As always, be sure to read my disclosures / disclaimers below. Cheers!

Recap of Today’s LIVE YouTube Briefing

I went LIVE on YouTube today to discuss SMSI, MRIN, GOOG, USAT, GAIA, TPCS, NBEV, TLRY, CGC, APHA, and HMMJ.

If you missed the live broadcast, you can see the entire replay here.

Negative on NBEV

Before I start, let me say the following:

1. I have nothing personal against NBEV. I have respect for management’s experience. Regardless of their track record at New Age Beverages, I don’t claim that I could do a better job of running NBEV or any other beverage company. I’m simply a business/equity analyst… and that’s where my experience is.

2. I have reached out to Wall Street veterans for their input on NBEV, its financials, and its valuation. However, I am not teamed up with anyone to attack this stock. Nor do I get paid for any of my research or articles. My background is well known and documented.

3. I have no interest in engaging in a holy war against the company or its stock. As has been the case with my past shorts (i.e. Bitcoin. Overstock, and Helios/MoviePass), my professional training and research simply leads me to conclude that NBEV is overvalued.

If you disagree, I respect that. Time will be the judge. It always is.

OK, enough preamble… let’s jump in.

Anyone involved with pott stocks should be familiar with the Horizons Marijuana Life Sciences Index ETF. This is a publicly-traded fund, which invests in dozens of publicly-traded pott stocks.

If you follow my work, this is important for the following reason…

My regular readers know that I’m very negative on NBEV’s valuation. Similar to my prior short calls on cryptocurrencies and Helios & Matheson / MoviePass (HMNY), many who own the stock don’t want to even hear a professional analysis.

That’s fine with me. However, if you wish to be successful, you have to learn to examine all data points and how to weigh them appropriately. Failure to learn this skill will subject you to something professionals call “confirmation bias”. It’s one of the top reasons why an investor will fail to make millions (and therefore a very important part of a professional’s training).

As it relates to NBEV, investors are in love with the story (I understand why!), but are missing/ignoring some critical weakness in the underlying asset, which I discussed in today’s video.

That being said, I’m quick to acknowledge Warren Buffett’s lesson that stocks are a voting station in the short-term and a weighing station in the long term.

In other words, stocks rise/fall based on supply/demand for the shares in the short term, but ultimately move toward their true and fair valuation over time.

Thus, even though I (and other professionals) believe that NBEV’s true value is 65-80% lower than its current stock price, I feel that the stock will reflect my analysis/math at some point. In the meantime, my short could go up and/or down.

This is where HMMJ can come in.

Based on my research, the stocks in HMMJ (as a basket) are a far superior investment to NBEV. I’m not saying that HMMJ is a great investment, but it is “far superior” to NBEV based on my assessment.

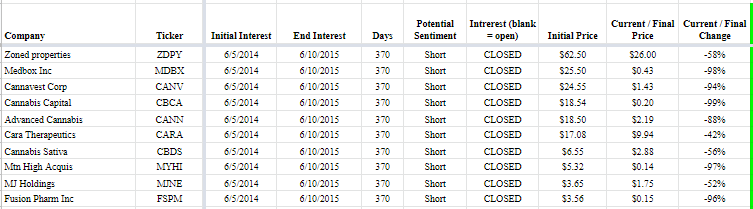

For those who don’t know, I’ve been following analyzing stocks for over 30 years, retired at 38 (due to my stock analysis ability), and have followed pott stocks for about 6 years. In fact, I did an extensive analysis of pott stocks in 2014, which concluded that 48 of 50 stocks I analyzed were overvalued (FYI, GWPH was one of the two that passed my tests).

I publicly advocated shorting 10 of those pott stocks and went a perfect 10 for 10…

Incidentally, GWPH was up more than 50% during this time frame.

Incidentally, GWPH was up more than 50% during this time frame.

For those who agree with my assessment on NBEV, but fear a continued rise in pott stocks, can buy HMMJ as a hedge against an NBEV short.

Similarly, those who wish to invest in pott stocks, but don’t have the time or training to figure out which ones are pumps, frauds, or simply overvalued, can buy HMMJ.

FYI, HMMJ aims to track the North American Marijuana Index, which “tracks the leading cannabis stocks operating in the United States and Canada. Constituents must have a business strategy focused on the marijuana or hemp industry, and are required to meet our minimum trading criteria. The Index is equal-weighted and rebalanced quarterly.”

If you want to see the stocks held by HMMJ, you can see it here.

Incidentally, despite what NBEV does, it did not qualify for inclusion in this index.

This provides some validation to what I’ve been saying for months. Any intelligent person (including NBEV longs) must agree that adding a new flavor (i.e. cherry; orange) or creating a diet version of your beverage is highly unlikely to make your company special.

