Long-time readers should note some significant changes in how I communicate in the public domain. The primary purpose of this forum is now to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Accordingly, this document should not be construed as an endorsement or recommendation of the companies or securities discussed herein. I am not an investment advisor and this is not an investment thesis. It is merely one part of the story, which I present for debate in hopes of determining all risks and upside potential. The disclosure at the end of this piece is critical to understanding the content of this document. Further, I frequently trade my positions and may buy, sell, or short the securities mentioned herein at any time, regardless of the facts or perceived implications of this article.

Please forgive any issues with the formatting. I worked on this piece until 4AM and had no energy left to make it look pretty. Cheers.

Last night, Smith Micro Software (SMSI) reported its Q1 results. As I previewed, the numbers were fine, but unimportant because the meat of the Sprint ramp is happening here in Q2. All of the exciting stuff was discussed on the conference call… and there was no shortage of exciting stuff!

As you can tell from the title of this article, we got what we wanted (and more).

If you want to skip to the punchline, feel free to scroll down to the Quote of the Call.

Otherwise, strap yourselves in. This is going to be a doozy…

Let start by getting the obligatory metrics out of the way. SMSI reported revenues of $5.46M (roughly flat vs. last year) and a net loss of $2.38M, a $500,000 (17%) improvement over last year’s Q1, despite 1) increasing R&D for the second straight quarter and 2) the company’s annual participation in the Mobile World Congress in Barcelona.

These numbers were in line with my expectations. The ramp at Sprint is just beginning to gain stream, so revenues from that relationship will be more prevalent in the Q2 results. Management’s press release commentary confirmed this:

“We believe we are very well positioned to continue executing on our strategic initiatives, resulting in expanded revenues and a return to profitability in the coming quarters.”

Later in the call, CFO Tim Huffmyer stated that SafePath generated “several hundreds of thousands of dollars” in Q1.

This was ahead of my expectations.

Based on my review & download model (built in-part on data provided by diogenese19348 from the Yahoo message boards), I estimated that SMSI exited Q1 on a $600,000 run rate. Since Q1 encompassed Jan 1 through March 31, I expected that SafePath only generated about $250,000 in Q1.

Mr. Huffmyer’s comment implied a minimum of $300,000.

Adjusting for this, my tracking model now gives me confidence that SafePath is now on a run rate of about $1 million per quarter.

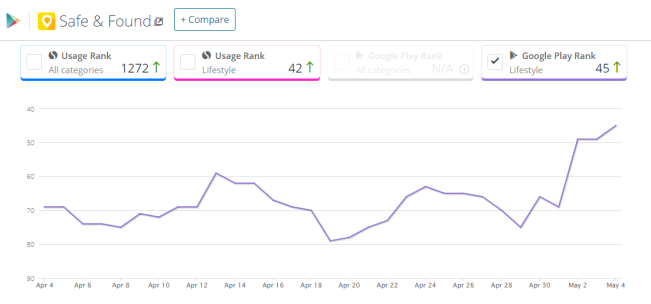

That’s excellent progress for a product that is just getting started, hasn’t yet benefited from a forced switch-over (which is slated to occur in the coming weeks, according to my due diligence), and is suddenly streaking up the Google Play download charts:

In other words, the company is now showing momentum, which explains why they’ve been exuding such confidence over the past couple of months.

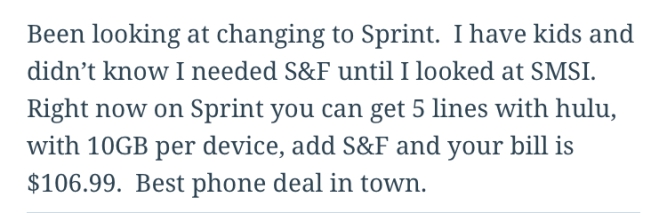

A full transition of Sprint’s Family Locator installed base would drive $3.5 million in quarterly revenue for SMSI. However, a full transition won’t happen (because some % of customers will cancel Family Locator without transitioning to Safe & Found, a.k.a. “breakage”). Luckily, this breakage will be offset by new customers, which Sprint will aggressively target starting this month, according to SMSI.

