As always, be sure to read my disclosures / disclaimers below. Cheers!

LIVE YouTube Briefing THURSDAY @ 12:30PM ET !

Those who follow Hedgeye, know that the U.S. economy is expected to be in “Quad 3” for most of 2019. In plain English, that means SLOWING GDP growth and ACCELERATING inflation. That’s an improvement over what we saw in Q4 (when GDP and inflation were both decelerating), but makes for a treacherous investing environment.

For advocates of professional valuation analysis, that’s GREAT news.

For the first time in recent memory, stocks are NOT all going up in unison. Good longs are going up and good shorts are going down… just the way it should always be (and always was until 2010).

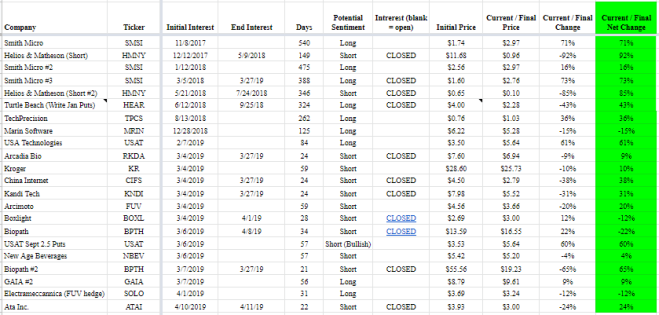

My 1% Portfolio has been on absolute fire for the past 18-months… and it’s not because the market is up. In fact, among my last 22 picks, 12 have been SHORTS! Among those, 10 have been profitable.

Of the 10 remaining positions (longs), 8 have been profitable… and one of those (Electrameccannica – SOLO) has served as a hedge against my short position in Arcimoto (FUV), which is up 20% vs. the 12% loss in SOLO (in other words, the combined position is working as planned).

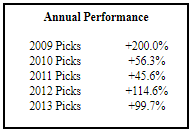

Overall, the 22 picks have averaged a 31% profit with an average holding period of 145 days (giving us an annualized return of 97.3%). Basically, my selections are back to performing the way they did before I briefly (and stupidly) came out of retirement.

It’s no coincidence that this hot streak started a couple months after my SEC investigation concluded. Distractions and stress are no good for stock picking. When you don’t have a worry in the world, it’s much easier to focus on good professional-level analysis. It’s also easier to kick back and not freak out about the occasional negative data point — something that happens to every stock.

Food for thought. #ProfessionalResearch #FundamentalResearch #MindOverEmotion

____________________

It’s been a few weeks since I’ve gone live… and a LOT has happened since then. I’ve put a lot of money to work in new long and short positions, which is exactly how I want to be situated with stocks revisiting record levels, despite an economy that is destine to slow down in the coming months (due to the fading effects of last year’s tax tailwind).

So, let’s talk about all of that!

I’ll be going LIVE on YouTube tomorrow (Thursday) at 12:30PM ET to discuss all of our old favorites, as well as my new ones.

As usual, we need enough people (at least 40) to make it worthwhile. I do my part to gather and share this info. The only thing I ask, if you appreciate my work, is to spread the word!

CATCH THE LIVE ACTION HERE: https://www.youtube.com/watch?v=FOUvysuLxHw

If you miss the live broadcast, be sure to check it out later. Cheers!

Still Negative on NBEV

On February 5, I said…

1. I have nothing personal against NBEV. I have respect for management’s experience. Regardless of their track record at New Age Beverages, I don’t claim that I could do a better job of running NBEV or any other beverage company. I’m simply a business/equity analyst… and that’s where my experience is.

2. I have reached out to Wall Street veterans for their input on NBEV, its financials, and its valuation. However, I am not teamed up with anyone to attack this stock. Nor do I get paid for any of my research or articles. My background is well known and documented.

3. I have no interest in engaging in a holy war against the company or its stock. As has been the case with my past shorts (i.e. Bitcoin. Overstock, and Helios/MoviePass), my professional training and research simply leads me to conclude that NBEV is overvalued.

If you disagree, I respect that. Time will be the judge. It always is.

My regular readers know that I’ve been very negative on NBEV’s valuation. This is similar to my prior short calls on cryptocurrencies and Helios & Matheson / MoviePass (HMNY). Investors are in love with the story (I understand why!), but are missing/ignoring some critical weakness in the underlying asset.