This is exactly what CBD will be. The rise of CBD is coming and it’s great news if you sell CBD to beverage makers (as companies like Aurora and Tilray do). However, for beverage makers, it’s just another SKU. It does not make you a marijuana company. Otherwise everyone from Coca-Cola to Budweiser will soon be a marijuana company.

Don’t take my word for it. Just Google it and see for yourself.

Thus, NBEV’s competitive positioning vis a vi leading beverage maker (which has always been sub-par) will not change with the addition on CBD.

Beyond that, NBEV’s guidance calls for $20 million in EBITDA this year. Now, assuming they meet this expectation, that gives it a current EV/EBITDA multiple of 25x. For those who don’t know, that is obscene for a mature company ($300 million in expected revenues) with little-to-negative organic growth.

Experts with whom I consult agree that something closer to 5-8x would be closer to normalcy (but still be generous). That’s a decline of 68-80% from current levels.

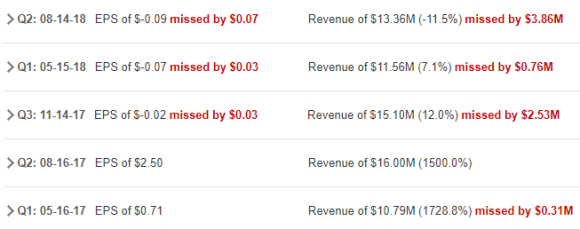

Beyond that, there’s plenty of reason to doubt NBEV’s ability to generate $20 million in EBITDA. I’ve tracked the company for years (and even owned the stock) but soon realized that management consistently over-promises and under-delivers.

Product-wise, its Kombucha and Pedialyte products have both fallen far short of expectations set by management. Financially, the company has missed several quarters.

For short-sellers, the stock is becoming increasingly attractive. Not only is the valuation rising, but its share count has nearly quintupled in just three years. Not long ago, it had 15 million shares outstanding at 20-cents — it was very easy to move.

Now, at $7+ with 75 million shares outstanding (accounting for the Morinda acquisition), it has lost much of its juicy stock-moving profile. In fact, with its $500+ million valuation, it is now firmly in the sights of institutions, contributing to a fast-growing short interest.

So, while the excitement surrounding pott stocks (see below) can enable NBEV to creep higher, it doesn’t make the valuation right.

More from my live broadcast HERE.

If you want to see the entire broadcast, you can see it here. Cheers!

More Research:

- My YouTube Channel

- Individual Stocks Showing Life

- The Quick Investor’s Guide To SMSI

- MoviePass Projected To Burn $600M In 2018

- Sprint Finally Rolling Out SMSI’s Safe & Found Nationwide!

- Lose 33% In 9 Months To Make 1,000% In 15?

- GAIA vs. MoviePass: CAC Shows Which One Is A True Mini-NFLX

- Buying SMSI — Today Is The Day I’ve Been Waiting For!

- Mark Gomes Research

To get my posts in real-time, just follow/subscribe to my free blog.

If you only want to receive my most critical reports, simply sign up for my MailChimp mailing list instead. If you’re on that list, you will only get key articles and occasional recaps of all the work I’ve recently done.

Disclosures / Disclaimers: I am long MRIN and HMMJ. I am short NBEV and NBEV call options. However, this is not a solicitation to buy, sell, or otherwise transact any stock or its derivatives. Nor should it be construed as an endorsement of any particular investment or opinion of the stock’s current or future price. To be clear, I do not encourage or recommend for anyone to follow my lead on this or any other stocks, since I may enter, exit, or reverse a position at any time without notice, regardless of the facts or perceived implications of this article.

I am not a financial advisor. Nor am I providing any recommendations, price targets, or opinions about valuation regarding the companies discussed herein. Any disclosures regarding my holdings are true as of the time this article is written, but subject change without notice. I frequently trade my positions, often on an intraday basis. Thus, it is possible that I might be buying and/or selling the securities mentioned herein and/or its derivative at any time, regardless of (and possibly contrary to) the content of this article.

I undertake no responsibility to update my disclosures and they may therefore be inaccurate thereafter. Likewise, any opinions are as of the date of publication, and are subject to change without notice and may not be updated. I believe that the sources of information I use are accurate but there can be no assurance that they are. All investments carry the risk of loss and the securities mentioned herein may entail a high level of risk. Investors considering an investment should perform their own research and consult with a qualified investment professional.

I wrote this article myself, and it expresses my own opinions. I am receiving no compensation for it, nor do I have a business relationship with any company whose stock is mentioned in this article. The information in this article is for informational purposes only and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

The primary purpose of this blog/forum is to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Last night I received my monthly Sprint Rewards email. For the first time I remember, Safe and Found was advertised with first month free. In the last 10 days we’ve seen the Smith Micro tweet training S call center, the AppAnnie ranking move up substantially (and hold now for a full week), and now S advertising S&F to S subscribers in monthly email. My conclusion is that S is ramping up their promotion of S&F now that S&F updated the app to do what S identifies as the chief complaint, allowing customers to track other phones on the S plan without the app being installed on that phone. In any case, this all bodes well for SMSI.