In other words, the company is making great (and now, accelerating) progress toward generating $3.5 million per quarter from Safe & Found. With expected operating margins in range of 70%, the math says that we can expect over $1 million in SafePath revenue for Q2. A continuation of this momentum leads to profitability in the second half (which is exactly what management has guided us toward).

It’s always nice when the numbers line up with management’s comments (and when management’s comments line up with reality).

The conference call provided further confirmation (of several things).

For starters, it should be noted that I was one of only two analysts who asked questions on the call. I view this as positive for the stock because 1) the story is clearly still under the radar and 2) the other analyst was James McIlree from Chardan Capital.

McIlree is a sell-side analyst. The only reason for him to be on the call is to prep an initiation report… and he’s typically generous with his price targets.

“I am encouraged with the progress made during the quarter across several areas of the organization. The first quarter results were in line with our internal expectations as we continue to build momentum with the launch of our SafePath platform at Sprint……I also want to address our recent private placement that was announced last week. We believe this is very positive for the company, strengthening our balance sheet, allowing us to accelerate our product roadmaps and M&A activity for 2018.”

“The funding was completed on May 3 and provided $6.3 million of net cash to support the business, as we evaluate our product roadmaps, M&A opportunities and as the SafePath platform continues to grow subscribers……We are extremely excited with this new round of funding as we continue our journey back to revenue and profit growth.”

“The wireless segment reported quarterly revenue of $4.8 million, compared to $4.4 million last year. The increase in the wireless revenue was a result of growth in both SafePath and CommSuite revenues as customer adoption rates increased for both product families, offset by lower revenues from a legacy QuickLink connection manager contract that came to end of life.”

“Our graphics portfolio will continue to grow throughout 2018, as several more releases are planned. These additional releases will further energize our market expansion, as we seek to transform our graphics portfolio into our comprehensive toolkit for digital artists.”

“I think that we are the premier (distributor of these kinds of products). We have two lead products that are very, very well-received in the market. I think that we have traveled all over the world to find these products, and I think we can continue to do that. And it really just builds on this idea of having a digital portfolio for artists. And I think what you see is a complementary group of products being slowly brought on board more and more”

“There are some exciting content-based opportunities emerging for graphics business in the expensive online universe of digital comics and the emerging virtual-reality market. Needless to say, there are exciting changes on the horizon within our graphics lineup, so stay tuned for future announcements.”

“During the fourth quarter of 2017, we rolled out CommSuite product enhancements, which we’ve now seen positive results from, and we do expect will contribute to 2018 revenue growth. Revenue from the Sprint SafePath launch is expected to accelerate based on recent and expected Sprint actions.”

“As a reminder, the Sprint launch is unique and that Sprint has an existing base of subscribers using a legacy product. The legacy product was originally due to sunset in first quarter of 2018 but has subsequently been delayed for several months. This change was based solely on Sprint operations and was not a result of the SafePath application, or change of our contract status.”

“Operating expense for the first quarter was $6.2 million, a decrease of $700,000 or 10% comparing to last year. In the near term we expect our quarterly operating expense to be approximately $6 million, which excludes any unannounced restructuring plans.”

“Strategies to boost customer loyalty and reduce subscriber churn remain a high priority for all mobile service providers. Of course one of the most effective ways to combat subscriber churn and create stickier customer relationships is through value added services like our SafePath Family platform and our CommSuite messaging platform.”

The key word there is “sticky”. Traditionally, SMSI has produced products that have been more temporary in nature. They make good money for a period of time, but the carriers don’t need the products indefinitely.

