Opening Disclosure — Long-time readers should note some significant changes in how I communicate in the public domain. The primary purpose of this forum is now to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Accordingly, this document should not be construed as an endorsement or recommendation of the companies or securities discussed herein. I am not an investment advisor and this is not an investment thesis. It is merely one part of the story, which I present for debate in hopes of determining all risks and upside potential. The disclosure at the end of this piece is critical to understanding the content and context of this document. Further, I frequently trade my positions and may buy, sell, or short the securities mentioned herein at any time, regardless of the facts or perceived implications of this article.

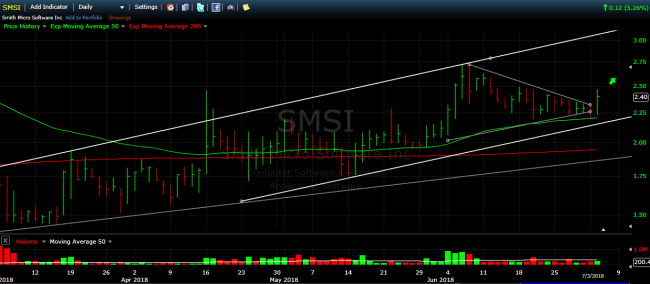

On Friday, SMSI broke out of a technical channel, generating the highest-volume “up” day since its sharp run in early-June.

Despite holding my rather large position, the pullback came as no surprise. It was due and healthy. Also healthy was the latest set of reviews. As I’ve been saying for months, I WOULD NOT RELY ON THE REVIEW DATA FOR ANYTHING. It has been skewed (positively and negatively) from Day 1 and tells us little about anything.

That being said, here it is for those of you who disagree…

Frankly, my recent Special Report series is the work investors should be paying attention to. However, I find that most investors can’t be bothered to spend an hour doing research, even if it required 1,000 hours to earn the money they’re investing.

But I didn’t write it for them. I wrote it for those who wish to learn how to invest like Wall Street professionals do.

Anyways… there were plenty of new (and REAL) data points to examine over the weekend.

One bit of great research came from Spence Watson, who has been a regular contributor on the chat boards here on my blog site. There, he said:

I signed up a few weeks ago during the $15 promo and I brought a new phone in. The first thing as soon as you activate, Sprint will pre-load 5 or 6 icons. One of the icons is S&F when you click on it, it takes you to google play to download.

I’ve also gotten several push notifications, at least one directly for S&F. I got one yesterday that said Apps you will love. When you click it, it takes you to a page of about a dozen apps with descriptions and then you download those as a bundle.

I also was seeing S&F every time I opened Chrome on my phone. The home page is a Sprint catch-all page that’s actually pretty good so I’ve left it rather than putting another home page. The icon went away after I signed up for S&F so I assume it reads your phone for apps when it opens.

Its also very prominent on Sprint Spot which is a kill time app of viral videos, DIY, etc. Several ads placed there. Finally I think that I’ve seen it in My Sprint which is where you go to play your bill. Think. Its not there now so I could be wrong about that.

No txt messages. However, I have it installed and I’ve only been on Sprint for 10 days. I’m looking for it so I see it at least once a day. Your average person won’t register that they’ve seen it so often. But the rule of marketing is you have to make 7 contacts before you ask for the sell so I’m sure the average Sprint customer is getting those 7 contacts.

SAN JUAN, PR – July 2, 2018 The school is finished and the summer is here, the children are excited. With summer come the much anticipated “freedom” for teenagers: hang out in the neighborhood pool with their friends, go for a walk in their car and of course, spend long moments on the screen of the phone or tablet.

While most parents are looking for children to have fun during their vacations and experience a bit of the independence of their age, it is also important to know that they are safe at all times.

With Safe & Found, a new Sprint application that provides real-time location updates, powerful parental controls and device security features, parents can count on that peace of mind. Families can use the Safe & Found application to set up alerts when their children arrive at a destination or if they have ventured out of a designated security zone.

The application can also block inappropriate web content and applications, restrict calls to reliable numbers only, and manage the amount of time children spend in certain applications.

Sprint offers the first month of Safe & Found free to new and existing customers. Once the free trial version expires, you can continue to use Safe & Found on the Sprint network for only $ 6.99 per month with coverage on up to five devices.

In addition, Sprint offers the best price in the Unlimited service industry.Safe & Found is available for iOS and Android devices.