LikeLiked by 1 person

AWESOME 🔥🔥🔥

Thanks for sharing that 💥 👍🏼

LikeLike

The CEO said this on the Q3 CC

“In the fourth quarter, we are launching a Spanish version of Safe & Found, Sprint’s branded SafePath product. Sprint retail stores will run promotional offers to increase sign-ups of new subscribers by sales associates. We will use contest and rewards to drive retail excitement and focus. We also have some digital online marketing campaigns focusing on targeted personas, such as millennial moms, Gen X moms and Hispanic moms, building awareness of the power of Safe & Found in promoting Family Safety.”

I do wonder if some or all of these initiatives were delayed to later in Q4 or even early Q1 (not unknown for Sprint to delay :-)) and what we are seeing now are the tangible results from these initiatives.

LikeLike

Looks like capitulation in ATTU? I could be wrong – but to me the price action seems largely disconnected from the fundamentals – the business commentary remains strong – more to the point, there’s nothing to suggest a slow-down in business such as in 2015 Q4 ER. It seems this mgmt tends to guide full year revenue really conservatively. (My guess is that some people are fearing a repeat of a slowdown such as in 2016? Struggling to find any other evidence of that.) Or am I missing something?

Also, it’s fast approaching 100 DMA, upper bounds of long-term CAGR trend and lower bounds of recent short-term trading channel – looking more attractive.

LikeLike

That’s all technical talk, so who knows? It got CRUSHED for more than -20% a few days before earnings, then fully recovered, hit a new high, and now getting hit again.

It’s a good business at a pretty good price. Moderate risk vs. moderate reward, favoring reward by ~60/40, IMHO.

I’m not involved at this moment.

LikeLike

Thanks for the USAT video. When a company (USAT) reports bmo what time in the morning do they generally do it? I hate to ask but I have failed miserably to find an answer this evening. Thanks again.

LikeLike

No idea. 🤷🏻♂️

LikeLiked by 1 person

USA Technologies auditor resigns, to restate FY17 and FY18 financials USA Technologies disclosed that RSM US LLP notified its Audit Committee of its resignation as the company’s independent registered public accounting firm. As of February 1, RSM had not completed its audit procedures or issued any reports on the company’s internal control over financial reporting and consolidated financial statements for the fiscal year ended June 30, 2018. RSM indicated in its letter to the Audit Committee that, based on the totality of the information, it had concluded in its professional judgment that it can no longer rely on management representations in connection with the audit of the company’s 2017 internal control over financial reporting and consolidated financial statements. The Audit Committee is currently seeking a new independent registered public accounting firm and intends to engage such firm as soon as practicable. As previously announced, the Audit Committee has substantially completed its internal investigation which focused principally on certain customer transactions entered into by USA Technologies during fiscal years 2017 and 2018. The determination of the board to restate the above-referenced financial statements was based upon the adjustments to the previously reported revenues proposed by the Audit Committee and its advisers. As previously reported, on a net basis, the proposed aggregate reduction to previously reported revenues during the fiscal quarters in question is not expected to exceed $5.5M. “In most cases, revenues that had been recognized prematurely were, or are expected to be, recognized in subsequent quarters, including quarters subsequent to the quarters impacted by the investigative findings. The investigation further found that certain items that had been recorded as expenses, such as the payment of marketing or servicing fees, were more appropriately treated as contra-revenue items in earlier fiscal quarters,” USA said.

Read more at:

https://thefly.com/landingPageNews.php?id=2860545

LikeLike

Yup. I was on StockTwits and LIVE on YouTube working on what this means.

The accountant was certain to resign upon the determination that the CFO was largely to blame (as evidenced by the findings and actions of USAT’s internal audit committee).

LikeLike

USAT news is bad. Will leave a dark cloud over co and its mgt for the foreseeable future. Yesterday I was regretting not getting back in. Today I’m extremely happy I dodged that bullet. Stock getting clobbered.

LikeLike

That’s a kneejerk reaction IMHO. While I agree that many investors will be scared by this, I think it’s irresponsible to feed into the fear without researching the situation and putting it in context.

That’s EXACTLY what I did for hours last night and determined that the accountant resignation is typical in these situations.

Further (and more important for investors), history has shown that stock declines associated with situations like this reverse within days/weeks.

FYI, I’m NOT defending the company or what it did… but I AM saying that the resignation was to be expected (based on historical norms), given the company’s de facto admission that company employees (most notably, the CFO) were to blame for the accounting issue.