“Let’s start off by talking about our SafePath implementation at Sprint, known as Safe & Found. Subscribers of the new Safe & Found service at Sprint continue to grow in correlation with the carriers increased marketing efforts. “

“Sprint continues to transition users of its legacy service to Safe & Found. There are several initiatives underway to acquire new users for the service as well. For example, Sprint is rolling out a new MMS-based acquisition campaign this month, targeted at its wider subscriber base.To support this initiative, they will also launch a retail-based campaign to build service awareness. To promote the Safe & Found service, Sprint is training and compensating retail associates and will be launching additional new promotional activities throughout the year.”

“With the next release, SafePath will evolve to a digital lifestyle management platform for the entire family that will provide enhanced location services, easy to use parental controls, powerful web filtering functionality and built-in support for new IoT products and services.This improved platform will extend the product’s capabilities to support a multitude of new consumer-oriented use-cases around wearable locators, pet trackers, onboard diagnostic devices (driver tracking) and home automation platforms.”

“It is also important to note the functional superiority of our SafePath platform on iOS devices versus the legacy service we’re focused on replacing. For instance, some large carriers such as T-Mobile still use the legacy platform, do not even offer an iOS version of the family location app. This lack of an iOS application leaves a significant portion of the user community without the access to a family safety platform. We see Sprint’s decision to replace the old service with the SafePath Family as a strong indicator that our vision for Family Safety services is directly on target.”

“Now let’s discuss the proposed merger of T-Mobile and Sprint. This will be a major change within the wireless world. First off, we have seen mergers many times over the years. I understand the process. I know how to develop and position our wireless solutions to take advantage of new opportunities as they arrive. In terms of the future of our business, I view this proposed merger as a stimulating and energizing opportunity. As you know, Smith Micro has always been very opportunistic, and I believe our ability to adapt and respond to the ever-evolving wireless marketplace is an advantage.

Our strength in balance sheet will allow us to accelerate roadmap development for both CommSuite and SafePath, products presently sold to Sprint…

…we have strong relationships with both Sprint and T-Mobile. Both carriers know our solutions and are confident in our ability to deliver valuable service offerings. As such, should Sprint and T-Mobile complete their merger, we are confident in our ability to leverage our relationships to expand our market position and support theirs.”

“I look forward to an exciting 2018. It promises to be a year of expanded revenues and a return to profitability in the coming quarters.”

Mark Gomes

Okay, good enough. When you talk about the $3.5 million full transition, what kind of profitability would you expect? Can you give us some color on how that might look?

Tim Huffmyer

Yes, Mark. The profit range for this product is set around 80%. So there – we’ve talked in the past about us not having to add much cost structure, necessarily to accommodate the scaling of this platform. So I think that probably will give you some good directional input from a modeling standpoint.

Mark Gomes

Okay. So nothing has changed there in the last several months?

Tim Huffmyer

Correct.

Mark Gomes

Looking at the recent raise of $7 million, when might we hear more details about your M&A initiatives?

Charles Messman

I think it’s fair to say that the company has been quite acquisitive. So as soon as we have things to talk about, we’ll announce that. I think this does put us in a much stronger position for all the different things that we’re working on.

Mark Gomes

Looking at Safe & Found, the Google Play reviews have risen from 2.1 stars before April to close to 2.7 for the month of April, and now over 3.0 for the month of May. To what can we attribute this?

Bill Smith

“…we’re making changes in the product itself to better serve (our customers). That’s one aspect of it. Being extremely proactive with our reviews and a lot of it is actually teaching them and showing them how to use the product…

…the most important thing is also just getting more reviews. There is a very small number of reviews, and I think you’ll see that going forward it’s a very big focus of the company across-the-board. So there’s several initiatives underway to get that moving in the right direction.”

“(Sprint wants) to get to a single platform and it’s just a matter of time to get people to move across. I don’t think anything has changed on that I think some of the marketing that you’re going to be seeing coming out from Sprint, only reinforces what I just said.”

Mark Gomes

You talked about moving your development and M&A initiatives — accelerating those efforts. Is that a direct result of the success you’re seeing at Sprint…?