As a student of valuation, I’ve been short NBEV, along with its call options. On my short, I’ve made a 30% profit. Below, you can see how writing (shorting) the call options has played out…

That’s a LOT of profit!

It just further proves Warren Buffett’s lesson that stocks are a voting station in the short-term and a weighing station in the long term. In other words, stocks rise/fall based on supply/demand for the shares in the short term, but ultimately move toward their true and fair valuation over time.

BTW, the options performance is one more reason to visit Google and learn more about options and option strategies.

FYI, NBEV has initiated an ATM offering of $100 million worth of stock (Google it if you don’t know what it means). In short, it could have seriously negative consequences for the shares, which are currently teetering at a critical support line (sitting at $5.17). If it breaks, it could be a quick ride to $4.20 (no pun intended).

In the meantime, Feel free to ask me questions on this topic tomorrow at 12:30PM by clicking the link… https://www.youtube.com/watch?v=FOUvysuLxHw

If you miss the live broadcast, be sure to check it out later. Cheers!

More Research:

- My YouTube Channel

- Individual Stocks Showing Life

- The Quick Investor’s Guide To SMSI

- MoviePass Projected To Burn $600M In 2018

- Sprint Finally Rolling Out SMSI’s Safe & Found Nationwide!

- Lose 33% In 9 Months To Make 1,000% In 15?

- GAIA vs. MoviePass: CAC Shows Which One Is A True Mini-NFLX

- Buying SMSI — Today Is The Day I’ve Been Waiting For!

- Mark Gomes Research

To get my posts in real-time, just follow/subscribe to my free blog.

If you only want to receive my most critical reports, simply sign up for my MailChimp mailing list instead. If you’re on that list, you will only get key articles and occasional recaps of all the work I’ve recently done.

Disclosures / Disclaimers: This is not a solicitation to buy, sell, or otherwise transact any stock or its derivatives. Nor should it be construed as an endorsement of any particular investment or opinion of the stock’s current or future price. To be clear, I do not encourage or recommend for anyone to follow my lead on this or any other stocks, since I may enter, exit, or reverse a position at any time without notice, regardless of the facts or perceived implications of this article.

I am not a financial advisor. Nor am I providing any recommendations, price targets, or opinions about valuation regarding the companies discussed herein. Any disclosures regarding my holdings are true as of the time this article is written, but subject change without notice. I frequently trade my positions, often on an intraday basis. Thus, it is possible that I might be buying and/or selling the securities mentioned herein and/or its derivative at any time, regardless of (and possibly contrary to) the content of this article.

I undertake no responsibility to update my disclosures and they may therefore be inaccurate thereafter. Likewise, any opinions are as of the date of publication, and are subject to change without notice and may not be updated. I believe that the sources of information I use are accurate but there can be no assurance that they are. All investments carry the risk of loss and the securities mentioned herein may entail a high level of risk. Investors considering an investment should perform their own research and consult with a qualified investment professional.

I wrote this article myself, and it expresses my own opinions. I am receiving no compensation for it, nor do I have a business relationship with any company whose stock is mentioned in this article. The information in this article is for informational purposes only and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

The primary purpose of this blog/forum is to attract new contacts with professional industry expertise to share research and receive feedback (confirmation / refutation) regarding my investment theses.

Please share the invite. Catch you all tomorrow!

LikeLike

I asked for your opinion on Comcast/smsi 4/27/19 will you have time for a response

LikeLike

I don’t have an answer. I recommend calling the company. If they give you an answer, you will be the first one with it and can trade ahead of telling everybody the info!

LikeLike

Haven’t found the answer. I recommend calling them!