To kneejerk react without that knowledge gets admonished here — they belong in the chat boards, not here where we aim to handle these situations like professionals.

Personally, the news bothers me less (very little) than the fact that I have to spend time analyzing it and steering emotionally-based statements to fact.

Again, these are NOT meant to defend the stock. In fact, I hope it drops 50% because I appear to be one of few people actually analyzing what it REALLY means.

Everyone else is reacting to the stock… which is down because people rapidly hit the sell button. Been there; done that…..

Each my Youtube channel for updates on this situation. I even went live last night… and PRACTICE PROFESSIONALISM through this. Selling MIGHT be the move, but THE WINNINGEST INVESTORS ask questions first and shoot later.

My work last night suggests at least 70/30 odds that today’s move proves an overreaction at the least and completely wrong at the most.

Stay Tuned 😎

LikeLike

Not for nothing, but this is also why I’ve telling folks to favor USATP over USAT (most recently in yesterday’s video).

LikeLike

Just bought a bunch of USAT at $3.40 hopefully for a quick play. Down near its 52 wk low.

LikeLike

Out at 3.95 🙂

LikeLike

Congrats on the trade…. but let’s stick to professional fundamental talk here. 👍🏼

LikeLike

Appreciate you disclosing your purchase after your highly bearish statement. That’s NOT sarcasm. 👍🏼

LikeLike

Mark when it comes to trading, my bearish comments don’t have to align with my actions. I saw an overreaction and jumped on that opportunity. I’m still not a fan of the co. The best thing for this co would be a buyout. Mgt has had other accounting issues over the years. I just don’t believe current mgt has what it takes to get this co to the next level.

LikeLike

I understand that 💯💯💯 because I “know” you… but most people don’t. So, as a “friend” I’m kindly saying that making a bearish statement and then buying the stock can be taken the wrong way (especially HERE, where I preach professional research, analysis, and discussion). Cool?

LikeLike

Cool! 🙂

LikeLiked by 1 person

Hi,

I am new to options and sold a SMSI puts July, 2019 $2.0 for $0.45. I also see the web showing the last close price of SMSI puts July, 2019 $3.0 for $1.30 on the market. The $3.0 SMSI option price ($1.30 @ Jan.17) is confusing to me. Of course, there are always good and bad trades.

Besides the open interest differences for $2.0 and $3.0 options, I’d like to know what is the differences between SMSI puts July, 2019 $2.0 for $0.45 and SMSI puts July, 2019 $3.0 for $1.45? It looks like SMSI puts July, 2019 $3.0 for $1.45 is much better than SMSI puts July, 2019 $2.0 for $0.45 for more premium. Is it right? I don’t find the answer on the web for my question.

Thanks,

LikeLike

Look at the last trade dates for the two strike prices. This is thinly traded so you may be looking at prices that are unrelated. Additionally check if there is a bid/ask and how that lines up with the last traded price. Hope that helps.

LikeLike

Oh I just looked at it. Forget previous comment the prices are relatively the same. The $3 option are farther in the money therefore more intrinsic value and also more risk of being put the stock.

LikeLike

Also, if you are new to options you might consider starting with covered calls. Naked put writing is a whole different game and might better be saved for later as the risks are considerably greater. JMHO

LikeLike

Def have to educate yourself before making any moves… but there is so much money to be made if you do.

My gut feel is that I made more money WRITING options (not buying them; I’m not a fan!) last year than owning stocks.

LikeLike

Mark, Appreciated your commentary on CELH China deal. Agreed with your points on focusing on their core markets, expenses etc. Additionally, as a former expat for a huge US company in China, I can tell you first hand that a small company trying to navigate the culture, bureaucracy, and immensely complicated business environment is a 1 in 1000 chance. Even the big boys have suffered significant carnage in going it alone there. Thanks as always.

LikeLike

No doubt. That’s why they had seasoned veterans handling the ramp up in China. However, the license deal ensures that those veterans are MORE DIRECTLY incentivized to succeed (AND very incentivized not to fail).

LikeLike

I wrote some Sep 2.5 puts on USAT and got .40 for them.

LikeLike

.45 not .40

LikeLike

That’s sweet too. I saw those. That’s like a bankruptcy bet, priced at 16% odds. Shoot, if you lose on that play, USATP likely goes to $44 💥

I may up my USATP limit price to buy more and cover them by writing those puts.

The brilliant thing about that is that both can win, but it’s not likely both lose (over time).

LikeLike

Hi Mark,

I just wanted to share this with the community.

I listen to Motley Fool podcast on regular basis and I thought this episode was helpful.

It talks about the defense industry and why submarines are important.

They don’t mention TPCS but it helped me understand the industry.

https://www.fool.com/podcasts/industry-focus/2019-01-31-energy-defense-contractors-and-the/

LikeLike

Thanks !

LikeLike