Bill Smith

“…this is one of those moments where you have a great opportunity to seize the marketplace and really move beyond what any of the competition is up to. I think that really is something that works for both SafePath and CommSuite…

…these are two products that we make a lot of our revenue from and we see both of these products being significant revenue drivers for us in the coming quarters. We just would really like to get so far out in front of the competitors, there’s just no way anybody would look to anybody else but us…

…I think the Sprint implementation being the first Tier 1 carrier to roll out our software offering, has been a great opportunity for us to learn more about what it takes to compete, to fine-tune our product, to fine-tune our offerings, to understand the go-to-market strategy, to understand what the user base is really looking for and we’re leveraging off of that. And then we’re going to take those learnings to other Tier 1 carriers, be that in the other part of the Americas, or in Europe, or in Asia/PAC, where we already have presence, and really try to grow this offering.

I think Family Safety is subject area… that’s near and dear to the hearts of people no matter where you live in the world. And these are scary times. There are strange things happening and being able to monitor the safety of your loved ones is really critical. So I think, it’s a great opportunity, and we intend to seize it.

We have been fortunate in raising additional capital that makes that even more possible. And we’re going to move forward.”

“we actually have a very strong conversion of people trying the app and using it to free trial. We’re actually quite pleased with that at this stage.”

“I don’t think (carriers) have to wait for 5G. I think wearables work well just fine under 4G as well. But I think probably the most important thing that we need to point out is the fact that SafePath provides a platform for which all wearable devices can be commonly connected to the carriers’ network. So that’s a major differentiator between SafePath and many of the competitive offerings that are out there, is that when SafePath was designed, it was designed with this in mind.”

“we are actively developing integration pathways within our visual voicemail product, to tie in with other voice-centric devices, such as Amazon Alexa and Google Home.”

“Next, let’s talk about our, QuickLink IoT platform, which continues to grow and evolve. The continued expansion of the IoT market has created emerging useful cases that we are well-positioned to address…

…We’re currently in conversations with several device and chipset OEMs as well as IoT solution providers and operators who have active interest in using our lightweight M2M client to add substantial management functionality to these resource-constraint devices. In the coming quarters, our QuickLink IoT product development team will continue their effort to reduce the size and resource consumption of our client, which will increase our competitive advantage in this attractive and growing market.”

“Now for a bit about our Wi-Fi optimization and management solution, NetWise. In terms of license count, the number of installed instances of our NetWise client continues to grow across our three major customers. Additionally, during the first quarter, we also saw growth in policy counts. This is a positive and solid indicator of the utility and effectiveness of our NetWise solution as an enabling technology in the emerging market of Wi-Fi-first mobile service. We see a fresh upside with NetWise, as we expand our market presence on new device types.

We also enhanced our analytics engine during the first quarter to better capture important data metrics, central to network planning, cost-saving strategies and in-depth understanding of Wi-Fi usage trends in large device populations. From these developments, it’s evident that the cost-saving benefits and strategic insight, enabled by our NetWise solution, continues to have value across the mobile services industry.”

“I think it’s intriguing to watch the growth of the wireless business at the cable MSO’s. Comcast is long-term customer. We have added cable customers as well here in the U.S., a very large size. So we have a lot invested in the sector.I think the activities that are going on between Comcast and Charter only serve to move this along, and we see this as a good opportunity. We’re here to really focus and help them move their business case forward.”

More Research:

- SMSI: Safe & Found Downloads Spike! Sprint Says Family Locator “could stop working at any time”

- “Top Ten Stocks” Update (and note to HMNY watchers): AMC & GAIA Report Stellar Earnings!

- Smith Micro Raises $7 Million (At A Premium) To Accelerate Its Momentum

- HMNY’s ATM Offering: Where’s The Stock Going Next?

- Sprint FINALLY Ramping Up SMSI’s Product!