LikeLike

Below is a time-stamped outline of this video (go to the video for easy-to-use links):

0:30 intro/disclosures

1:42 comments on general market; expressed his feelings of caution w/overall market; introduced viewers to various platforms to interact with him

4:30 discussion of Hedge Eye Quad 3

7:32 IPO Candy and DCF analysis discussion

12:00 further discussion of general market

13:13 $SMSI discussion and possible hedges due to $IWC concerns, especially $NBEV (and discussion of their fair value)

19:37 $GAIA and their recent Q1 report; possible VWAP activity; discussion of sine curve and importance of operating leverage

31:20 $SMLR and how they save insurance companies money; those companies in turn help sell their product; possibility to be added to Russell 2000

37:16 $AEHR and semiconductor market (including $AMAT $STM)

39:55 $HEAR and discussion of cyclicality/replacement cycle; discussion of more permanent trend of battle royale gaming

44:10 $USAT continues to show signs the accounting issues were relatively minor; discussion of fair value if issue resolved favorably

46:20 Mark’s 1% portfolio and SEC investigation

49:52 $RIOT and his belief it is overvalued; opens possibility for round of funding

55:00 $OSSIF monitor oil pipelines for breakage

55:55 $ZYXI hiring lots of new salespeople; great operating leverage

56:50 $GAN (London exchange) possible growth due to gambling legalization

58:25 $NWGI similar to $GAN

59:00 $KR still short

59:15 $PICO unlocked value in some water rights; $CDZI possible short hedge

1:00:36 Bert Hochfeld and Rich Davis as good analysts; $CLDR, $CARG, $SMAR, $SFIX, $PINS

1:02:15 $MSG and benefits to them from gambling legalization

1:03:05 $ZUO, $PVTL

1:03:30 $SWIR possible IoT play

1:04:25 $LOGM fallen behind technology curve

1:06:55 $TSLA issues/concerns

1:08:35 $MRIN nothing new

1:08:49 AUDIO AND VIDEO TEMPORARILY WENT DEAD

1:10:05 AUDIO AND VIDEO RETURNED

1:11:05 all shorts mentioned hereafter have been fundamentally examined and determined to be short

1:15:40 $SLGG recent ipo, believes it was pushed on institutions

1:17:32 $LB and $KR a lot of leverage/debt

1:18:32 $BVSN deflation in software value

1:19:44 $HOG see prior videos

1:19:55 $DKS tough comps due to prior competitors going out of business several years ago combined with a declining market

1:23:20 discussion of CEO survey re possible recession

1:25:50 $EPAY aging technology

1:26:45 $DOX and NFV issues

1:28:08 $SBH and competition

1:29:15 $UPS economic and $AMZN concerns

1:29:35 $POST and $LCUT debt concerns

1:30:40 stocks he considers “garbage” at their 5/2/19 valuations

1:31:40 $ATAI believes it’s a pump

1:33:30 $BPTH another pump

1:36:20 $RBZ

1:36:35 $ZYNE good info in Roth report even though he disagrees with price target

1:38:00 $NTCT possible future short as NFV picks up

1:39:30 closing comments and tips on researching stocks

LikeLike

Hello, Mark! Just watched the video. It was good stuff.

I have been following you since PTT (yes, i signed up for the lifetime membership and got burnt i.e. GTAT) but recovered my losses and made much more from HMNY.

Wanted to tell you that I appreciate your good work and sharing to help retail investors do better.

Thank you!

LikeLiked by 1 person

Hey SY, I appreciate the note. That was a bad year for all involved, but I’m happy to have gotten back to doing this charitably (and more so to see that it has been mending fences). Many thanks 🙏🏼 Cheers.

LikeLike

Regarding MRIN, given they demonstrate the stoppage in client churn and initial positive progress on Marin One acceptance; whether it shows up in revenue or positive commentary for the sales outlook and pipeline; we should begin to fly with positive EBITDA in sight. a silly $30 million low market cap. Excited about the upcoming results, though still maybe another few quarters before traction shown.

LikeLike

Hey Mark,

I know you don’t take requests but I wanted to thank you for a stock that you had on a watchlist several years ago with PTT. Digimark (DMRC) who makes invisible bar codes for product packaging has been trying to develop the market since that time looks to finally be exiting the “wait time” phase into the “gold mine” phase with their announced licensing deal with Walmart. I bought the stock back in 2015 and although it’s run up quite a bit in the last few days I agree with an SA author who feels that the sock hasn’t even begun to price in the significant potential. https://seekingalpha.com/article/4260869-digimarc-post-transformative-deal-walmart-digimarc-now-rare-one-question-stock?app=1.

I also see another potential marketplace for this technology which I posted in the comments section.