For more information: https://safeandfound.sprint.com.

Finally, I saved the best for last.

This came from the smartest SMSI chat board I frequent (aside from the one here, of course!). The transcription is courtesy of Siri, so excuse me if it’s a little off:

In case you can’t read the text, here it is:

An update to an earlier post, I stopped at my local sprint store — it’s been three weeks since I was there and they in fact do have posters up and are actively converting existing clients.

Spoke to the manager who had in-depth knowledge of the product (and, in fact, is using it on his personal device to track his children), as well as an assistant manager who is an expert on iPhones was able to show me how, between Safe & Found and Apple’s internal product, I can accomplish almost everything I’m looking to do.

They’ve had great success with conversions. They say the majority of people they’ve converted her keeping it past the 30 day free trial and they are converting them in the store.

So, it’s been a big change of direction here in the first store that I checked in my local market from three weeks ago, based upon the marketing and the knowledge and the actual data of conversions.

So, good news… and I will check in a couple additional stores over the holiday coming up here soon.

In short, while it’s just one data point, it helps to validate the conclusions of my Special Report series. Sprint is taking the Safe & Found seriously. They’re methodically rolling it out and seeing great success in the stores as they get up, running, and educated on the product.

Bottom Line: I’m maintaining my earnings estimates for SMSI, but am feeling more and more bullish about the story. The stock seems to be done consolidating and earnings are coming up in a few weeks, so it’s hard not to feel great about my investment in SMSI.

Here’s the current chart:

…along with its rapidly rising usage rank:

Here’s to a great end to the week… and an even better month ahead. Cheers!

_________________________________

More Research:

- The Quick Investor’s Guide To SMSI

- Tracking Sprint’s Safe & Found Roll-Out On Twitter

- Videocast: AEHR 10-Q, MoviePass Update

- Does SMSI Stand For “Smart Money Speeding In”?

- MoviePass Projected To Burn $600M In 2018

- Sprint Finally Rolling Out SMSI’s Safe & Found Nationwide!

- AEHR Grows 175% — Beats On The Top & Bottom Line (Buying More)

- SMSI 10-Q Released — Strategies For Trading The Stock

- Lose 33% In 9 Months To Make 1,000% In 15?

- GAIA vs. MoviePass: CAC Shows Which One Is A True Mini-NFLX

- Buying SMSI — Today Is The Day I’ve Been Waiting For!

- SMSI: Riding A New Trend & Making Its Latest Comeback

- Mark Gomes Research

To get my posts in real-time, just follow/subscribe to my free blog.

If you only want to receive my most critical reports, simply sign up for my MailChimp mailing list instead. If you’re on that list, you will only get key articles and occasional recaps of all the work I’ve recently done.

Disclosures / Disclaimers: I am long SMSI. However, this is not a solicitation to buy, sell, or otherwise transact any stock or its derivatives. Nor should it be construed as an endorsement of any particular investment or opinion of the stock’s current or future price. To be clear, I do not encourage or recommend for anyone to follow my lead on this or any other stocks, since I may enter, exit, or reverse a position at any time without notice, regardless of the facts or perceived implications of this article.

I am not a financial advisor. Nor am I providing any recommendations, price targets, or opinions about valuation regarding the companies discussed herein. Any disclosures regarding my holdings are true as of the time this article is written, but subject change without notice. I frequently trade my positions, often on an intraday basis. Thus, it is possible that I might be buying and/or selling the securities mentioned herein and/or its derivative at any time, regardless of (and possibly contrary to) the content of this article.

I undertake no responsibility to update my disclosures and they may therefore be inaccurate thereafter. Likewise, any opinions are as of the date of publication, and are subject to change without notice and may not be updated. I believe that the sources of information I use are accurate but there can be no assurance that they are. All investments carry the risk of loss and the securities mentioned herein may entail a high level of risk. Investors considering an investment should perform their own research and consult with a qualified investment professional.