- Videocast: AEHR 10-Q, MoviePass Update

- AEHR Grows 175% — Beats On The Top & Bottom Line (Buying More)

- GAIA vs. MoviePass: CAC Shows Which One Is A True Mini-NFLX

- Major Update on SMSI

- SMSI’s Safe & Found App: 100,000 Downloads & Counting

- MoviePass Projected To Burn $600M In 2018

- SMSI: Riding A New Trend & Making Its Latest Comeback

- Mark Gomes Research

To get my posts in real-time, just follow/subscribe to this free blog.

If you only want to receive my most critical reports, simply sign up for my MailChimp mailing list instead. If you’re on that list, you will only get key articles and occasional recaps of all the work I’ve recently done.

Disclosures / Disclaimers: I am long SMSI. However, this is not a solicitation to buy, sell, or otherwise transact any stock or its derivatives. Nor should it be construed as an endorsement of any particular investment or opinion of the stock’s current or future price. To be clear, I do not encourage or recommend for anyone to follow my lead on this or any other stocks, since I may enter, exit, or reverse a position at any time without notice, regardless of the facts or perceived implications of this article.

I am not a financial advisor. Nor am I providing any recommendations, price targets, or opinions about valuation regarding the companies discussed herein. Any disclosures regarding my holdings are true as of the time this article is written, but subject change without notice. I frequently trade my positions, often on an intraday basis. Thus, it is possible that I might be buying and/or selling the securities mentioned herein and/or its derivative at any time, regardless of (and possibly contrary to) the content of this article.

I undertake no responsibility to update my disclosures and they may therefore be inaccurate thereafter. Likewise, any opinions are as of the date of publication, and are subject to change without notice and may not be updated. I believe that the sources of information I use are accurate but there can be no assurance that they are. All investments carry the risk of loss and the securities mentioned herein may entail a high level of risk. Investors considering an investment should perform their own research and consult with a qualified investment professional.

I wrote this article myself, and it expresses my own opinions. I am receiving no compensation for it, nor do I have a business relationship with any company whose stock is mentioned in this article. The information in this article is for informational purposes only and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

The primary purpose of this blog/forum is to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Excellent report, Mark. I really think the home automation platforms and wearable locators (including pet trackers) is where the future of the company will be. We sure have to do our research on this market to see what Amazon is working on or how Tile, Marco Polo, or Paw Tracker compare to SMSI’s platform.

Thanks again.

LikeLiked by 1 person

Once again, excellent report Mark! This is got to be one of the best opportunities I’ve seen for that last several years. As you’ve outlined, SMSI’s market potential is gigantic and the stock price on this micro cap will dramatically rise once the investment community discovers it.

I was curious what you think of the increased short interest? Data provided by nasdaq increased on April 30th to 1,930,153.

://www.nasdaq.com/symbol/smsi/short-interest

Please keep in mind, I’m not bashing the stock. If anything, this is giving new investors a chance to load up at rock bottom prices.

My question to you is do you think the stock is being shorted due to the way the last two offerings were made? If so, I wonder how long this will go on for?

LikeLike

I think the high short interest is bullish. It represents soaked up supply in the market.

Yes, I think the stock is being shorted due to the way the last two offerings were made, but there’s no way to know how long this will go on for. The stock has been RISING despite the shorting, so what will happen when it stops? I don’t want to miss that. 😂

LikeLiked by 2 people

Sorry, here’s the correct link:

https://www.nasdaq.com/symbol/smsi/short-interest

LikeLike

Thanks for the link 👍🏼

Amazing. 660,000 shares shorted in just over 2 weeks and the stock rose from $1.80 to $1.99 — again, what happens when the shorting abates / reverses?

LikeLiked by 3 people

p.s. the 660,000 increase that accompanied the $7 million raise is nearly proportional to the 560,000 increase that accompanied the $5 million raise.

This may indicate that the shorting is near complete.

