getting ready for MovieFone integration)

LikeLiked by 1 person

I kind of feel bad. A trader on twitter who has a pretty big youtube following, was pumped because he had caught that recent HMNY move up, was saying it was going to $6. I almost told him they were about to dilute, but I didn’t because he’d been bashing a ticker I’ve been riding that’s in the euphoria phase. I’ll be sure to share next time.

LikeLike

That’s where trading without research will get you. 🤷🏻♂️

LikeLike

Interesting read on MoviePass patents – http://bobvisse.com/moivepass-patent-contains-broad-claims-that-span-well-beyond-theaters/

LikeLiked by 1 person

Gotta agree with every words of this. Congrats!

LikeLiked by 1 person