I wrote this article myself, and it expresses my own opinions. I am receiving no compensation for it, nor do I have a business relationship with any company whose stock is mentioned in this article. The information in this article is for informational purposes only and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

The primary purpose of this blog/forum is to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Mark- Great follow up to your SMSI report(s). I’ve been so thankful and happy with your in-depth reporting and follow-up on a company who many of us are excited about the rollout, potential, direction, management. I’ve been out of the country but keeping a close eye on your reports. So one idea i have to assist (for all of us, including you) in expanding the network of research is to deligate a weekly (or monthly) assignment of some sort so we can use our crowd (your followers) in the best way possible. This is just an idea of course, but I tend to think people are more inclined to take action when they have a direction in mind. What you’ve thought of so far (ownership % and store rollout success) has been super helpful for data points. Let’s keep up the momentum. My point is, many of us want to help but may not know the most effective ways. Cheers, and thanks again.

LikeLike

by the way, this is ‘Carvski’ a long-time follower.. just messed up on my login:) hah

LikeLike

Nice! Cheers brother!

LikeLike

Thanks dog! Trust me, I’m thinking of new ways to put this network of collaborators to work!

LikeLiked by 1 person

Great news about Safe and Found being available in Puerto Rico although I’m not sure if cell phone coverage is back online. I know they were knocked flat after the hurricane. As you know, the rebuilding of infrastructure has been extremely slow……I will try to check to see if there is any progress.

LikeLike

I’m just in excited to see language expansion.

Most of the products don’t have support beyond English (and some even specifically say that they have no current plans to do so).

There are a lot of carriers overseas!

LikeLiked by 2 people

You said, “This came from the smartest SMSI chat board I frequent” What board might that be?

LikeLike

You can find it at http://www.storytrading.com

Not all of his boards have smart people, but the SMSI one definitely does.

LikeLike

That’s Whatsapp, not a chat board per se’. I’ll pass. I don’t need the world knowing my phone # 🙂

LikeLike

Good point

LikeLike

Good work, Mark. In a recent update with management they seemed to agree with what your research is finding. While they have experienced an uptick in daily subscriptions it hasnât been âmindblowingâ yet but definitely moving in the positive direction. The only point they disagree with is the sunsetting of the Location Labs product in the near term. While they agree it may have been under discussion, there has been a management change in that division and the new mgr isnât ready to pull the plug yet. Has Chardan put out their research yet, or is this still more of the technical breakout at $2.61 today?

Brian Swift Chief Investment Officer SRA Capital Management 2400 Bridgeway, Ste 230 Sausalito, CA 94965 415-590-4324 (office) 415-990-0215 (cell) briangswift@gmail.com

This email message is for the sole use of the intended recipient(s) and may contain confidential and privileged information Any unauthorized review, use disclosure or distribution is prohibited. If you are not the intended recipient, please contact the sender by reply email and destroy all copies of the original message.

>

LikeLike

Thanks for all the contribution. Happy to see the uptake rate ramping. As I’ve said, the key isn’t competition, reviews, sunset date, Chardan initiation, etc. That’s all short term stuff that takes a big back seat to what is happening strategically with the company and its direction.

Looking forward to seeing them acquire new apps and win new accounts. The whole 3×3=9 thing I discussed in last week’s video.

People who have held that mindset have been being rewarded. It’s been a great one to trade, but even better as an investment. For sure, my investment shares are earning me a lot more $$ than my various trades have. Not complaining either way!

Going live on YouTube for a 100% Q and a session, probably around 330 or 4 o’clock eastern time.

Cheers!

LikeLiked by 1 person

Hi Mark,

Again, thank you so much for your generous sharing. You’ve helped my portfolios to increase by about 25% this year thus far. (I’ve got 25% SMSI in one portfolio and way too much in another – started buying at $1.50.)

I found you through “Reminiscences of a Stockblogger” blog last year and he has a new post this morning on SMSI:

https://reminiscencesofastockblogger.com/2018/07/07/smith-micro-stealing-a-good-stock-pick/

All the best –

LikeLike

Thanks for the kudos and sharing. You just gave the two things a love getting back for what I do. 👍🏼👍🏼👍🏼🙌🏼

LikeLike

Those who haven’t seen it, another blogger has picked up coverage on SMSI. Now TWO people talking about the stock. 😂😂😂

http://reminiscencesofastockblogger.com/2018/07/07/smith-micro-stealing-a-good-stock-pick/

LikeLiked by 1 person

Thanks Mark for all the research you have done on SMSI. It’s nice to have someone dedicated to breaking down the fundamentals and numbers the way you have been. What do you use to gather data on the usage rate and number of downloads for Safe and Found?

LikeLiked by 2 people

Good question for a Live Q&A session. There are a variety of things which I triangulate.

LikeLike