LikeLiked by 2 people

Here is how an increase in short interest percentages can be misleading. There is a website called “short volumebot” that compiles the percentage of daily short interest. I’ve checked their numbers against the actual total volume of shares traded on a daily basis provided by yahoo finance. I discovered that the “short volumebot” site does not report the entire volume of shares traded. I”m thinking they just report what is shorted on the nasdaq?

http://www.volumebot.com/?s=smsiDate

Short Volume Total Volume Short Percent Actual Total Volume Reported By Yahoo Finance

05-09-2018 98,730 123,082 80.21% 206,700

05-08-2018 72,570 136,774 53.06% 241,100

05-07-2018 181,250 267,748 67.69% 464,100

05-04-2018 125,599 177,767 70.65% 331,700

The point being is that some of these sited make it seem like a stock is being heavily shorted while this is not the case.

LikeLike

The daily shorting data is BS. I believe the biweekly NASDAQ data.

LikeLiked by 2 people

Thanks for the write up Mark. I’d like to contribute a data point regarding the upcoming MMS marketing campaign Sprint will be rolling out as I’m familiar with the online ad industry.

Assumptions:

1. MMS/SMS read rate is around 95-98%, with an open rate of around 20%. This means 95% of folks who receive a text will read it, with 20% will open the link. I assume a 10% open rate.

2. I’ve conservatively pegged the signup rate of S&F to be 2% given the nature of this type of apps being a bit harder to fully get up and running than a simpler app (i.e., game).

3. Sprint has around 55-60M subscribers, and assuming sprint will be advertising to only 10-25% of their total sub base (i.e., targeting families, and accounting for duplicate subs within the same family). Again, I’m being conservative.

Running some simple math:

55M * 10% Open rate * 2% signup rate = 110,000 potential new customers for S&F.

I believe these will be on the free trial. I do not know how many will convert to become paid subs so I’ll leave that part out. However, I believe (and agree with your excitement) that this single campaign has the potential to add significantly to S&F’s total sub base and bottom line. Also, an added benefit of these new subs is that I believe they’ll be more inclined to leave positive reviews as compared to legacy subs from Family Locator.

All this is to say, at $3.5/user per month, this campaign could lead to 110+ new customers which will result an an additional 1M+ in Quarterly revenue.

One last note, I believe this campaign will run sometimes in June, and assuming a one month free trial is offered, paid subs will most likely not kick in until mid July at the earliest. So I believe sub results will be shown in Q2 results, and revenue/profit results will be shown in Q3/Q4 results.

I’m pretty excited. I’d love to hear other’s thoughts, and please correct me if any of my assumptions seem outlandish. Cheers.

LikeLiked by 2 people

Fantastic post. This is what this blog is all about. You provide your expertise and I provide mine.

Totally agree… and this is just one promotion. They’ll surely replicate it. Further, this is at least the third bundle / promotion / campaign I’ve heard about.

If they push this like Costco did MoviePass (Costco isn’t that much bigger than Sprint in terms of customer count), the multi-month end result should yield a lot more than 110K customers… but that’s with a persistent push. Your one-time push number sounds spot on to me (and consistent with what I’ve heard about Sprint’s Year-1 subscriber goal). Cheers! 🔥🔥

LikeLiked by 2 people

Appreciate all your hard work on this Mark! Added more Oct $2.5 calls today to complement my long common share position.

LikeLike

👍🏼

LikeLike

“I love it when a plan comes together!” – we’re like the new A-Team which must make you Hannibal, Mark (I’ll let you figure out the similarities, but it begins with being wrongly arrested and escaping to become a soldier of fortune haha…) Most people don’t realise how exciting it is to have information confirmed. They always want big news. Well done!

Devil’s advocate for a moment – does anyone know who makes T-Mobiles’s Family Where app (Sprint’s legacy app)? They obviously know T-Mobile does not provide their product to iOS users and must have been working on an improved version to avoid losing their contract, all while pulling in a nice revenue from T-Mobile. I want to try and find out when it might be released and if it will be in time to compete with Safe & Found (meaning that when Sprint made the decision there was no competing product or update available but now there may be).