Another massive opportunity is in Healthcare (You mentioned pharma which I assume is inclusive of medical devices in your definition). There are approximately 1-2M sku’s in the acute care hospital market for devices. The amount of lost charge capture by hospitals in the US in excess of $10B (significant problem in a market where the average hospital is making 4-5% operating margins). Think of this as healthcare’s form of shrinkage. Cleary a few hundred million invested to meaningfully address the $10B in loses is a compelling proposition and a fantastic lever on operating margins for hospitals. This doesn’t even address the other million or so healthcare products used in the non-hospital setting (Drs Offices, Long term care centers, etc.)

Smaller codes can be placed on small devices and even incorporated into the product form factor versus the packaging (think bulk packed non-sterile syringes). If you take $50/sku barcode per year there’s another $50-$100M revenue on the mfg. side for labeling. Add in $7K per mfg. for the software licensing for the packaging/product graphics times 2K manufacturers (conservative) and there’s an additional $14M/yr. in revenue. So the conservative TAM for the US alone is $64-$128M annually. Globally it’s an order of magnitude greater than that. I’ve been in this stock since 2015. Almost gave up a few times, traded it a few times but not anymore. This may turn out to be my all time biggest winner and I am sticking around for the long haul.

Thanks again even the stocks that you watched but didn’t pick have provided this investor with some impressive returns!

LikeLike

Took awhile, but yes 😎 there’s probably 10 more points of potential upside from here, but the meat of the easy $$$ is likely behind us.

Cheers!

LikeLike

Mark, this might be a dumb question but if they made .02 cents per share last quarter and they have more subs for safe and found, along with increased revenue, what happened to earnings growth?

Thanks Eric

LikeLike

Acquisition expenses, trade show costs, and bonuses. Q1 expenses are always higher. They drop down in Q2.

Net net, another strong quarter. I have them doing $0.11 of EPS in Q4 without a Sprint sunset, ANY new customers (including Sprint IOT), or added Comcast revs (which is now in play).

LikeLike

Aren’t acquisition expenses backed out in adjusted earnings- don’t believe that piece weighed on adjusted esrnings??

LikeLike

Acquisition expenses, yes. But they took on the employees of ISM — those are ongoing operating expenses, which need to be reconciled over the next few months.

Plus, Q1 is typically their high-expense quarter due to trade shows and bonus compensation.

LikeLike

What was update on new carrier – I couldn’t listen to conference call?

LikeLike

Nope… And didn’t expect one. They said that their pipeline is the biggest that it’s ever been and that they have multiple deals in the works.

As I stated before, I don’t expect the new T1 to be announced by June 30, which is fine by me. The numbers are ramping fast without any new customers, products, add-ons, or sunsets (all of which represent upside to my current forecast & valuation estimate).

LikeLike

Thanks Mark – agree – looks pretty good from just an organic perspective of existing business!

LikeLike

Yep. Another strong quarter of execution. Some people got overly excited, which may cause them to lose sight of the top/bottom line beat… and more importantly, what they will likely report for Q2.

LikeLike

Mark,

Thanks for the answer

LikeLike

I have them at 4.5 cents next Qtr – will wait and see how it plays out.

LikeLike

That’s about right (and bullish). That ramps up toward $0.11 for Q4, which should drive a $5 share price.

LikeLike

Going LIVE at 8PM (5 mins) to review my newly updated $SMSI EPS model for 2019 & 2020.

LikeLike

Hi Mark. Are you still short (or negative) on New Age Beverage. Effectively has $85M cash on hand, trading 4.5 times that in market cap. Company seems doing quite well and lining things up with major retailers and distributors, around the globe too. Q1 released today. Thanks,

>

LikeLike

VERY negative. Should be trading at 2x revs at most. Most of those revs are from their more-than-mature acquisition. Plus, my team knows the CEO VERY well, going back several years… and he has never even come close to delivering on a strategic initiative.

LikeLike

In all their press releases regarding the Morinda acquisition, they keep claiming they will have a $300 million revenue company, yet they only did $60 million in Q1. Q1 is usually seasonally slow, but can’t see they hit $300 million in ’19 without another acquisition.

LikeLike

This has been and will be a terribly run company (for investors) until they’re not. Even if you are bullish, they are Wait Time at best, which is something to avoid until they demonstrate traction.

Trust me… this has been one of my biggest moneymakers over the past year.

I have nothing against them — it’s just business.

LikeLike