Another interesting point – also not a data point. It seems a third party app will still be required to lock the S&F app as “All devices can uninstall the app and turn off location services without a password” (from Sprint’s faq page re. S&F).

LikeLike

Location Labs makes the legacy product being used by all the major carriers. They competed head to head for Sprint’s next generation offering and from what I heard location labs’ product barely worked.

Smith is working on the other issue you raised. It’s all just software… and SMSI has a 30+ year development track record. Just takes recognition and then time/resources.

Cheers!

LikeLike

Hi Mark, any updates on Unterberg dumping the stock. You had mentioned you had the scoop and were going to release the info. Thanks.

LikeLike

I will…

LikeLike

From what was said and doing some extrapolating, there are 4 dominoes concerning S&F and SmithMicro that soon should fall in quick succession:

1) New and improved version of S&F.

2) Sunset of Family Locator

3) S&F marketing campaign from Sprint

4) SMSI investment roadshow

I do google searches for sprint “safe & found” limited to the past week. Right now there is exactly 1 google page with 4 of those result being owned by some guy named Mark Gomes! Most of the other results are meaningless. Easy to forgot how early current stock holders are. After that 1st domino falls things are going to get fun.

LikeLiked by 1 person

Mark, away from all the awesome info on financials, subs, etc. can you please tell me how this would work for a pet? I assume for an inanimate object something can be put in/on that item to be tracked, but an animal, unless it’s on their collar or an implanted chip? Thanks much

LikeLiked by 1 person

On the collar makes the most sense. These devices are small and shrinking every year!

LikeLike

Thank u

LikeLike

Ok this maybe a stretch, but what do you think of this:

1) Smith Micro Announces Exclusive Distribution Agreement with Escape Motions to Resell Portfolio of Digital Art Software

2) https://www.laserfocusworld.com/articles/2018/03/clearink-investment-to-speed-launch-of-wearable-and-educational-reflective-displays.html

3) Wearable locators

Did they sign the distribution deal to create amazing/arty GUIs for wearable tech?

LikeLike

https://play.google.com/store/apps/details?id=com.sprint.safefound&showAllReviews=true

Check the recent reviews. These reviews still suck! I sure hope SMSI fixes these bugs asap. The canned message from Sprint say that “updates are on the way.” It’s imperative that SMSI gets this right asap. I don’t think it’s surprising that Sprint has delayed the Family Locator app even though Bill Smith says that decision was not because of underperforming. To put it bluntly, I don’t believe him!

LikeLike

Maybe I”m over reacting? I have to admit I do find a lot of new reviews that love the app better than Family Locator. I’m wondering if the company that made Family Locator is having their employees write many of the bad reviews? I wouldn’t put it past them.

If the bad reviews are real, there are some legitimate issues but I also see a lot of user errors.

LikeLiked by 1 person

Yes. Read my research.

LikeLike

I’ve written enough on this subject. If you don’t believe Bill (or Sprint or me) I can only respect your decision / opinion.

One last time….

Yes, there are bad reviews, but they’re 0.2% of downloads. I don’t know how I can make it any more clear. No product satisfies 100% of customers.

99.8% are NOT giving them 1-Star. That’s your stat! 😂😉

LikeLiked by 1 person

I know its been covered many times, but….Sort by newest first. Completely different story.

5, 3, 5, 1(wants Locator), 3 (Doesn’t work in China?!?), 5, 5, 2, 1 (Too many features!), 1 (Again too many features!)………..

LikeLike

Thanks. Low sample size, but that’s consistent with what Sprint people told me… and that organization deals with a LOT more than a few people per day 😉

Again, first-hand experience is best.

LikeLike

Okay, okay, but how to explain that the Family Locator app gets far better reviews?

LikeLike

IDK (and really don’t care), because I know how reviews work. They’re NOT entirely reliable (for MANY reasons).

I’ve made several hundred thousand dollars on this because I did what a good investor is supposed to do — I made the effort to test the product, instead of reading into a few people’s negative opinions.

Don’t trust me. Don’t trust Bill. Don’t trust Sprint. Do your homework and TRUST YOURSELF. That way you can also become a contributor to this collaborative effort. Remember, this is not a research service, it’s a group.

I hope I’m not being too harsh. I’m a nice guy, but a (very) tough coach. My tone is meant to help you develop a winning investment mindset and method.

I hope you take that advice. It pays big!

LikeLiked by 1 person

Okay, that’s good advice…….makes perfect sense.

I’m going to sign up to test it myself.

LikeLike

Awesome 😊 Can’t wait to hear your feedback. I’ll be sure to deliver it to SMSI and my contacts at Sprint.

FYI, if you’re not on Sprint, you’ll need to find a friend who is. Whoever the lead “customer” is needs to be on Sprint, but all other users can be on any carrier’s service.

I’ve piggybacked on two trials because I’m T-Mobile (which is actually great, because I got to see how well the product works on T-Mobile and iOS). iOS killed Location Labs and I’d love to see SMSI win T-Mobile.

#research

LikeLike

Darn, I have an iPhone 7+ but I’m on Verizon so I’ll have to find a friend who has Sprint.

Thanks again, I’m eager to give it a try.

LikeLike

👍🏼

LikeLike

Currently there are devices you can put on a pet that does locate them though I can’t remember the cost.

I would get one just for the fun of knowing where my cat goes.

LikeLike

Right. There are several products like that. Now imagine being able to track every child, every pet, every relative, and anything of value, all from one app.

That’s where they’re going with this…

LikeLiked by 1 person

I’m pretty sure all the existing products, like Tile, use bluetooth with only about a 100 foot range, whereas I believe IoT trackers – that work with your cel – will be locatable through the network like your phone (not sure if through cell signal, gps or both). Big difference! You don’t have to be within 100 feet of the item to find it.

LikeLiked by 1 person

Bingo!

Just keep in mind that location trackers like safe and found are best suited for making sure that a person, animal, or item are in a general area (ideal for tracking and theft protection).

LikeLike

I like where they are going with this. Not sure if this was addressed, but I can see using this technology for bad reasons. Just one things that come to mind, stalkers? Idk, just thinking out loud…I feel like they would have thought of this and how to guard against using the tech for evil purposes.

LikeLike

Try it out. Not usable for stalkers. Have to be invited in.

In fact, EVERYONE who is interested / involved in the stock should try the product. There so much misunderstanding and misinformation out there, this is one of the most simple things to do to gain an understanding of what’s going on. 😉🙌🏼🔥

LikeLike

Do you have any ancillary plays you’re watching regarding the whole safe and found premise? ie. the dog collar manufacturers, tracking devices etc.

LikeLike

Nah. Very competitive space. Good thinking though!

LikeLike

SMSI stock not performing as hoped

LikeLike

What was hoped?

I don’t care what a stock does. I only care about my calculation of its value. That dictates how I react to the stock’s movement.

I happily bought more here in the low 1.80s (at least as a trade). If it jumps, I can consider selling the trade. If it goes further down, no worries, because I think the stock is worth a lot more than $2.

LikeLiked by 2 people

I just emailed a new round of SMSI census info to all participants. Have a great weekend!

LikeLike

Still no email, thx

LikeLike

Resend your position to the Contact page. Let’s see if I got/get it. Cheers.

LikeLike

Just resent, thx

LikeLike

Didn’t get it the first time. Just sent you the results.

LikeLike

I just resent my position also, I haven’t received the results. Thanks mark

LikeLike

Got it this time and just sent the initial results to you. Will update when the number goes up enough to warrant an update. Cheers!

LikeLike

Hi Mark. I just resent my info. I also hadn’t received an email. Thanks

LikeLike

Got it for the first time. Sending info now 👍🏼

LikeLike